Tesla Sales Haven’t Dropped Like This Since 2012

Happy Monday! It’s July 1, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

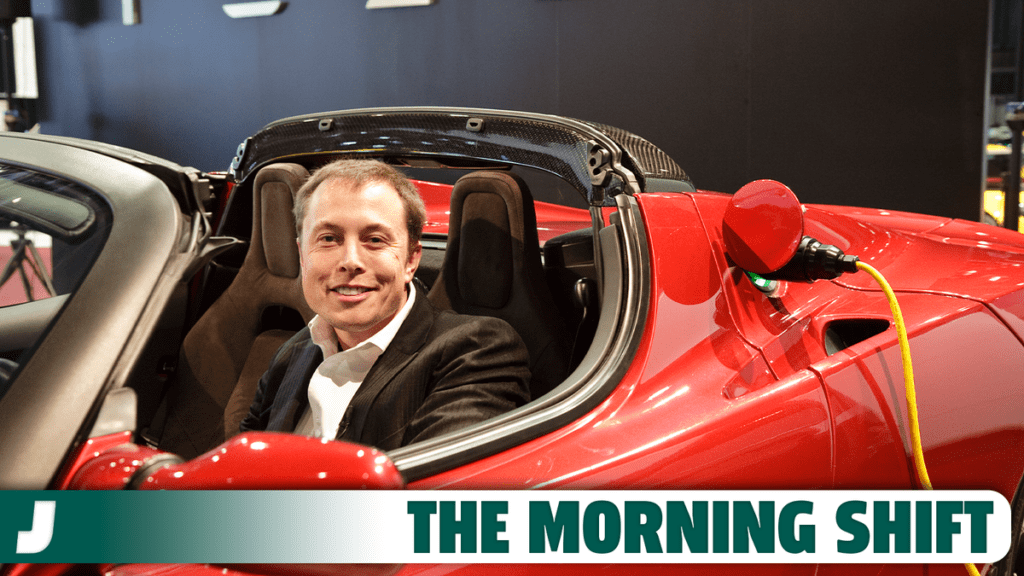

Walter Isaacson On Elon Musk(s)

1st Gear: Tesla Faces Second Consecutive Quarter Of Falling Sales

Tesla’s cars are, by and large, getting old. The company may have an ethos of constant changes behind the scenes, but customers mainly see vehicles that haven’t visually changed in years — being peddled by a man they increasingly want nothing to do with. It’s no surprise, then that Tesla isn’t doing so hot. From Bloomberg:

Tesla Inc. is expected to report another quarter of weaker sales, and it’s running out of alibis.

Analysts are estimating the carmaker will report on Tuesday that it handed over 441,019 electric vehicles in the second quarter, a 5.4% drop from a year ago. This would be a second consecutive quarterly decline, which Tesla last posted when it was phasing out its first model, the Roadster, in 2012.

…

Tesla’s older lineup of vehicles is having a harder time keeping up with fresher offerings from rival EV manufacturers.

…

Musk also announced deep staffing cuts in April, which affected more than 10% of Tesla’s workers, including sales staff. While that may have helped the company conserve cash, it also may have factored in its second-quarter delivery numbers.

Customers who are new to EVs typically have lots of questions about battery range, charging stations and software-based features. Musk is nevertheless increasingly betting on a mostly online sales process and encouraging consumers to order Teslas without even visiting a showroom.

Some folks have said that Tesla’s fall here is tied to the decline of the EV market, but they may be looking at the situation backwards. Tesla has such dominant EV market share in the United States that its bad sales can lower numbers across the entire industry — even as competitors do better and better.

2nd Gear: CDK Cyberattack Could Cost Dealers 10 Percent Of Quarterly Earnings

The CDK cyberattack hasn’t stopped hurting dealers, and we may not see the end of its effects for some time. For now, though, we’re at least getting an idea of its magnitude — to the tune of 10 percent EPS drops from major dealer groups. From Automotive News:

The six largest U.S. publicly traded franchised dealership groups will likely see an average 10 percent drop in their second-quarter earnings per share due to the June 19 CDK Global cyberattacks, according to a new J.P. Morgan analysis.

The dealer groups’ service and parts operations face the biggest hits from CDK’s dealership management systems outage, J.P. Morgan said.

“We believe dealer [service and parts] will bear the brunt of the DMS outage, given significant efficiency loss (primarily related to parts inventory tracking and appointment service scheduling), while new and used car sales and F&I are likely to see a slightly lower impact in the near term,” the June 28 note said.

Those poor, poor dealership owners. How will they ever put food on the table in their third, fourth, or fifth homes? Do you know how much groceries cost in the Hamptons?

3rd Gear: Auto Emissions Regulations Could Go Up In Smoke After Supreme Court Ruling

Last week, the United States Supreme Court overturned a 40-year-old legal doctrine called Chevron deference. Chevron deference grew out of another Court ruling, Chevron v Natural Resources Defense Council, and it’s one of those weird legal things that you don’t really think about until it’s gone. All it said was that the Court would defer to federal agencies when interpreting legislation, allowing them to weigh in with their expertise. Now, it seems, it’s all back on the Court’s plate. From Reuters:

A U.S. Supreme Court decision limiting federal regulatory powers to interpret ambiguous laws could undermine President Joe Biden’s effort to cut tailpipe emissions from the nation’s vehicle fleet, two environmental law attorneys told Reuters.

In a decision released on Friday, the justices ruled 6-3 to overturn a 1984 precedent known as the “Chevron deference” which required judges to defer to reasonable federal agency interpretations of U.S. laws deemed to be ambiguous, like the Clean Air Act.

While the ruling from the nation’s highest court could make it harder for federal agencies to defend stringent regulations around a variety of environmental, healthcare and other laws, the attorneys told Reuters that Biden’s efforts to slash planet-warming greenhouse gas (GHG) emissions from cars and trucks could be particularly vulnerable.

That’s because the rules target mobile sources of greenhouse gas rather than stationary ones like power plants, even though environmental laws are ambiguous on whether regulators have the mandate to do that.

The interesting thing about Chevron deference is that it actually comes out of Reagan-era jurisprudence — it was meant to move the onus of interpreting regulations from the business-unfriendly court to the then-business-friendly EPA. Now, of course, those sides have flipped, so the Court is taking regulatory interpretation permissions back for itself.

4th Gear: There’s Always Money In The World Of Self-Driving

Nvidia, producer of chips for semi-autonomous vehicles and gaming PCs alike, had a very good month last month. It turns out there’s a lot of money in this whole “AI” thing. From Reuters:

Artificial intelligence-focused companies, mostly chipmakers, saw big gains in their market capitalization at the end of June, with Nvidia briefly overtaking Microsoft to become the most valuable company in the world.

Nvidia shares rose as much as 27% in June, boosting its market capitalization to $3.34 trillion, before giving up some of their gains later in the month, due to profit booking and concerns over its high valuations.

Much of these gains likely come from the non-vehicle AI industry, which is absolutely totally going to revolutionize the world with its ability to (checks notes) summarize articles badly. Just like how crypto replaced all fiat currency and NFTs replaced art. Remember when that happened?

Reverse: I Feel Like We Don’t Talk About About How Good Of A Slant Rhyme ‘PG-13′ Is

Pee gee thirteen. It just sounds good.

On The Radio: Charli XCX – ‘So I’

Charli xcx – So I (official lyric video)

You ever just miss SOPHIE? I do. Charli XCX does too.