Tesla's Ambitions Will Cost Hundreds of Billions

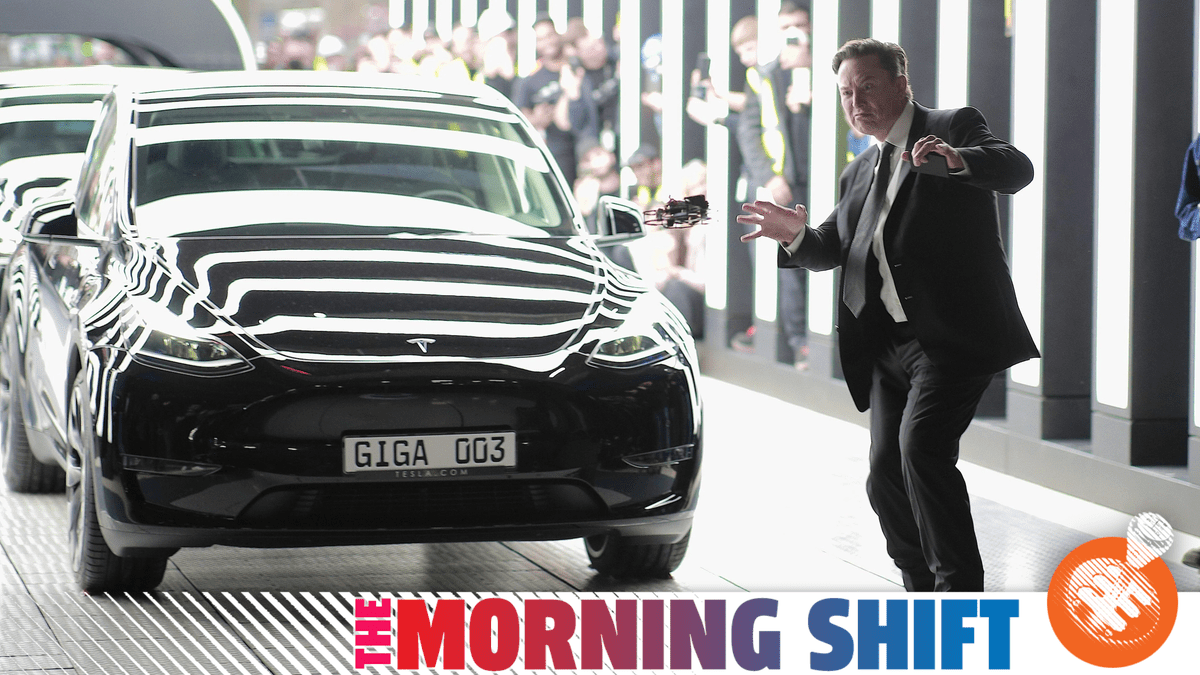

Photo: Christian Marquardt (Getty Images)

Elon Musk has some lofty (and probably impossible) goals for Tesla to hit by the end of the decade, Toyota’s global vehicle output dropped again in July, and Tesla is being hit with a class action lawsuit over phantom braking issues. All that and more in The Morning Shift for Tuesday, August 30, 2022.

1st Gear: Elon’s Bold Tesla Output Goals

Elon Musk has set a, let’s say bold, goal of selling 20 million vehicles in 2030. If that were to happen, Tesla would be literally twice the size of any other automaker in history, and it would account for about 20 percent of the total global vehicle market.

For the record, Tesla is only on a pace to sell about 1.5 million vehicles this year. That means they’d have to increase production 13-fold. It’s a tall order to say the least.

Some analysts are equating it to something like the Manhattan Project, but for a car company. From Reuters:

Musk’s vision poses staggering challenges to the 19-year-old Texas-based automaker, not the least of which is securing enough batteries and critical raw materials such as lithium and nickel to supply 20 million vehicles.

