Surging Seas and Soaring Premiums: Navigating the Rising Tide of Home Insurance Costs

New Insurify Report Predicts Rate Increases of up to 23% for Home Insurance in some states

As 2024 unfolds, American homeowners should begin bracing for another wave of increases in home insurance premiums says a new report from Cambridge-based Insurify, an online virtual insurance agent. Yet, for states grappling with the dual threats of climate change and economic instability, the forecast is even more daunting. Particularly in coastal states, residents are facing double-digit increases that could redefine the affordability and accessibility of home insurance particularly in the face of new reports predicting an active 2024 hurricane season.

Insurify’s latest Home Insurance Projection report lays out a stark landscape where regions like Florida, Louisiana, and Oklahoma — already burdened by some of the highest insurance costs in the nation — will see the sharpest spikes.

Home insurance costs are projected to increase the most in Louisiana, Maine, and Michigan by the end of 2024 with Louisiana topping the charts with a projected surge of 23%, Maine with +19% and Michigan at +14% – a stark indicator of the growing financial pressures on homeowners in high-risk areas.

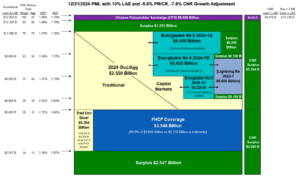

The report also sheds light on a troubling trend: over the last two years, home insurance rates have climbed by 20%, and the momentum shows no signs of waning. By year’s end, the report predicts an average premium increase of 6% meaning the average national rate is poised to reach $2,522. This rise is not just a matter of dollars and cents but a reflection of a broader challenge facing the insurance industry: the increasing frequency and intensity of climate-related events.

The Uninsurability Crisis

One of the most alarming insights from the Insurify report concerns the potential for certain regions to become uninsurable. “It’s possible that the highest-risk areas will become uninsurable,” notes Betsy Stella, Vice President of Carrier Management and Operations at Insurify. The implication is clear — as risks escalate, insurance companies might retreat, leaving homeowners to face the brunt of climate impacts without financial safeguards.

However, the market dynamics could still offer a glimmer of hope. Stella suggests that where there is demand, suppliers typically emerge. The critical question then becomes: at what cost?

The Flood Insurance Gap

Amidst rising premiums, there is also a significant gap in homeowner preparedness, particularly regarding flood risks. Insurify’s findings reveal that at least 60% of American homeowners report lacking flood coverage. This oversight is particularly concerning given that climate change continues to impact home values and increase vulnerability to environmental disasters.

The Florida Factor

Nowhere are the trends more visible than in Florida, where homeowners already pay the highest premiums in the nation. Last year, the average rate was a staggering $10,996, with an additional 7% increase projected for 2024 potentially bringing the average annual rate to $11,759. Such figures are not just statistics but a bellwether for the national insurance landscape, signaling potential crises in affordability and insurance coverage availability.

Looking Ahead

As the insurance industry confronts these challenges, the path forward requires innovation, adaptation, and preparedness. For homeowners, the rising costs underscore the importance of evaluating and updating their insurance coverage, particularly in high-risk areas. For insurers, the increasing claims related to climate events demand a recalibration of risk assessment models and customer engagement strategies.