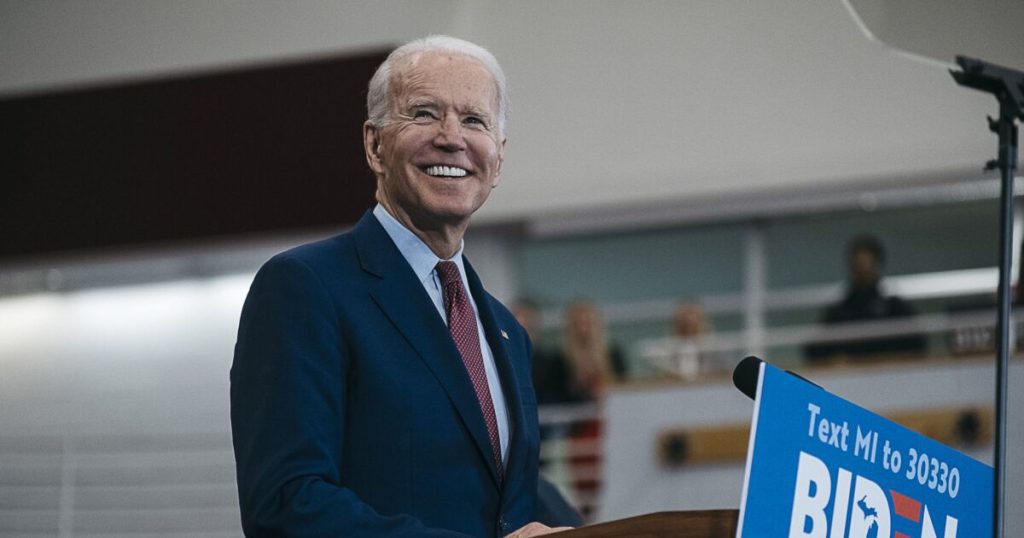

Secure 2.0 heads to Biden. Here's what it means for retirees

As Congress finally pushed through its $1.7 trillion spending bill at the last minute, it also concluded another saga: the months-long quest to pass Secure 2.0.

The sweeping retirement legislation, pieced together from several different Senate and House bills, had been percolating in Congress for the better part of a year. The package is full of popular reforms, supported by the industry and backed by a rare bipartisan consensus — but for months, it never got a vote.

On Friday, that long wait came to an end without drama or fanfare. Instead of giving Secure 2.0 its own vote, lawmakers folded it into the omnibus bill, which had to pass in order to avoid a government shutdown. Meanwhile, most of Washington’s attention was on the upcoming holidays, an ominous snowstorm and a speech to Congress by Ukrainian President Volodymyr Zelensky.

But even if it was denied the spotlight, the new law is significant. Like its predecessor, the Secure Act of 2019, Secure 2.0 is a patchwork of small fixes that many say will make saving for retirement easier. Among other measures, it bolsters auto-enrollment in 401(k)s, raises the limits for catch-up contributions and offers help paying off student loans and emergency expenses. It won’t solve every problem, but many experts say it’s a substantial step in the right direction.

“This is a good bill for the American people, and it’s a good bill for the retirement services industry,” said Paul Richman, chief government and political affairs officer at the Insured Retirement Institute. “I think it’s a win-win all around. It’ll mean more retirement savings to help bring us closer to addressing the looming retirement crisis that we know is out there.”

Here are five of the many ways Secure 2.0 will change retirement in America: