Property Insurance: Opportunities for New Profit Centers

Published on

December 14, 2023

Where will tomorrow’s profits come from?

When you look at the history of nearly any long-term, successful company, you see occasional shifts in product and service offerings. IBM is a great example. IBM is 112 years old. For most of that time, IBM was considered a manufacturer. Their products were machines that could tabulate, type, and hold data. Many of these machines were cutting-edge. IBM’s electric typewriters used a rotating ball to strike the ribbon and paper, instead of a lever. The result was a faster typing pace and a more flexible look and feel from type — you could swap out the ball for a different font.

When you look at IBM today, you don’t think of manufacturing. Their profitable products have changed over time. These shifts and “business risks” give companies greater resilience and longevity by allowing the company to overlap core business capabilities with the new business opportunities that exist outside the core business. Many times these fringe businesses become core businesses, then, if the company is around long enough, those core businesses are often replaced by other up-and-coming opportunities. Look how far cloud computing, automation, and AI are from desktop calculators and punch card tabulators.

Some insurers might argue that their core value proposition of risk products will never change. But in today’s world, “never” can be overturned in a moment. Leading insurers should always keep an eye out for profitable opportunities on the periphery. Is there a new profit center waiting in the wings for your organization to pick it up?

Signs from the fringe

At Majesco, we closely examine customer trends that will affect insurance’s product offerings and its fringe opportunities. Through our market surveys, we identify areas where there are gaps between what individual and business customers want and what insurers are currently providing. Some of these gaps are large. They represent opportunities that are too big to miss. For an in-depth look at these trends, be sure to read Bridging the Customer Expectation Gap: Property Insurance.

For today’s discussion, we’ll focus on three areas of value-added service opportunity as identified through Majesco research:

Preventive services (Commercial and Individual P&C)

Usage-based supplemental coverage (Commercial and Individual P&C)

Services directed to specific lifestyle needs (Individual P&C)

Preventive Services (Commercial/SMB)

Risk is growing. According to McKinsey’s 2023 insurance report, a combination of factors is going to push insurers into new market territories.[i]

Increased CAT events in the US (Up 50% in the 2017-2023 timeframe from the 2007-2017 timeframe),

Increased cyber risks, and

The need for greater relevance with their offerings

Either insurers and reinsurers need to gear up to take on more risk, or they must innovate around helping customers reduce or eliminate risk. Or maybe it’s all of the above. Today’s increased catastrophes, inflation, volatile market environment, and pressure on profitability demand a greater focus on preventable losses and better outcomes through underwriting profitability, proactive risk mitigation to minimize or eliminate claims, and enhanced customer experiences.

Business customers want confidence and security that goes beyond the loss-recovery contract. While insurers are focused on how they can better assess risk, many are now expanding to also focus on the prevention of losses and creating risk resilience for customers.

Prevention is the future of insurance. While prevention services through surveys and education are not new in the insurance industry, the ways to identify and prevent risk are changing. Every technology or value-added service that aids in prevention and risk mitigation is a technology that will give insurers a stable foundation upon which to grow, even in unstable times. A prevented claim also happens to be the ultimate customer experience.

Majesco is helping insurers to identify preventable risks and reduceable impacts by looking at both commercial mindsets and new technologies that can assist. We began by looking at the disparities between SMB and Insurer interest in particular technologies and services.

Commercial Property SMB – Insurer Gaps

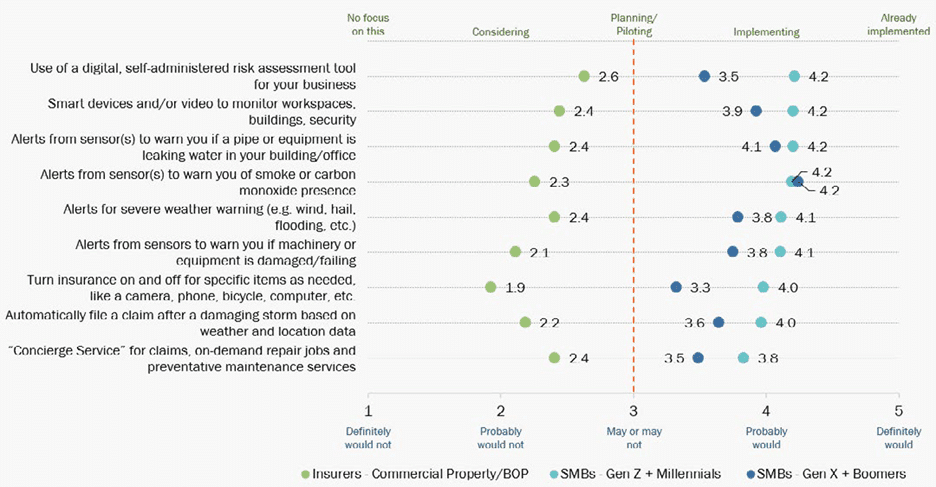

According to Majesco surveys, there are large gaps between what SMB customers want and what insurers are or are not delivering, with up to a two-times differential, as seen in Figure 1. Most importantly, this is consistent for both generational groups (Gen Z-Millennial SMBs and Gen X-Boomer SMBs), with little differentiation.

Looking at the right side of Figure 1, we see the SMB propensity to use particular preventive technologies and services. These include Security monitoring with smart devices or video, plus sensors and alerts for smoke/CO, water leaks, equipment failure, and severe weather. Items such as these promote safety and provide peace of mind by helping to avoid or minimize risk.

