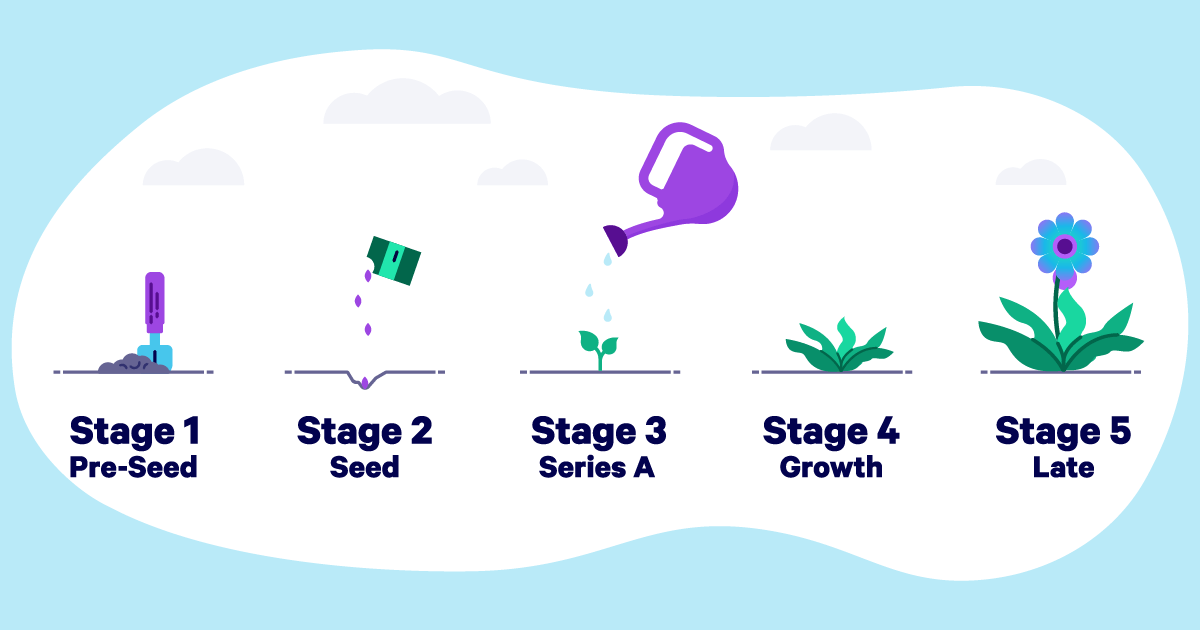

The Stages of a Startup

So you have a great new idea that you think may be the next startup success story. And you have big dreams of following in the startup footsteps of Airbnb, Uber, and Instagram. Before you start calling yourself the next Elon Musk, you should know that being successful in the startup world takes a lot more than just a great idea. In fact, 90% of all startups fail.

So how can your startup be part of the illustrious 10%? One component is having an awareness of the different expectations at various startup stages, from idea to exit.

When should you launch your product? How do you know if your product is ready for market? When should you scale? When do you start talking to investors? Every stage has new milestones and requirements, and being aware of them can help keep your startup on track for success.

There’s a lot of ground to cover, so let’s get to it.

1. Pre-Seed Stage

One surefire way to find yourself part of the 90% failure stat is by not doing some due diligence before launching. Every startup addresses a specific problem, and the pre-seed phase is fundamental for analyzing and validating your business hypotheses. Unfortunately, 42% of startups fail because there is no market need for their products or services.

The pre-seed stage can help identify your startup’s potential success or failure by looking at existing challenges, competitors, and the feasibility of introducing a new product/service. Think of this stage as laying the foundation for your company.

Some of the questions that every entrepreneur should be able to answer before moving to the next stage include:

Does my solution address a real problem?

Is my solution similar to one that already exists?

Who is my ideal customer?

What similar products/services are they using?

How will my product/service be different?

What features are most important to customers?

But since you obviously think your idea is great (it is your idea, after all), it’s crucial to get some outside perspectives to determine how your startup will be received and how your ideas might be used. The best way to do that is by going to the source: your potential customers. Interviewing customers will help you understand their needs, what they’re looking for, and what they’re willing to pay for.

Plus, investing time in conducting interviews will pay off ten-fold when you can use responses from future customers rather than just guesses when developing products and marketing campaigns. Not to mention that those interview findings will be a huge help when you’re developing a unique pitch deck. Considering that 14% of startups fail because they ignore their customers, it makes sense not to gloss over this step.

Of course, market research isn’t cheap, so while you’ll be digging into your own pockets to get things going, you’ll likely be looking for some funds to help out. You’re not about to start pitching venture capitalists with little more to go on than an idea that you scribbled on the back of a napkin, which is why funding for the pre-seed stage is often known as the “friends and family” round.

A tip: It’s a good idea to sort out any necessary partnership agreements, copyrights, or other legal issues as early as possible. Waiting until a later stage to deal with legal matters can get expensive and complicated.

2. Seed Stage

Once you’ve done the analysis and laid the groundwork for your startup, it’s time to plant the seed to build your business.

This explanation from Investopedia sums up the seed stage perfectly:

“You can think of the ‘seed’ funding as part of an analogy for planting a tree. This early financial support is ideally the ‘seed’ which will help to grow the business. Given enough revenue and a successful business strategy, as well as the perseverance and dedication of investors, the company will hopefully grow eventually grow into a ‘tree.’”

This stage marks the official beginning of equity funding for your startup. And that’s crucial because you can have the best idea your industry has ever seen, but it means nothing if you don’t have the capital to support it. Running out of money or failing to raise new capital is the top reason why startups fail, with 38% succumbing to cash problems.

By now, you already have a minimum viable product (MVP) and you’re looking to turn the MVP into something ready to go on the market. You’ll also need financial support for marketing strategies, hiring people for key roles, and conducting additional market research to help refine your product-market fit. Think of this as the development stage of your startup.

This is also the stage where you’ll want to think about insurance policies that will allow you to take risks to help your business thrive. Using insurance policies as a risk transfer can help make your business more attractive to potential partners and investors, which can help put your startup on a stable and secure growth path. (And remember that you’ll need workers’ compensation coverage once you start hiring employees.)

Because capital starts to become very important in the seed stage, you’ll need to look beyond your family and friends for contributions. Potential investors for seed-stage startups include incubators, crowdfunding, and angel investors. Since investors are taking a significant risk by investing in your startup at this stage, they’ll expect an equity stake in the business in exchange for their financial contribution. And if you’re wondering what other companies often raise in this stage, in 2020, the median seed round investment was $1 million, and the median pre-money valuation was $6 million.

3. Series A Stage

Few terms are more synonymous with the startup world than Series A. And with good reason. This stage is a major achievement and marks your company’s first round of venture capital financing.

Once a startup has developed its product or service, established a customer base, and has a steady revenue stream, it can opt to move to Series A funding to expand and optimize its offerings. This stage marks the first round of venture capital financing for your company.

In the Series A stage, it’s essential to have a business plan that will generate long-term profits. All too often, an entrepreneur comes up with a great idea that garners a lot of excitement early on, but they don’t have a plan for monetizing it in the long run, leading to its demise. So you’ll want to brush up on things like fundraising strategies and perfecting your pitch deck before you start calling up potential investors.

Keep in mind that investors want to hear about more than just a great idea at this stage. They want to hear about a startup with a viable business strategy for becoming profitable. Simply put, they want to know the return on investment. And that’s understandable considering that Series A investments have ballooned in recent years, reaching a median of $13 million in 2021. As of 2021, the median pre-money valuation for Series A startups was $24 million.

That leap in financial contributions means you’ll want to prioritize getting some additional insurance coverage at this stage. When it comes to raising funds, most institutional investors, like venture capital firms, will mandate as part of the term sheet that a directors and officers (D&O) insurance policy must be in place before the financing is finalized.

Get a comprehensive insurance policy in 15 minutes.

Get an instant quote to find out how little peace of mind can cost.