…

Along the way, Tesla would need to build seven or eight more “gigafactories” – an average of one every 12 months or so – take share from every competitor and emerge as a company the size of Volkswagen AG and Toyota Motor Corp combined. It would also need about 30 times as much battery capacity to supply all of its vehicle factories.

The price tag will be steep: Tesla could spend an estimated $400 billion or more over the next eight years to build new vehicle assembly and battery plants around the globe, and another $200 billion or more to build or buy the batteries, including the cost of the raw materials.

G/O Media may get a commission

28% Off

Apple AirPods Pro Wireless Earbuds

Music+

These are the pinnacle of Apple AirPod design, and feature active noise cancelling, a transparency mode for when you need to hear what’s around you, spatial audio for accuracy, adaptive EQ, and are even sweat resistant.

Multiple countries, including Indonesia, Canada and India are currently fighting to win Tesla’s next factory. A decision could come from the company by the end of 2022.

Producing 20 million vehicles a year would require Tesla to expand both its own battery-making capacity, and the capacity of its battery partners and the raw materials producers that supply them.

“Long-term, we’re expecting to make on the order of 3,000 gigawatt hours or 3 terawatt hours per year,” Musk told investors in July. “I think we’ve got a good chance of achieving this actually before 2030, but I’m highly confident that we could do it by 2030.”

Tesla’s current battery production capacity is 100 gigawatt-hours.

So, it certainly seems like a tall order for Tesla and Musk to hit this goal, but I suppose stranger things have happened.

2nd Gear: Toyota May Miss the Mark Again

Toyota is on board the struggle bus at the moment. The company announced that its July global vehicle production fell 8.6 percent compared to last year. That means it will miss its production target for the fourth month in a row.

The chip shortage, Covid outbreaks, severe weather and a recall probe have hampered production. From Reuters:

The sustained weakness in overall performance in July from the world’s largest automaker by sales has raised concerns that Toyota may have to lower its annual production target of 9.7 million vehicles, even as China dials back pandemic restrictions and chip shortages are showing some signs of easing.

Toyota produced 706,547 vehicles worldwide last month, below its target of around 800,000 units and the year-earlier output of 773,135.

Production in the first four months of the current fiscal year, which began in April, has fallen 10.3% short of its initial plan.

…

Toyota said domestic production had tumbled 28.2%, outweighing record July overseas production, up 4.5%, driven by a strong recovery in Europe, China and the rest of Asia.

Earlier this month, Toyota said it was going to hold to its annual production target. It’s planning to raise output through November. That is, of course, depending on the supply of both parts and people. The company says it expects a September production rebound of about 850,000 vehicles. That would be a record for the month.

3rd Gear: Tesla Hit With Another Lawsuit

A Tesla Model 3 owner in California is suing the company as part of a proposed class action lawsuit over the vehicle’s phantom braking issue. The lawsuit calls it a “frightening and dangerous nightmare.”

The lawsuit from the San Francisco-based Tesla owner, Jose Alvarez Toledo, alleges the company rushed autonomous driving vehicles to the market with unsafe technology. From Reuters:

This adds to growing public and regulatory scrutiny of Tesla’s driver assistant technology, despite Tesla CEO Elon Musk promising full self-driving by this year-end.

“When the sudden unintended braking defect occurs, they turn what is supposed to be a safety feature into a frightening and dangerous nightmare,” said Toledo’s lawsuit, which was filed on Friday in federal court in the northern district of California.

The lawsuit seeks class action status for all U.S. owners or leasors of a Tesla that suffers from the sudden unintended braking defect.

Earlier this year, the NHTSA opened an investigation into over 415,000 Teslas over reports of phantom braking when Autopilot was engaged in the cars

4th Gear: Tesla Violated Labor Law

It just isn’t Tesla’s day on The Morning Shift.

The National Labor Relations Board ruled that Tesla violated labor laws when the company didn’t allow employees to wear pro-union shirts.

This move overturned a Trump-era precedent that took a different view on the matter. From Bloomberg:

“Wearing union insignia, whether a button or a t-shirt, is a critical form of protected communication,” NLRB Chairman Lauren McFerran said in a statement Monday after the 3-2 ruling by the agency’s Democratic majority. “For many decades, employees have used insignia to advocate for their workplace interests — from supporting organizing campaigns, to protesting unfair conditions in the workplace — and the law has always protected them.”

The electric carmaker required production workers to wear black shirts with the Tesla logo, or occasionally all-black shirts when a supervisor gave permission, according to the ruling. The majority said the policy interferes with workers’ rights under the 1935 National Labor Relations Act.

Tesla argued that the dress code was put in place to prevent clothing from “mutilating” cars. It also says employees were free to display other sorts of union insignia while at work.

But during a 2018 hearing in the case, former Tesla employees testified that managers told them to remove t-shirts supporting the United Auto Workers union, even though their co-workers wore shirts supporting sports teams without incident.

The change to the dress code now allows employees to wear union shirts… as long as those shirts are black.

“When an employer interferes in any way with its employees’ right to display union insignia, the employer must prove special circumstances that justify its interference,” the NLRB said in its ruling.

5th Gear: Figuring Out What Qualifies for the EV Tax Credit Isn’t Easy

As it turns out, the guidelines for what vehicles qualify for the $7,500 EV tax credit under The Inflation Reduction Act is confusing both car buyers and automakers, which isn’t great.

In an effort to comply with new regulations about how much of the car must be built in North America and how many components must be sourced from trade-friendly countries, some automakers are already making changes. From the Detroit Free Press:

While it’s easy to figure out where a vehicle or battery is assembled, tracking down where some of the battery’s parts and materials come from will be tricky. Once that’s accomplished, relocating operations to — or increasing mining and material processing in — the U.S. or friendly countries we have free trade agreements with will be more complicated and take longer than building a new battery plant.

“It’s very difficult at this point to say which EVs will actually be eligible based on materials and battery manufacturing requirements,” Chris Harto, senior energy policy analyst for Consumer Reports, told the Detroit Free Press. “It may even be impossible for the manufacturers themselves to know for sure until the IRS comes out with its draft guidance later this year.”

These are some of the issues that lay ahead for automakers and consumers, alike, according to Freep.

It may be years before many vehicles are eligible for the full $7,500 credit.

Vehicles currently eligible will not get the new $3,750 assembly unless they’re made in the U.S., Canada or Mexico. That will eliminate many EVs that received the previous benefit.

The battery must not only be assembled in North America, but use materials from friendly countries to qualify for the other $3,750.

Automakers that hit the original incentive’s cap of 200,000 vehicle sales won’t qualify for the new incentive till 2023. That’s bad news for General Motors and Tesla, the early leaders in EV sales.

There’s a price cap on how much eligible vehicles cost. Some trims levels of a given vehicle may qualify while others won’t.

Nobody, not government regulators, automakers, dealers or salespeople, knows exactly how it will all work — yet.

…

Caps on the price of eligible vehicles: $55,000 for cars, $80,000 for pickups, SUVs and vans. That may seem straightforward, but the Cadillac Lyriq, an SUV according to the EPA, should be eligible. The Genesis GV60, which Genesis calls an SUV but the EPA classifies as a car, might not be.Will the credit be given immediately, so the dealer can knock it off the sales price, or will buyers have to wait to do their taxes?Income limits of $150,000 for single filers and $300,000 for married couples.And as mentioned earlier, for the first time, used EVs will qualify for an incentive up to $4,000. The income limit is $75,000 for single filers, $150,000 for married couples.

So, it’s really going to take some time to get all of this sorted out. It’ll probably be a while before automakers really catch up to the new regulations, and it’ll probably be even longer before consumers truly understand what does and doesn’t qualify for the tax credits.

Reverse: History in Space

Neutral: Suh Dude?

Suh Dude