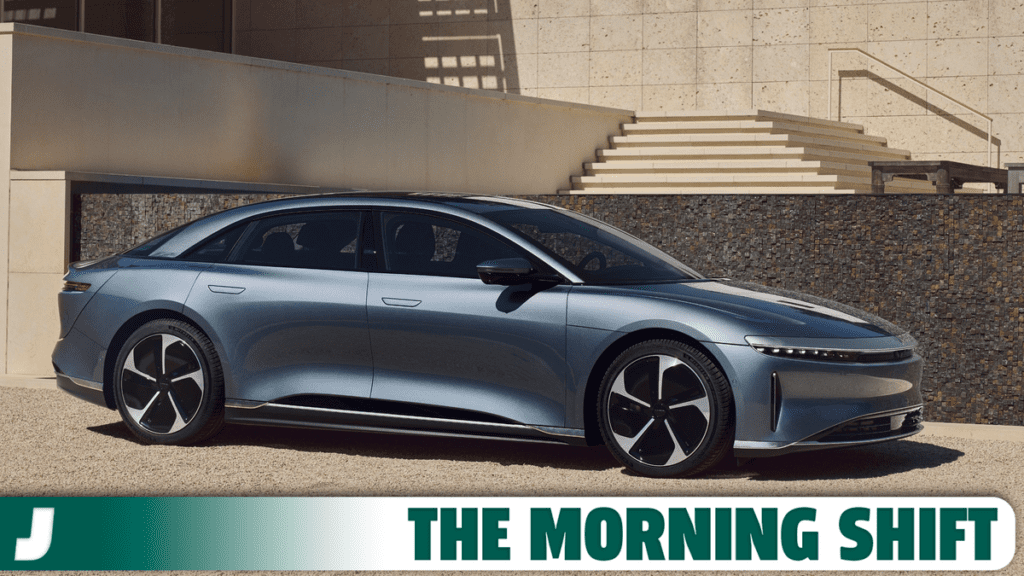

Lucid Slashes Air Prices To Challenge Tesla In EV Price War

Good morning! It’s Monday, August 7, 2023, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

What Car Should You Buy: Weird and Unique Ride for The Family

1st Gear: A Steep Discount On Air

Lucid has reportedly cut prices on its Air electric sedan by as much as $12,400 as part of a limited-time offer. It comes as rising competition in the EV segment sparks a bit of a price war. From Reuters:

Lucid reduced the price of the Air Pure by $5,000 to $82,400 from $87,400, and cut prices of the more powerful Touring and Grand Touring versions by $12,400 to $95,000 and $125,600, adding that the offer would be valid as long as supplies last.

A spokesperson for Lucid said the company was unable to provide details on how much stock will be part of this offer.

Tesla’s Model S and its performance version Model S Plaid – direct competitors with the Air – are priced at $88,490 and $108,490 down from $104,990 and $135,990 at the beginning of the year.

This news comes just one year after Lucid raised Air prices, citing rising raw materials costs and a slow supply chain brought on by the Covid-19 pandemic. Since then, rising interest rates and recession fears have slowed demand.

That has sent ripples through the industry, making it difficult for money-losing startups such as Lucid, which also face competition from traditional automakers launching electric models, to grab market share.

Helping some lower-priced models woo customers is a $7,500 federal tax credit under the Inflation Reduction Act, but more expensive cars such as Lucid’s Air are not eligible.

The outlet reports that Lucid is expected to show worsening losses in its second-quarter earnings report.

2nd Gear: Toyota Wants Robotaxis, Too!

Toyota and two Chinese partners are reportedly setting up a joint venture with the end goal of bringing self-driving vehicles to the masses. Sound familiar? I bet it does.

The automaker, its manufacturing affiliate in China and autonomous tech company Pony.ai will invest over one billion yuan ($139 million) in this new driverless EV initiative. Right now, there’s no timeline or estimated number of vehicles to be found. From Bloomberg:

The three-party venture aims to “advance the future mass production and large-scale deployment of fully driverless robotaxis,” according to a statement from Pony.ai.

Self-driving car technology has attracted investment from a number of top auto and technology companies and many have pilot programs scattered across the US and in China. But progress has been slower than once projected.

