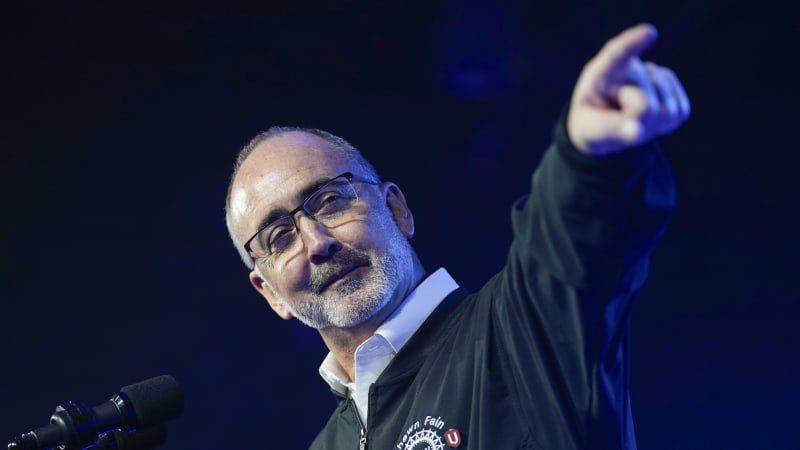

UAW chief, having won concessions from strikes, takes aim at nonunion automakers

DETROIT — Entering contract talks with Detroit’s three automakers, Shawn Fain set lofty expectations for what he could gain for his union members — and delivered on many of them. He secured significant pay raises, improved benefits, the right to strike over plant closures and a raft of other concessions.

But to the United Auto Workers president, the agreements that emerged from talks that were marked by six weeks of strikes were merely the start of a victory streak and a renaissance for the 88-year-old union. Now, Fain has set his latest ambitious goal: To gain UAW membership in nonunion companies across the industry — from foreign automakers with U.S. operations like Toyota to electric vehicle makers like Tesla to EV battery plants that will likely represent a sizable share of auto jobs in the decades ahead.

Already, Fain asserted in an interview with The Associated Press, the contracts have benefited workers in nonunion auto companies: Soon after the UAW won major pay raises for its workers, Toyota, Honda, Hyundai and Nissan — all nonunion operations — raised their own workers’ pay in what Fain characterized as an obvious bid to stop the UAW from unionizing those workforces.

Last week, workers at General Motors, Ford and Stellantis collectively voted 64% to ratify the new settlement deals, which are among the richest contracts in the UAW 88-year history. The agreements ended many wage tiers, gave temporary hires better pay and a path to full-time work and boosted from around 6% to 10% the annual 401(k) contributions for those without pension plans.

According to Fain, workers at some nonunion plants, including the electric vehicle sales leader, Tesla, have contacted the UAW about joining the union, which hasn’t even begun its organizing efforts. Fain noted that the nonunion companies didn’t raise pay for their workers until after the UAW won general and cost-of-living raises, which should reach 33% by the time the contacts expire in 2028.

“Companies play their workers as fools sometimes,” he said in the interview. “They care about keeping more for themselves and leaving the employees to fend for themselves.”

Fain, who took office just eight months ago in the first direct election of UAW leaders in its history, said the time is right for labor unions to grow as they did in the 1930s and 40s, before they began a steady decline beginning in the 1950s. American workers, he said, are fed up with stagnant wages while corporate executives earn ever-growing multiples of median worker pay.

Companies, Fain said, will spend “limitless amounts” to try to stop the UAW, but the union can point to its Detroit contracts to show workers they will have a voice. In that way, he said, the union is a “great equalizer.”

Fain declined to say which nonunion companies the UAW would target first. But high on the list is Tesla, whose biggest shareholder is CEO Elon Musk, the world’s wealthiest man and an outspoken opponent of the union.

“The world’s richest man is the richest man for a reason,” Fain said. “They get this kind of wealth by exploiting other people.”

Musk, who also runs the rocket company SpaceX, is talking about shipping Tesla production to Mexico and other low-cost countries.

A message was left seeking comment from Tesla.

The union leader said he expects Toyota, Honda and others to fight the UAW’s organizing effort by threatening to close factories or eliminate benefits. Musk has threated to end stock awards that go to production workers if they vote to join the union. Fain said the UAW, if given the opportunity, would negotiate to retain and increase those stock awards.

The union, Fain says, also will have to organize Detroit automakers’ EV battery plants, which are joint ventures with South Korean companies. GM and Stellantis, the maker of Jeep and Ram vehicles, have agreed to bring their joint venture plants under the union’s national contract, making it easier for the UAW to sign them up. Ford has not.

That, he said, could become a problem if Ford fights the UAW’s efforts to organize at the plants in Kentucky and Tennessee.

“Unless they change their tune, it’s going to be an all-out war,” Fain said.

Ford did agree to put a wholly owned battery plant being planned for Michigan and a planned electric pickup plant in Tennessee into the UAW contract. But in the interview, Fain accused CEO Jim Farley of agreeing to work with the union on the joint-venture plants — only to renege later.

“At that point, things didn’t go well,” Fain said. “We had to make progress where we could, and we did.”

In response, Ford said in a statement that it negotiated in good faith with the UAW and agreed to work with it on a fair deal to address the issue of union representation of the battery plants.

“These are multi-billion dollar investments, and the future of our industry is in the balance, so any deal must make sustainable business sense,” the company said.

Fain declined to say what his fight would look like or if it could mean a strike against Ford in 2025, when the joint-venture plants are set to open.

“It just means we’re going to do what we have to do to get it,” he said. “Those workers deserve their fair share of economic and social justice.”

Ford has said it couldn’t pledge to unionize the battery plants because its joint venture partner would have to agree and the plants aren’t exclusively under its control. In addition, Ford has said, the plants haven’t been built, and it can’t agree to the unionization of workers who haven’t been hired yet.

In the contract talks, Fain said, he would have liked to gain stronger pension increases for longtime workers with defined benefit plans. He’d also like steady pension checks for newer hires rather than 401(k) plans. The union plans to seek law changes requiring “retirement security” for all workers, and will push for the benefits in 2028 contract talks.

In the interview, Fain said he doesn’t expect the higher costs that the automakers will absorb from the new contracts to lead them to build new factories in Mexico or Canada. The union, he said, can strike if a U.S. plant is closed and could take action if companies build new factories elsewhere.

The UAW, he said, will try to work with the companies. But he noted that partnering with the automakers in the past to address costs has typically benefited them to the exclusion of workers. He noted the concessions the UAW agreed to in 2008 to help the automakers survive dire financial problems.

This time, he said, union members negotiated for themselves but also won raises for nonunion workers in the South who would have received nothing without the UAW.

“That’s something to be proud of,” he said.