Tesla Gigafactory Hourly Workers Get Raises, Still Underpaid

Good morning! It’s Tuesday, December 19, 2023, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

The Hype Behind Tesla Stock Success In 2023

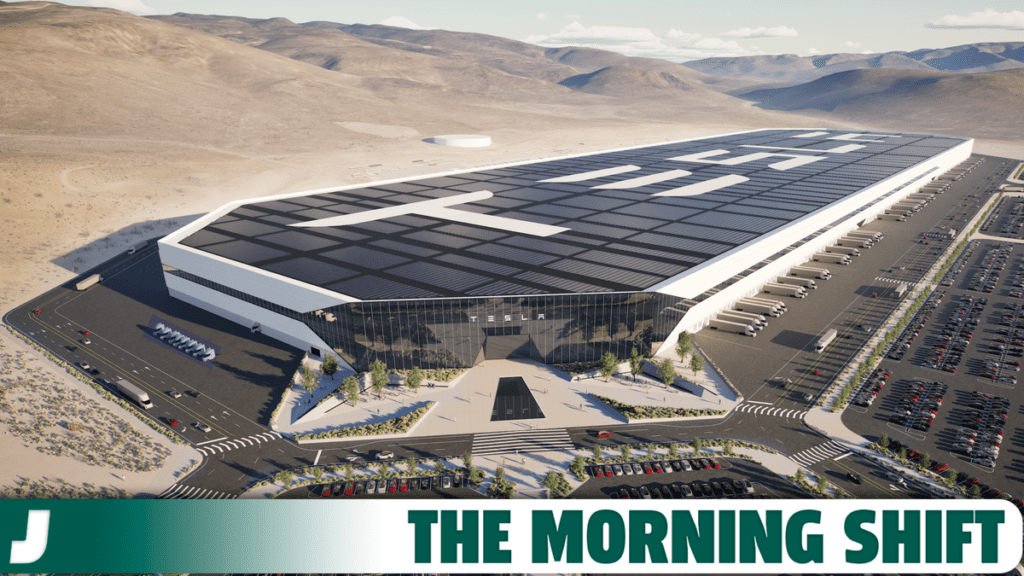

1st Gear: Nevada Tesla Factory Workers Get Pay Raise

Tesla has told workers at its Gigafactory in Sparks, Nevada that some set-rate hourly workers will see pay increases around 10 percent starting in January of 2024. The move is being done, with no doubt in my mind, to try to stave off a unionization or collective bargaining push at the factory. From CNBC:

According to internal materials seen by CNBC, and workers at the plant who were informed of “cost of living adjustments,” Tesla will bump hourly workers from $20 to $22 an hour on the low end, and from $30.65 up to $34.50 an hour on the high end. It’s also streamlining some levels, so that several levels of worker making between $26.20 and $30.65 an hour today will be adjusted to $34.50 an hour, for instance.

The adjustments also represent a 10% or greater raise for most hourly workers, adding anywhere from $2 to $8.30 an hour to their pay.

[…]

The United Auto Workers won record contracts after contentious negotiations and U.S. labor strikes with General Motors, Ford Motor and Chrysler-parent Stellantis earlier this year. As CNBC previously reported, UAW President Shawn Fain repeatedly said he plans to take that fight from Detroit automakers to Tesla, Toyota Motor and other non-unionized automakers operating in the U.S.

The news comes as Tesla deals with its strongest unionization and collective bargaining push yet. In October, Tesla workers at its service and collision repair centers in Sweden started striking. It has now spread to Denmark, Finland and Norway, and it includes workers involved in shipping, trash collection and other services. One of Denmark’s largest pension funds announced it would sell its holding of Tesla stock.

The EV maker’s promise of a significant cost of living adjustment for workers at the Nevada Gigafactory also comes as Tesla faces increased competition for talent, and as CEO Elon Musk touches off one controversy after another via public speaking engagements and posts on X, formerly Twitter, the social media platform he acquired late last year.