Toyota announced the venture on its Chinese language website. The automotive giant invested $400 million in Pony.ai three years ago, solidifying a partnership forged in 2019.

Pony.ai, founded in 2016, also has a relationship with Guangzhou Automobile Group, which is Toyota’s manufacturing partner at GAC Toyota Motor Co.

Pony.ai is reportedly based in Fremont, California. It develops and operates self-driving fleets of vehicles in both the U.S. and China.

3rd Gear: It Wasn’t All Yellow

U.S. trucking company Yellow has reportedly filed for Chapter 11 bankruptcy protection, and it says it is going to wind down operations after struggling with mounting debt and tense negotiations with the Teamsters Union. The company, which is the better part of 100 years old, filed in a Delaware court and estimated assets and liabilities between $1 billion and $10 billion. It also said it has over 100,000 creditors.

Yellow folding is going to put about 30,000 workers in the freight industry at risk, and it’s bad timing. The industry is already reportedly dealing with a serious slump in volumes. From Reuters:

Yellow said on Sunday it intends to fully pay back a $700 million loan former President Donald Trump’s administration issued to bail out the long-troubled firm in 2020 under a pandemic relief program.

The company has $1.3 billion in debt payments coming due in 2024, including a $567.4 million private-equity term loan in June and the U.S. loan in September.

Yellow also has a roughly $450 million secured revolving loan from a syndicate of banks arranged by Citizens Bank NA, Merrill Lynch and others that expires in January 2024.

[…]

Yellow also has a roughly $450 million secured revolving loan from a syndicate of banks arranged by Citizens Bank NA, Merrill Lynch and others that expires in January 2024.

Yellow also has a roughly $450 million secured revolving loan from a syndicate of banks arranged by Citizens Bank NA, Merrill Lynch and others that expires in January 2024.

Yellow recently averted a strike by 22,000 Teamsters-represented workers, according to Reuters. In fact, the company reportedly lames Teamsters for driving it into bankruptcy. I suppose if you cannot afford to pay your workers the wage they deserve, then maybe you shouldn’t be a company anymore.

4th Gear: Chinese Battery Maker Wants To Go Public

A battery maker in China that reportedly built a battery capable of going 1,000 kilometers (620 miles if you speak freedom) on a single charge plans to go public as soon as 2025. Beijing WeLion New Energy Technology Co. is relying on automakers to embrace next-generation cells as they attempt to make consumers give up on their range anxiety.

The company already supplies long-range semi-solid state cells to Chinese EV startup Nio. However, it is targeting a 20-fold surge in revenue to 10 billion yuan ($1.4 billion) by 2025. From Bloomberg:

The company, better known as WeLion, was valued at 15.7 billion yuan in its most recent funding round, said Li, who also holds the title of chief scientist.

Solid-state batteries are a potential game changer for the EV industry because they enable high-voltage, high-capacity cathodes that provide a substantial boost to battery capacity and performance.

While no one has succeeded yet in commercializing solid-state batteries, WeLion’s semi-solid state cell is being used in Nio’s new ES6 sport utility vehicle unveiled in May, making it one of few next-generation battery makers in the world to start mass production.

WeLion’s battery for Nio has a 150 kilowatt-hour pack, and the 1,000-kilometer range compares favorably with the Lucid Air Dream Edition R (840 kilometers) and Tesla Inc.’s Model S (640 kilometers). The cell has an energy density of 360 watt-hours per kilogram, Li said. That’s higher than the estimated 300 watt-hours per kilogram of Tesla’s 4680 battery, according to Shinyoung Securities in Seoul.

This sort of tech has attracted interest from a number of automakers including Volkswagen, Ford, Mercedes-Benz and Geely. To meet its sales goals, WeLion is reportedly building four more battery production facilities in China to boost its annual capacity to 30 gigawatt-hours by 2025. That’s a big jump from the 6 GWh the company is currently producing.

Reverse: Yikes!

Neutral: Drive An E-Type

Photo: Andy Kalmowitz / Jalopnik

I don’t fit at all, and I could not care less. Story to come.

On The Radio: Jim Croce – “Bad, Bad Leroy Brown”

Bad, Bad Leroy Brown

This is what 30-year-olds used to look like.