These services have among the highest levels of interest for both segments. Both groups’ demand for services is to help make their lives easier with high interest in digital property self-assessment tools, automatic claims FNOLs based on severe weather and location data, and concierge service for repairs and preventative maintenance. For SMBs, this becomes a real value with all the pressures they face day to day.

Consider automated and concierge services, for example. Insurers have an opportunity to fix one issue — the SMB time crunch — while addressing primary risk issues, such as preventive maintenance that can save claims. Value-added services like these can add value to both the policyholder and the insurer.

The technologies and data that power value-added services exist today and many of them are operational. For example, Majesco’s LossControl360 uses AI and machine learning to better assess risk and provide a report of areas to reduce it. Insurers can use the vast loss control survey data Majesco has along with third-party data to use our Property Intelligence AI model to enhance underwriting, and loss control assessments and then leverage the results to communicate and educate customers on understanding and managing their risk.

Figure 1

Customer-Insurer gaps in value-added services for commercial property insurance

Usage-Based Insurer Gaps for All P&C Carriers

Both personal and commercial P&C are suffering from gaps that can be remedied through usage-based products for all types of property. One common issue regards insuring items that are seldom used, such as recreational vehicles, small (but expensive) personal items, such as photography equipment, or other recreational equipment, such as bikes and scooters. For SMBs, these might include pieces of rarely used, but important equipment, rented vehicles specialty, event-driven initiatives that may occasionally fall under the realm of E&S policies. Wherever there is a temporary, short-term risk, there is the opportunity for a new product and revenue.

Looking at both Figure 1 and Figure 2, we get a sense that the greatest gaps occur on these types of items, where individuals and SMBs want coverage, but can’t abide by the cost of a full-time policy. Insurers would love the additional premiums, but their systems aren’t always built to handle insurance that can be turned on and off. This seems like a valuable opportunity for insurers to close protection gaps and begin serving a growing market. It makes the most sense to begin offering these products to current policyholders, but with experience, these products are also ripe for placement through channel partners.

Personal Property Consumer – Insurer Gaps

People want safety and they want their lives to run smoothly, amid an unpredictable world. They have lifestyle needs. They will pay for services to help them maintain the status quo despite new challenges. This is the sweet spot of value-added services. To confirm that current insurance-related technologies are desired by customers, Majesco surveyed consumer sentiment. Are these technologies viable for adoption? Will they be accepted?

In our consumer research, we see a generational alignment in value-added services in the homeowner/renter insurance space, likely driven by their top-of-mind issues (Figure 2). Customers value safety and peace of mind from alerts and monitoring devices/services like smoke/CO and water leak sensors, home monitoring for elderly family members, and severe weather alerts. These offerings have among the highest levels of interest for both generational segments.

In particular, the monitoring of elderly family members leverages sensor technology to help keep them in their homes rather than a nursing home or assisted living, helping to manage their financial top-of-mind issues. The US population is aging, which is going to create fresh customer needs and insurance opportunities. In October 2023, the U.S. Census Bureau released a report that roughly 4 million households with an adult age 65 or older, “had difficulty living in or using some features of their home.” Nationally, very few homes are prepared to house an aging population. For example, only 19.6% of homes in New England would be considered “aging-ready.”[ii]

As the population ages and as middle-aged caregivers are called upon to make decisions that will benefit the level of care for an older parent, these customers will be seeking protective and preventive services that could be considered fringe businesses — but may become core profit centers as the population continues to age. Home retrofitting for safety, adding home sensors and cameras to improve levels of care in the home, and developing methods for watching over water and electrical damage (common issues for the elderly in their homes). And this is just for elder care. If insurers consider additional lifestyle factors, an entire array of possible products and services begins to take shape.

Ease of automatic claims FNOLs based on weather and location data, automated cyber security monitoring, and digital property self-assessment tools all provide self-service capabilities increasingly demanded by customers. A world of risk contains worry. Insurers can ease worries with value-adds.

For example, concierge services for repairs and preventative maintenance are also of high interest among consumers. They know the value of their spare time and many of them don’t want to spend their spare time fixing things. Risk prevention and mitigation of their most valuable assets – their home and personal property — is a high priority.

The breadth and strong interest in these value-added services offer insurers an opportunity to deepen customer relationships while creating potential new revenue streams to offset the interest in personalized pricing. But insurers need to move well beyond consideration into action…by delivering value-added services.

Figure 2

Customer-Insurer gaps in value-added services for personal property insurance

Your Entrepreneurial Enterprise

Your business has a core product or service. It is the thing you do well, and it provides profits over the long haul. Those with an entrepreneurial spirit also go after the products and services that surround the periphery of what they do. They see opportunities on the fringe. They break down walls of convention to gain access to new markets with fresh ideas.

Where is your next profit center? Majesco has recently rolled out a new and expanded line of insurance-focused products, such as our P&C Intelligent Core Suite, Majesco Loss Control, Majesco Property Intelligence[DG1] , and Majesco Copilot, developed using Microsoft’s cutting-edge AI models. They are ready to help insurers move into innovation’s fast lane.

Build resilience into your framework by adding value-added services to your mix. Contact Majesco today and be sure to attend our upcoming trends webinar, Majesco at the Forefront: Strategies and Innovations Shaping the Insurance Industry.

[i] Javanmardian, Kia, James Polybank, Sirus Ramezani, Shannon Varney, Leda Zaharieva, Global Insurance Report 2023: Expanding commercial P&Cs market relevance, McKinsey & Co. March 2023

[ii] Census Bureau Releases New Report on Aging-Ready Homes, October 10, 2023, US Census Bureau

[DG1]Yperlink these