Tesla Investors Have Concerns About 'Twitter Overhang'

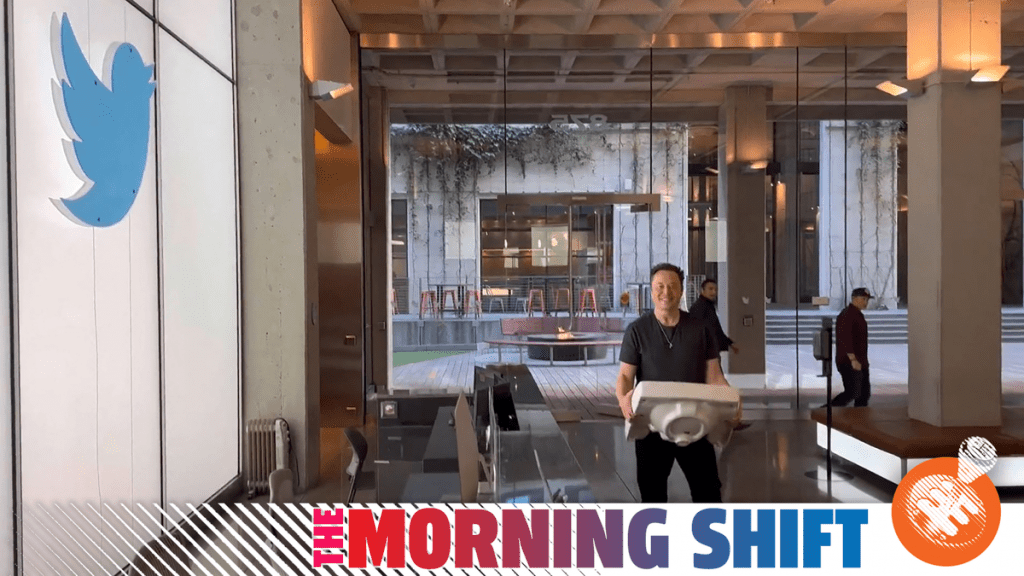

Photo: Twitter account of Elon Musk/AFP (Getty Images)

Tesla shareholders aren’t too happy with the new Twitter Complaint Hotline Operator, an Uber whistleblower says the company can’t last much longer, and Polestar is still raking in funding. All that and more in The Morning Shift for Thursday, November 3, 2022.

1st Gear: Tesla Investors Aren’t Too Happy About This Whole ‘Twitter’ Thing

Elon Musk owns Twitter now, and the company has already seen its income sources start to dry up under his management. But it’s Musk’s other company, Tesla, that seems to be taking the biggest hit. Its share price collapsed when the Twitter deal was first announced, and shows no signs of recovering any time soon. From Bloomberg:

The phrase “Twitter overhang” was inescapable among Elon Musk’s biggest fans on the social media platform he started pursuing seven months ago.

Tesla shares fell into a funk after Musk took a stake in Twitter, agreed to buy it and then tried to wiggle out of the deal. Bulls theorized that the stock would recover once the saga was over. Some even celebrated when the deal closed last week by selling merch with the words “Twitter Overhang Lifted” and an arrow pointing to the moon.

…

Tesla shares didn’t react much after Musk clinched the acquisition, then took a whack along with much of the market Wednesday, when Federal Reserve Chairman Jerome Powell said the central bank will keep raising interest rates to tame inflation. The stock is now trading below where it was when the Twitter deal closed, and monetary policy may be the least of the carmaker’s concerns over the coming months.

…

Before Musk officially closed his deal, it began to sink in that Twitter’s problems had become Tesla’s, at least to a degree. Bloomberg was first to report that Musk had asked some of the car manufacturer’s engineers to meet with product leaders at the social media company’s San Francisco headquarters and review its code.

According to CNBC, dozens of the more than 50 Tesla staffers dispatched to Twitter were uprooted from Tesla’s Autopilot team. That group is familiar with being under the gun, having been unable to realize their leader’s self-driving vision. Last week, it emerged that statements the company has made about its technology are being investigated by the US Justice Department and Securities and Exchange Commission.

Even if the Tesla engineers’ detour ends up being short-lived, there are other ways Twitter could continue to drag on the electric-vehicle leader. The company recently disrupted three China-based operations that were covertly trying to use the service to influence American politics in the months leading up the midterm elections, the Washington Post reported this week.

Tesla is now caught between a rock and a hard place, facing potential blowback from China if Twitter continues to thwart these sorts of influence campaigns, or from the US if it fails to do so.

It’s possible that this whole “buying Twitter so you can ensure transphobia survives on the platform” plan may not have been fully thought out. Oh well! At least Musk will get those eight monthly dollars from someone, probably.

2nd Gear: Uber Lobbyist-Turned-Whistleblower Says Company Is “Not Sustainable”

Uber is, more or less, a complicated machine that transforms venture capital money into taxis. But, according to one company whistleblower, this Silicon Valley alchemy doesn’t exactly make for a lasting, stable business. From Reuters:

Mark MacGann, the whistleblower behind the so-called Uber Files, said on Wednesday that the ride-hailing company seemed to be taking steps toward improving its work culture, but that its business model was still “absolutely” unsustainable.

…

MacGann, who led Uber’s lobbying efforts to win over governments, identified himself as the source who leaked the more than 124,000 company files.

MacGann said he decided to speak out because he believed Uber knowingly flouted laws and misled people about the benefits to drivers of the company’s gig-economy model.

…

“My message to Uber is: ‘you’ve done well, (but) you can do it so much better (because) the current model is absolutely not sustainable,’” MacGann told a news conference during Europe’s largest tech conference, the Web Summit, in Lisbon.

He said Uber recently reiterated that the “core of its business model is independent contractors, since everybody wants to be self-employed, everybody wants flexibility.”

He said the facts, however, contradict this view as there are Uber drivers suing the company in various countries to “have a basic minimum of social protection such as sick pay.”

“Uber is pumping tens of millions of dollars in Europe, United States, other parts of the world fighting legislation,” he said.

G/O Media may get a commission

Wear your fandom on your sleeve.

MobyFox’s officially-licensed bands and custom watch faces are homages to fandoms spanning decades—from The Beatles, to Black Panther.

Underpaying your workers, burning them out, then churning through them doesn’t seem like a fantastic business plan to me, but what do I know? It’s not like I went to college for business or anything.

3rd Gear: Polestar Gets $1.6 Billion In New Funding

Polestar is in a bit of a weird place right now. It builds performance electric Volvos, except they aren’t always performance-oriented and Volvo also builds its own EVs. It’s not entirely clear what the brand is meant to do, besides be really really, really ridiculously good-looking, but it seems Volvo wants it to keep doing its thing. From Reuters:

Electric vehicle maker Polestar said on Thursday it had secured $1.6 billion in financing from its two main shareholders to help it deliver its growth plans amid volatile markets.

Volvo Car (VOLCARb.ST), which co-founded the brand with China’s Geely (0175.HK) in 2017, said it would provide an $800 million loan to the firm. Its other major shareholder, PSD Investment, will provide the same amount through “direct and indirect financial and liquidity support,” Polestar said.

Volvo, which owns just over 48% in Polestar, said its loan included options for Volvo to convert some of its loans to equity in a potential future equity raising by Polestar.

“We welcome the continued support from our major shareholders at a time when the capital markets are volatile and unpredictable,” Polestar CEO Thomas Ingenlath said in a statement.

The Sweden-based carmaker said the funding, alongside previously secured resources, would provide the company with sufficient funds through 2023.

So Polestar sticks around for at least another year, with the option for Volvo to fully subsume it later on. But, Volvo just spun Polestar off? What’s the plan here?

4th Gear: The New Car Market Seems To Be Improving

No, not in terms of dealer markups. Those will stick around as long as F&I offices can get away with them. But for raw sales, numbers seem to be moving in the right direction — cautiously, slowly, but moving all the same. From Automotive News:

U.S. sales rose by double digits for the second straight month at Toyota Motor Corp., while deliveries at Hyundai and Kia advanced for the third straight period in October behind higher demand for electrified vehicles and healthy retail volume as the auto industry’s supply crunch slowly eases.

U.S. light-vehicle deliveries rose last month from October 2021 levels as inventory slowly improves and demand remains steady — even amid rising interest rates, gasoline prices and new-vehicle MSRPs that are putting extra pressure on affordability. LMC Automotive said light-vehicle sales grew by 11 percent to 1.17 million in October, the best month since April, and are now off 10.9 percent for the year.

The seasonally adjusted annualized rate of sales in October came in at 14.9 million vehicles, Baird said, topping the range of analysts’ estimates — 13.4 million to 14.7 million. That is up sharply from the October 2021 rate of 13.21 million vehicles. The seasonally adjusted annual rate, which tallied 13.67 in September, has remained below 15 million vehicles since July 2021, except for January 2022 when it came in at 15.23 million.

More sales means automakers have built more cars to sell. That bodes well for the various resource shortages the industry has had to content with recently, though it’s no sure sign that we’re out of the woods.

5th Gear: Germany Wonders If Maybe We Shouldn’t Mine The Seabed For Minerals

Everything in the world now seems to run on batteries, but the materials to make them are in short supply. In response, some companies have started mining the ocean floor for the precious minerals needed to store energy. Germany, however, thinks there isn’t enough research on the environmental impact of this sort of mining — and is shutting the process down. For now, at least. From Automotive News:

Germany has called for a pause in the developing deep-sea mining industry, saying not enough is known about the likely impacts of mining the seabed for battery metals.

The world’s fourth-biggest economy joins countries including New Zealand and France in calling for seabed mining exploration to stop until further research is done on environmental effects.

German automakers Volkswagen and BMW have previously said they would not buy metals mined from the seabed.

The move by Germany is likely to change the dynamic of negotiations at the International Seabed Authority (ISA) over deep-sea mining regulations, Deep Sea Conservation Coalition co-founder Matthew Gianni, who is observing the talks in Jamaica, said.

…

“The German Government here wants to underline its view that the current knowledge and available science is insufficient to approve deep seabed mining until further notice,” Germany’s delegation said at the ISA on Monday, describing its call for a pause in the industry as “precautionary.”

If there’s one thing I know about humans, it’s that we’re at absolutely zero risk of delving too greedily and too deep. That’s just unlike us.

Reverse: The World Is Blessed With Australian Rock

Neutral: Where Are You Going After Twitter?

We’ll all need somewhere to sit back with our popcorn and watch the site burn. Will it be Tumblr? Mastodon? The Oppositelock Discord?