What Makes Scaffolding Insurance Crucial for Construction Companies?

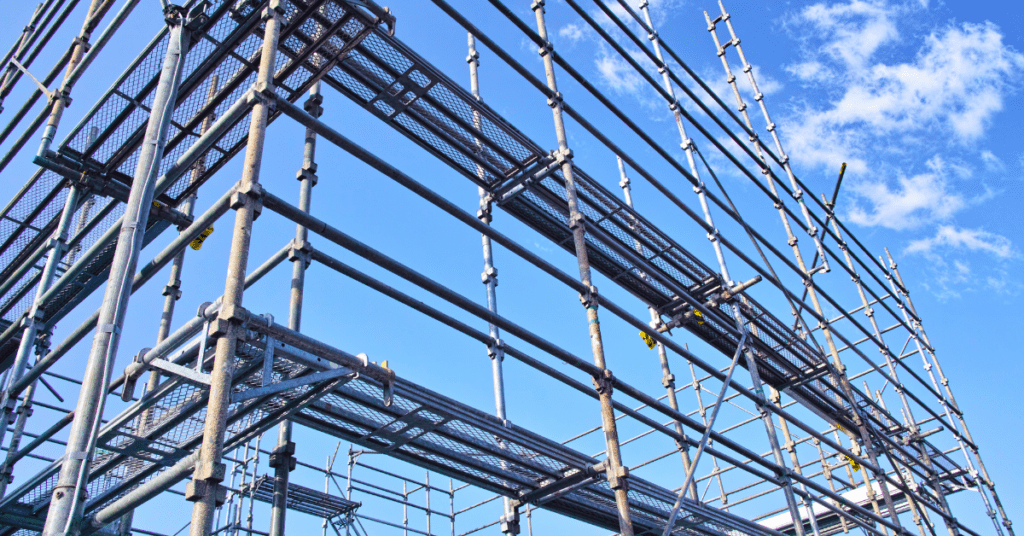

Imagine you’re overseeing a large construction project, and a scaffold collapses, causing significant damage and injuries. Scaffolding insurance is essential because it protects your company from the financial fallout of such incidents. Not only does it cover medical expenses and potential lawsuits, but it also guarantees you meet industry regulations, thereby maintaining your firm’s credibility. Without this insurance, you risk jeopardising not just the project at hand but your entire business’s future. So, what specific aspects make scaffolding insurance an indispensable part of your risk management strategy?

Key Takeaways

– Risk Mitigation: Reduces financial and legal risks from scaffolding-related accidents and damages.

– Employee Safety: Ensures worker protection through consistent safety protocols and training.

– Liability Protection: Provides coverage against claims for injuries and property damage.

– Project Continuity: Minimises disruptions and covers costs for repairs and legal expenses.

– Compliance Assurance: Ensures adherence to industry regulations and avoids penalties.

Risk Management

Effective risk management in construction begins with identifying potential hazards and implementing strategies to mitigate them.

When you assess risks on a construction site, you start with hazard identification. This involves recognising all possible dangers, such as unstable scaffolding, falling debris, and electrical hazards. You can’t afford to overlook any detail because even minor oversights can lead to significant accidents.

Once hazards are identified, you need to conduct a thorough risk assessment. This means evaluating the likelihood and potential impact of each hazard. By doing so, you prioritise which risks need immediate attention and which can be managed over time. For instance, if you find that scaffolding isn’t properly secured, addressing that risk should take precedence over less essential issues.

Next, implement strategies to mitigate these risks. This could involve reinforcing scaffolding structures, installing safety nets, or providing workers with proper training.

Additionally, regular inspections and maintenance are vital to guarantee that risk management practices remain effective over time.

Employee Safety

To guarantee employee safety on construction sites, start by establishing clear safety protocols and providing thorough training to all workers.

Worker training should encompass the proper use of scaffolding, recognising potential hazards, and understanding emergency procedures. This training isn’t a one-time event; it should be ongoing to make sure everyone is up-to-date with the latest safety standards and practices.

Conducting regular site inspections is another critical step. These inspections should be meticulously planned and executed to identify any potential safety issues before they become serious problems.

Inspectors should focus on checking the integrity of scaffolding structures, making sure that all components are secure and in good working condition. They should also verify that safety measures such as guardrails, toe boards, and fall arrest systems are in place and functioning correctly.

Moreover, encourage a culture of safety where employees are empowered to report hazards and suggest improvements. When workers feel responsible for their safety and that of their colleagues, the likelihood of accidents decreases.

Liability Protection

Ensuring robust liability protection is essential for construction companies to safeguard against potential legal and financial repercussions. When accidents occur, your company could face costly lawsuits. Scaffolding insurance specifically addresses these risks by providing coverage that protects against claims related to injuries, property damage, and other liabilities.

Understanding the claims process is a critical component of effective liability protection. When an incident arises, you need to promptly report it to your insurance provider, who’ll then investigate and determine the validity of the claim. Clear communication and thorough documentation can expedite this process, ensuring that claims are resolved efficiently and fairly.

You have various policy options to evaluate, each offering different levels of coverage and premiums. A general liability policy can cover a broad range of incidents, including third-party injuries and property damage. However, for more specialised needs, you might explore excess liability or umbrella policies that provide additional layers of protection.

Choosing the right policy option will depend on your specific risks and operational scale. By meticulously assessing these factors, you can tailor your scaffolding insurance to provide extensive liability protection, thereby minimising potential disruptions to your business.