So, Tesla workers are being paid a bit more, which is always welcome. However, it isn’t really on par with other automakers that fall under the UAW umbrella.

2nd Gear: Audi Pares Back EV Rollout

Audi is slowing its rather ambitious rollout of electric vehicles to not burden its factories and dealers with cars no one is buying since EV growth is much slower than expected. From Bloomberg:

“We first looked at what order and density of launches the organization could handle,” new Chief Executive Officer Gernot Döllner said in an interview in Audi’s headquarters in Ingolstadt, Germany. “In the end, we decided to spread it out to not overwhelm the team and the dealerships.”

A key profit center for Volkswagen AG, Audi plans to bring out 20 models by 2026, with half of them fully electric.

The task is urgent because Audi’s portfolio is growing stale as rivals Mercedes-Benz Group AG and BMW AG prepare to bring out their next generation of EVs from mid-decade. The luxury-car maker is looking back on a few torpid months culminating in VW CEO Oliver Blume in June singling out Audi as falling short of its potential. The same month, he swapped out Audi’s CEO with Döllner, who has worked with Blume at Porsche, with a task of boosting long-term operating return to 13% from around 9%.

Audi’s Q6 e-tron, repeatedly pushed back by issues at VW’s in-house software unit Cariad, will kick off the model offensive when it rolls off production lines in the second quarter. The car will be the first coming off a new platform underpinning several new vehicles. Another electric model and two combustion engine cars round out the new launches for next year, and a third combustion-engine model is planned for 2025.

Audi’s troubles partly stem from the long-standing hurdles in selling EVs as the industry pushes into a phase of broader adoption: incumbent carmakers are still struggling to ramp up a competitive lineup that delivers acceptable returns, and consumers are put off by high prices and patchy infrastructure.

Bloomberg reports that because automakers like Audi and BMW still rely on combustion-engine powered vehicles for their bottom lines, it leaves the EV field open for Tesla, BYD and other Chinese-made EVs.

Audi has lagged competitors on transitioning a lineup that’s heavily skewed to diesel engines with a series of hurdles getting in the way. The issues, ranging from a dealer dispute in China, the heavy burden of the diesel-emissions cheating scandal and more recently to problems building software, have capped growth for the brand.

[…]

To combat the EV slide in China, Audi and long-standing Chinese partner SAIC Motor Corp Ltd. in July agreed to partner on developing EVs, marking a turning point for Chinese automaking that’s so far been led by learning from foreign manufacturers. The pair will work on vehicle underpinnings to accelerate Audi’s electrification and protect market share.

“At the moment, we play a relevant role especially in the combustion engine segment,” Döllner said. “Our task with both partners is to make the Audi brand a relevant player in the EV segment as well.”

So, Audi EVs are having a tough go of it, and I feel like some of that might come down to the mind-numbingly confusing “E-Tron” nomenclature it has come up with. It hurts my lil brain too much.

3rd Gear: Nikola Founder Gets Four Years

A judge sentenced Nikola Founder Trevor Milton to four years in prison for defrauding investors at his electric truck company. He was convicted on several fraud charges in 2022, and witnesses testified that he lied to ordinary investors about “nearly every aspect” of Nikola. From the Wall Street Journal:

Milton said the company’s zero-emission truck prototype was drivable when it wasn’t. He said Nikola was equipped to produce the necessary hydrogen to power the trucks when it wasn’t. And he boasted that the company had a long list of sales orders, many to companies that didn’t exist.

Milton, speaking through tears during a three-hour hearing in Manhattan, told the judge that his statements about the company referred to its business model. “I did not intend to harm anyone, and I did not commit those crimes,” he said during a rambling 30-minute statement.

