Toyota Finally Admits It Won't Make Its Full-Year Production Target

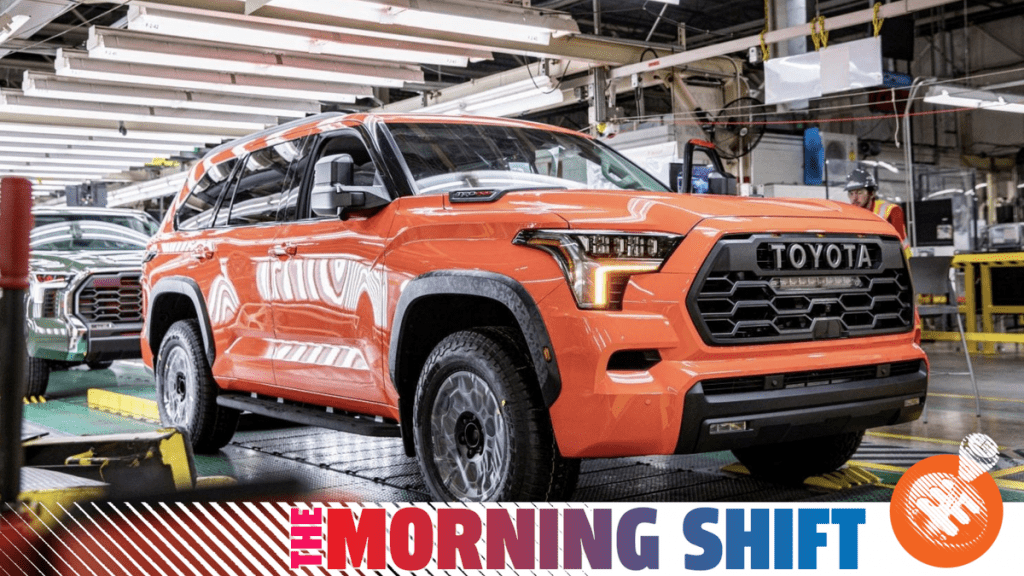

Photo: Toyota

The global chip shortage and supply chain issues mean Toyota is about to miss the mark in terms of production, a new report predicts top automakers could invest nearly $1.2 trillion in EVs by 2030, and Tesla’s lithium refinery plans in Texas get the green light. Those stories and more in this freaky Friday edition of The Morning Shift for October 21, 2022.

1st Gear: Toyota Will Miss The Mark

Toyota has announced it is cutting its fiscal-year production forecasts because of supply chain issues and the global semiconductor chip shortage. This long-awaited move comes after months of the company putting it off, even though it seemed a bit inevitable.

The company has reportedly remained tight-lipped on its new production target for the fiscal year, which ends on March 31, 2023. New guidance could reportedly come at next month’s fiscal second-quarter earnings meeting. From Automotive News:

Toyota had stubbornly clung to its goal of churning out 9.7 million vehicles in the current fiscal year, even as it repeatedly cut monthly plans amid global supply chain upheaval.

[…]

As recently as September, Toyota had said it wanted to manufacture 900,000 vehicle a month from September through November, as it raced to recoup lost volume from earlier in the year. But it later cut September output to 850,000 and October’s output to 800,000.

In a statement issued Oct. 21, the automaker said November total would also be lowered to 800,000, covering 250,000 units in Japan and 550,000 overseas.

Suspensions in Japan will affect 11 lines in eight plants, out of 28 lines in 14 plants.

Affected nameplates include the Corolla, Corolla Cross, RAV4, Camry, Crown, Land Cruiser Prado and 4Runner, as well as the Lexus LS, IS RC, NX, UX, ES and GX.

G/O Media may get a commission

49% off

Cordless Leaf Blower

Leaves … leave now.

his lightweight but powerful motor runs on a rechargeable battery, and includes two tubes for maximum reach.

That goal of 9.7 million vehicles in one fiscal year would have been an all-time high for the company. We should note that number only represents Toyota and Lexus, not Daihatsu or Hino.

2nd Gear: Over $1 Trillion Could be Spent on EVs By 2023

A new report from Reuters says the world’s top automakers are planning to spend nearly $1.2 trillion on the batteries, raw materials, development, and production of electric vehicles by 2030. That number doubles ones from just a year ago.

Automakers are reportedly gearing up to build a combined 54 million electric vehicles in 2030. That would mean over 50 percent of all vehicles sold that year would be EVs. From Reuters:

To support that unprecedented level of EVs, carmakers and their battery partners are planning to install 5.8 terawatt-hours of battery production capacity by 2030, according to data from Benchmark Mineral Intelligence and the manufacturers.

Leading the charge is Tesla (TSLA.O), where Chief Executive Elon Musk has outlined an audacious plan to build 20 million EVs in 2030, requiring an estimated 3 terawatt-hours of batteries. Musk in late October said Tesla already is working on a smaller vehicle platform targeted to cost half as much as the Model 3 and Model Y.

[…]

Germany’s Volkswagen (VOWG_p.DE), while lagging behind Tesla, has ambitious plans through the end of the decade, targeting well over $100 billion to build out its global EV portfolio, add new battery “gigafactories” in Europe and North America and lock up supplies of key raw materials.

Japan’s Toyota Motor Corp (7203.T) is investing $70 billion to electrify vehicles and produce more batteries, and expects to sell at least 3.5 million battery electric models (BEVs) in 2030. It plans at least 30 different BEVs and expects to transition the entire Lexus range to battery electric over that span.