Financial Security

Financial security in the construction industry hinges on the strategic implementation of scaffolding insurance to mitigate unforeseen financial risks and guarantee business continuity. By investing in scaffolding insurance, you protect your company against significant financial losses arising from accidents, theft, or damage to scaffolding equipment. Understanding the cost implications of potential incidents versus the relatively modest premiums of insurance is vital. This form of protection guarantees you won’t face crippling expenses that could disrupt your cash flow or halt your projects.

When considering investment considerations, you need to evaluate the balance between immediate costs and long-term financial stability. Scaffolding insurance premiums may seem like an added expense, but it’s an investment in safeguarding your business against unpredictable events. Think about it: without insurance, a single accident could result in substantial out-of-pocket costs, legal fees, and potential project delays. These setbacks could severely impact your bottom line and your reputation in the industry.

Moreover, scaffolding insurance can also influence your ability to secure financing. Lenders and investors often look favourably on companies that proactively manage risks, thereby enhancing your financial standing and offering peace of mind to stakeholders.

Compliance Requirements

Manoeuvring the complex landscape of compliance requirements for scaffolding insurance guarantees your construction company adheres to industry regulations and avoids costly penalties. Regulatory standards are stringent, and non-compliance can result in severe financial repercussions and project delays. Confirming your insurance policies meet these standards is essential.

To help you navigate these requirements, consider the following:

– Understand Local Regulations: Different regions have specific scaffolding regulations. Verify your insurance policy aligns with these local laws.

– Review Policy Inclusions: Your insurance must cover all potential risks associated with scaffolding, including accidents and structural failures.

– Documentation and Record-Keeping: Maintain accurate records of your insurance coverage and confirm they’re readily accessible for inspections.

– Regular Policy Updates: Regulatory standards can change. Regularly review and update your insurance policies to remain compliant.

– Employee Training: Confirm your workforce is trained on compliance standards and understands the importance of adhering to insurance requirements.

Project Continuity

Effective scaffolding insurance plays a vital role in maintaining project continuity by mitigating risks that could otherwise lead to unexpected disruptions. When unforeseen incidents occur, such as scaffolding collapses or accidents, the immediate impact often includes project delays and construction disruptions. Scaffolding insurance guarantees that these incidents don’t bring your project to a standstill by covering the costs associated with damages and repairs.

Having this insurance means you can quickly address any scaffolding-related issues without diverting funds from other essential areas of the project. This rapid response helps you stay on schedule, preventing costly delays that could affect your bottom line. Additionally, it provides peace of mind, knowing that even in the face of unexpected problems, your project can continue with minimal interruption.

Scaffolding insurance also supports project continuity by covering legal and medical expenses if workers are injured. This financial protection allows you to focus on maintaining workflow and adhering to project timelines. By preemptively addressing potential construction disruptions, scaffolding insurance becomes an indispensable asset in safeguarding not just the physical structure, but the overall timeline and budget of your construction projects.

Reputation Management

Maintaining a robust reputation in the construction industry hinges on your ability to manage risks effectively, and scaffolding insurance plays an essential role in this endeavour. When accidents happen, they don’t just affect your project’s timeline or budget; they also considerably impact brand trust and customer perception. Scaffolding insurance guarantees that any mishaps are swiftly and efficiently handled, mitigating potential harm to your reputation.

Consider these points to understand how scaffolding insurance can bolster your reputation:

– Risk Mitigation: By having insurance, you show clients that you take safety seriously, which enhances brand trust.

– Financial Stability: Insurance coverage helps manage unexpected costs, portraying a financially responsible image.

– Customer Assurance: Clients feel more secure knowing that any issues will be promptly addressed, positively influencing customer perception.

– Competitive Edge: Companies with thorough insurance are viewed more favourably, giving you an advantage over uninsured competitors.

– Legal Compliance: Adhering to insurance requirements demonstrates professionalism and reliability, reinforcing trust.

Each of these factors contributes to building a solid reputation, essential for long-term success in the construction industry. Properly managing risks with scaffolding insurance not only protects your projects but also fortifies the trust and perception clients have in your brand.

Frequently Asked Questions

How Does Scaffolding Insurance Affect Project Timelines and Deadlines?

Scaffolding insurance reduces project delays by covering unforeseen accidents. Effective risk management guarantees timely compensation and quick resolution, minimising disruptions. You’ll maintain project timelines and deadlines, keeping your construction schedule on track.

What Are the Specific Coverage Options Available in Scaffolding Insurance?

Like Pandora’s box, scaffolding insurance has hidden complexities. You’ll find specific coverage options like damage protection and liability. However, watch for coverage limitations and policy exclusions, as they can greatly affect what’s actually covered.

Can Scaffolding Insurance Be Customised for Different Types of Construction Projects?

You can customise scaffolding insurance to address project specific risks. These custom coverage options guarantee that your insurance fits the unique challenges and needs of each construction project, providing thorough and precise protection.

How Do Policy Premiums for Scaffolding Insurance Get Calculated?

To calculate policy premiums for scaffolding insurance, you’ll consider premium factors like project size, duration, and location. Insurers conduct a risk assessment, evaluating potential hazards, safety measures, and past claims to determine the final premium.

What Should Construction Companies Look for When Choosing a Scaffolding Insurance Provider?

Picture a smooth, seamless process. You’ll want a provider with a stellar reputation and an efficient claim process. Check reviews, ask for referrals, and guarantee they handle claims swiftly and fairly to avoid costly delays.

Conclusion

Essentially, scaffolding insurance isn’t just a safety net—it’s a fortress guarding your construction empire.

By ensuring robust risk management, employee safety, liability protection, and financial security, it keeps your projects running smoothly and your reputation untarnished.

Complying with regulations and maintaining project continuity without this insurance would be a Herculean task.

Ultimately, scaffolding insurance is indispensable for your company’s long-term stability and client trust.