U.S. District Judge Edgardo Ramos, who also ordered Milton to pay a $1 million fine and forfeit a property in Utah, said real people were hurt by his actions. “The law does not grant a pass for good intentions,” Ramos said. “It is decidedly the obligation of business executives who are seeking to have the public purchase their stock to speak the truth.”

Despite all this, Milton will remain out on bail while he appeals his conviction. It must be nice to be rich.

Sentencing in fraud cases can depend heavily on how much financial loss a defendant caused. In Milton’s case, Ramos was sorting through three very different calculations, as well as philosophical questions about how long was appropriate for the first-time offender to spend behind bars.

Prosecutors pegged the total loss caused by Milton at more than $660 million, which under federal sentencing guidelines could mean 60 years in prison. They conceded that was too long, but pushed for 11 years, akin to what Theranos founder Elizabeth Holmes received a year ago for her deceptions about the blood-testing company’s technology.

“We are talking about a very serious crime with an impact on a lot of people,” said Assistant U.S. Attorney Matthew Podolsky. Milton cultivated the trust of ordinary people on social media then misled them about his company, Podolsky said.

Probation officials estimated that Milton caused $125 million in losses, the amount Nikola paid to settle an investigation by the Securities and Exchange Commission while neither admitting nor denying wrongdoing. That translates under the sentencing guidelines to 17.5 to nearly 22 years, though they also recommended 11.

Milton’s lawyers, ever the optimists, said that number was actually $0 and asked the judge for no prison time at all. That, uh, didn’t happen.

The judge said it would be ludicrous to sentence Milton to a very lengthy term in line with federal guidelines, which are advisory. Ramos said that he had sentenced other defendants who had lower loss amounts to more prison time, because they “looked their victims in the eye as they took the last dollar from their pocket.”

“I want you to know, I don’t believe that’s who you are,” the judge said.

Milton said while leaving the courthouse that the judge was “very compassionate and understood the situation.”

Lawyers for Milton, who sought a sentence of probation, argued that any misstatements stemmed from Milton’s deeply held optimism and rosy worldview, not a scheme to deceive investors. And while Holmes put people at risk by touting unreliable blood-testing technology, Milton didn’t hurt Nikola customers, they said.

His lawyers apparently argued that media coverage of his trial “will punish Trevor for the rest of his life.” I don’t know. I feel like if I defrauded people out of millions and the only punishment I got was sites like Jalopnik making fun of me, I’d be okay. Maybe I’m just built different.

4th Gear: Hyundai’s $219M Hit On Sale Of Russian Plant

Hyundai plans to sell its plant in Russia for 7,000 roubles, which works out to a little bit over $77. The move makes it the latest global automaker to sell its Russian assets since the country attacked Ukraine.

That is, uh, not how much factories usually sell for. In fact, in a regulator filing, Hyundai said it would be taking a 287 billion won ($219.19 million) hit on the plant which hasn’t built any cars since March of 2022. From Reuters:

The company said it was seeking to transfer its assets in the plant in St. Petersburg to Russia’s Art-Finance and include a buyback option, adding that it plans to complete the deal by Dec. 28.

A Hyundai Motor official said it would receive 10,000 roubles in total for the sale of all its Russian assets.

Hyundai and its affiliate Kia Corp were among the top three selling brands in Russia before the war. Since then global players have pulled out with Chinese brands moving in to replace them.

Hyundai Motor is following other major automakers that have sold their assets in Russia for a nominal fee and included buyback options that could one day allow them to return.

In May, Volkswagen sold its shares in its Russian assets to Art-Finance, which is supported by the autodealer group Avilon.

Renault, Nissan, Volkswagen, Mercedes-Benz, BMW, Toyota and Ford have all pulled out of Russia. Tough.

Reverse: My Heart Will Go On

Neutral: I’m Driving Fast Cars On Video Again

2024 Jaguar F-PACE SVR | Jalopnik Reviews

On The Radio: Kelly Clarkson – “Underneath The Tree”

Kelly Clarkson – Underneath the Tree (Official Video)