Ford Motor Co (F.N) keeps boosting its spending level on new EVs – now at $50 billion – and at least 240 gigawatt-hours of battery capacity with its partners as it aims to produce around 3 million BEVs in 2030 – half its total volume.

Mercedes-Benz (MBGn.DE) has earmarked at least $47 billion for EV development and production, nearly two-thirds of that to boost its global battery capacity with partners to more than 200 gigawatt-hours.

Other companies like General Motors, BMW and Stellantis are planning to spend at least $35 billion each on EVs and batteries. It’ll be some time before we see if these projections are correct or not, but damn it sure looks like we are indeed heading to that EV future.

3rd Gear: Tesla’s Texan Lithium Refinery

Tesla has given the green light to move forward with its plans to build a lithium refinery on the Gulf Coast of Texas. It’s being reported that the move is being done in an effort to have more control over the supply chain of electric vehicle batteries. From Bloomberg:

The Austin, Texas-based company has been weighing the project for months, as Bloomberg News previously reported, but had been considering at least one other site in Louisiana. The company has told state regulators it plans to build a battery-grade lithium hydroxide refining facility near Corpus Christi that would process raw ore material into something more production-ready.

Musk called lithium prices “crazy expensive” and has repeatedly encouraged entrepreneurs to start refining lithium as a way to ease supply bottlenecks of the key material used in lithium-ion batteries.

It’s previously been reported that Tesla plans to ship the final product from the refinery by both truck and rail to Tesla battery manufacturing sites.

4th Gear: CATL Slows North American Investment Plans

Chinese battery manufacturer CATL is reportedly slowing its plans for battery plant investments in the U.S. and Mexico. The movie is based on concerns over new rules the U.S. has put in place in regards to sourcing battery materials. CATL fears it will drive costs higher.

CATL – which supplies batteries to one in three EVs – planned to invest in South Carolina, Kentucky and northern Mexico. It was part of the company’s plans to expand beyond just China. CATL plans to provide batteries to several companies including Ford and BMW. From Reuters:

But CATL executives have slowed the process of vetting sites for potential new plants in North America since late August when the United States imposed tough new restrictions on the sourcing of material used in EV batteries, two people, who spoke on condition they not be named, told Reuters.

[…]

Executives from Volkswagen (VOWG_p.DE), BMW, and Hyundai (005380.KS) have urged U.S. legislators to give automakers operating in the United States more time to meet the required battery sourcing targets to qualify for tax incentives.

But the shift by CATL represents the first known example of an automaker or major supplier rethinking an investment because of the new law, known as the Inflation Reduction Act (IRA).

[…]

CATL sees North America as a crucial market, the two people with knowledge of its planning said. But the new U.S. rules on sourcing battery materials had become a “banana peel” that have slowed the company’s investment plans, one said.

The rules would hike the costs of manufacturing batteries in the United States to a level higher than shipping them from China even if the U.S. government offers subsidies for CATL to build the plants, said a third person, who also asked not to be identified.

Right now, there’s no word on just how long of a delay CATL was considering in its North American expansion, according to Reuters. The company also isn’t sure whether or not it could make adjustments in its approach to keep costs down.

5th: EV Start-Up Ditches U.K. for U.S.

Arrival, a U.K.-based electric vehicle start-up, is putting hundreds of jobs in that country at risk after it announced that it would be moving its van production to the United States. The move will reportedly lead to a “sizable” reduction in its U.K.-based workforce. From the Financial Times:

It is the second wave of savings the company has been forced to make in the space of three months, after it cut 800 jobs in the summer and announced the cancellation of its car and bus projects, in order to focus on its electric delivery van.

On Thursday, the London-based company said it has not been able to tap its expected financial reserves due to the collapse of its share price, meaning that it has to take new measures to preserve its cash pile that stood at $330mn at the end of September.

It’s reported that the company has just about 1,900 staffers remaining after the last round of job cuts. However, Arrival hasn’t said exactly how many of those jobs would be lost after the latest move.

Its Bicester site, the company’s first planned “microfactory”, requires “significant further investment” to begin mass production, and “the company has determined the benefits of such an investment would be best directed at the US market”.

It has an order from UPS for 10,000 electric vans, which it initially expected to meet by shipping them from the UK while bringing a US factory online.

[…]

The decision is potentially the first UK impact of the US Inflation Reduction Act, which incentivises manufacturers to locate battery vehicle production in North America.

Arrival will “focus resources on a family of van products for the US market”, and will only use the Bicester site for some early subscale manufacturing, it said. Last month, the company announced it manufactured the first van at the site, saying it proves that its “microfactory” concept works.

Arrival once had a 3 billion euro valuation in 2020, but now that number is just $480 million.

Reverse: Pittsburgh Does Something Useful

Neutral: I Took My Cat to the Park

Photo: Andy Kalmowitz

This is one of my cats, named Clio. She’s very sweet and usually likes the outdoors, but she really was not a fan of Central Park. That’s too bad, if you ask me. Central Park is usually pretty lovely. Before you ask, yes she has legs. She was just loafed. My other cat, Janet, was left at home because there’s just no way she would be up for a park visit.

At any rate, I highly suggest you bring your pets outside on a leash. People seem to love it. I don’t know why, but it really just sparks joy in passers by to see a cat on a leash. Oh, and please enjoy your weekend. Hopefully, the weather is nice wherever you are.