Find a Policy

If you aren’t quite sure what you need, check out our Startup Insurance Benchmarking Report to see what other companies are buying and paying for their insurnace.

Analyzing Insurance Costs for Startups

Embroker Vertical Insurance Index

How much are you paying for your insurance? Are you purchasing the right policies? Find out what founders are doing, and the trends that you may not have seen.

Download the Report

Listen, we won’t pretend that this stage is easy. The reality is that many startups that have a successful seed round can’t generate interest from investors during the Series A round. In fact, only around 7.5% of companies that achieve seed funding manage to get Series A financing. It takes a lot of work, but your company will be well-positioned for future success and growth if you’re successful in this stage.

4. Growth Stage

If you’ve made it to the growth stage, give yourself a huge pat on the back. You’ve overcome a roller coaster ride of highs and lows through the early years of building your company. Now that you’ve proven market demand for your product or service, you’ve set your sights on further scaling operations.

The growth stage begins after receiving Series A funding and includes Series B and C investments. At this point, your company has grown beyond potential, and has shown the ability and expectation to hit projected targets while bringing in revenue. The median pre-money valuation for Series B startups was $40 million as of 2021, and $68 million for Series C startups.

It’s no secret that scaling can be tricky to figure out, and you’ll undoubtedly find yourself back on that roller coaster ride. But being ready and willing to pivot and adapt can help avoid potentially catastrophic situations and take advantage of opportunities. Just be sure not to rush into scaling too fast. A study by Startup Genome found that 74% of high-growth startups fail because of premature scaling.

And amidst all that growth, don’t forget about your product or service, which will need to adapt with your company’s growth and improve to become appealing to more customers.

Part of scaling operations means that your team will have to grow. So you’ll need to start expanding your team beyond just the necessary roles, with more specialized talent coming on board. And, fortunately, you now have the means (and reputation) to recruit talented individuals who will help take your company to the next level.

Like most founders, you’ve probably been wearing 14 different hats up until this point. But you can no longer be the company’s CEO, CMO, HR department, and tech support. As a result, you’ll need to offload some tasks to other team members so that you can focus on guiding the company through this crucial phase.

5. Late Stage

Congratulations! If you’ve reached this phase, your startup is a bonafide established and profitable company.

Undoubtedly things look A LOT different now from your seed stage years, and there’s a good chance that people no longer view your company as a startup. At this point, your business is well-known within the industry, with a proven track record for products or services, a loyal customer base, and a fully staffed team. Basically, it’s every founder’s dream.

This stage puts founders at a crossroads in terms of the next step. You could push for further expansion, by introducing new products or services, entering into new locales, or through acquisitions. But first, you’ll have to consider whether the business can sustain more growth and where you’ll get the funds to fuel the expansion. If so, you may want to plan an exit strategy.

One option you may consider to help with financing further growth is going public. For many founders, going public is the ideal endgame for their startup. Of course, that’s just one route to take, and many startups never reach the IPO (initial public offering) phase. However, if an IPO is on the table, you’ll want to carefully consider all of the implications of going public (which definitely won’t be a cakewalk) to decide if it’s the right decision for your company at this point. And forgoing an IPO doesn’t mean your company is doomed – just look at Cargill, one of the largest private companies in the U.S. that had $134 billion in annual revenue in 2021.

Even if your company isn’t ready for an IPO, you may find yourself eager for a change and interested in moving on. After all of the blood, sweat, and tears (though hopefully not literally) that you’ve put into building your business from the ground up, it may be worth benefiting from the value of your creation. Other options include selling the company to a larger corporation, or merging with one.

It’s important to remember that there’s no set timeline for progressing through the various stages. Some startups may never go beyond the seed funding stage, others may spend years trying to grow beyond Series A, some may get bought early by other companies, and a select few (aka, the unicorns of the bunch) may see exponential growth that catapults them through the stages. It’s whatever works best for your company.

However, regardless of the timing your company’s journey takes, being aware of the different stages of a startup’s lifecycle can help you capitalize on opportunities to optimize your chances of success.

For more business tips and advice, check out Embroker’s Startup Newsletter.