Lucid And Rivian Are Gearing Up For A Miserable 2024

Good morning! It’s Thursday, February 22, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

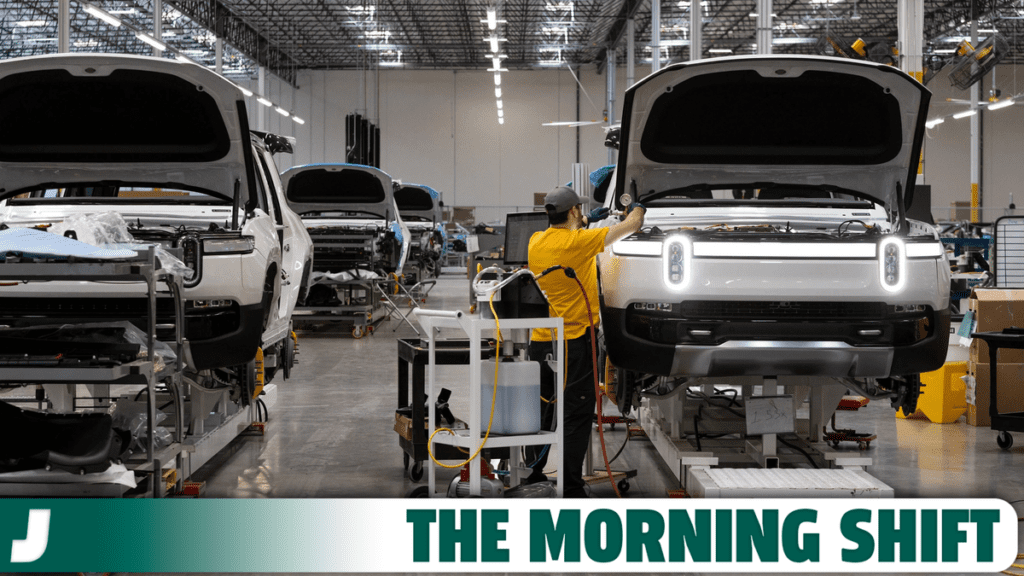

Rivian Recalls Nearly Every Car It Has Built

1st Gear: Rivian, Lucid 2024 Production Falls On Weakening Demand

Luxury electric vehicle startups Lucid and Rivian have both forecasted their 2024 production numbers to be well below analyst estimates. You can thank high borrowing costs for expediting weakening demand of pricier battery-electric vehicles. Just to add insult to injury, Lucid said it is cutting 10 percent of its workforce.

Ford, General Motors and Tesla have all signaled a slowdown in EV demand, and this has led to a price war between EV makers in an effort to entice customers. Unfortunately for the manufacturers, it has drastically hurt margins.

Here’s the latest on Rivian, from Reuters:

Rivian, the maker of R1T pickup trucks and R1S SUVs, is planning a weeks-long production shut down this year to upgrade its production line to improve efficiency and cut costs.

As a result, Rivian said it expects to produce 57,000 vehicles in 2024, well below estimates of 81,700 units, according to eight analysts polled by Visible Alpha. It produced 57,232 vehicles last year.

“There is a host of macro level challenges,” Rivian CEO RJ Scaringe told Reuters, adding that high interest rates and geopolitical risks were making consumers more conscious and price sensitive.

After shying away from cutting the price of its vehicles last year, Rivian this month introduced lower-range options for its existing cars that are $3,100 cheaper.

Still, Rivian said it expects deliveries in the current quarter to be 10-15% lower than the already weak fourth quarter and that its order book had reduced due to factors including cancellations.

Rivian has been focusing on reducing its cash burn by re-negotiating supply contracts and building some components in house. Along with the cost benefits from the production line upgrade, the company said it expects margins to improve by the end of the year.

“A lot is riding on” the company’s smaller and cheaper R2 SUV that is set to be unveiled next month, Vitaly Golomb, a Rivian investor and an investment banker, told Reuters. Production is scheduled to start in 2026.

Lucid is in a very similar situation, and it plans to introduce a mid-size car into the market in late 2026 to widen its customer base. That’ll come following its Gravity SUV which will go into production in late 2024.

Here’s more about Lucid’s state of the state, from Reuters:

“With that we’re going to target a $50,000 price point,” Lucid CEO Peter Rawlinson said in an interview.

“Right now, we’re competing with Mercedes and Porsche. When that comes out, we’re going after Tesla Model Y and Model 3,” he said, adding that he expects Lucid’s total addressable market to increase 20 times.

Lucid, which has been slashing prices of its Air luxury electric sedans, also forecast production for 2024 that was much lower than Wall Street’s expectations.

It expects to make 9,000 units this year, up from 8,428 vehicles in 2023. Wall Street estimated 22,594 units, according to five analysts polled by Visible Alpha.

After reading all of this, one thing is clear. It is not a fun time to be an automotive newcomer trying to build an expensive electric vehicle right now.

2nd Gear: Mercedes Also Drops 2024 EV Sales Target

Well, past Andy, it’s also not a fun time to be the oldest automaker in the world trying to build an expensive electric vehicle right now.

You see, Mercedes-Benz has warned electric vehicles will remain more expensive than their internal combustion-powered siblings for years to come, and demand is cooling for expensive electric vehicles. Not a great situation, man. From Bloomberg:

The manufacturer on Thursday forecast lower returns in 2024, citing challenges from a slowing economy. Mercedes also pared back its outlook for EV sales, with demand mainly in the small and medium segments where it’s not as present.

Variable cost parity between EVs and traditional cars “is many years away,” Chief Executive Officer Ola Källenius told Bloomberg Television. “You can see that in the pricing.”

Mercedes still rose as much as 5.4% — the steepest intraday gain since November 2022 — after announcing a €3 billion ($3.2 billion) share buyback program. The CEO flagged potential for additional buybacks if Mercedes can keep producing free cash flow like it has in the past years.

While the company is rewarding shareholders, its push to sell more top-end cars like the S-Class to bolster profits and fund the costly transition to battery technology is running into first roadblocks.

The carmaker long benefited from pent-up demand that helped offset some of the economic challenges. But orders are expected to normalize this year as high living and borrowing costs weigh on consumption. The company also needs to deal with fierce competition in its key market China — where it plans to introduce 15 new models this year — and pressure from Tesla Inc.’s frequent price cuts.

“The macro environment is quite challenging,” Källenius told Bloomberg TV. “We still have the effects lingering from the higher interest rates and China is going through some structural challenges.”

Bloomberg says sales of fully electric vehicles are set to grow in 2024 at their slowest rate since 2019. This stall in momentum is heating up the competition between automakers.

Mercedes is forecasting an automaking margin of as low as 10% this year on roughly stable unit sales. Profitability came in at 12.6% last year — toward the lower end of guidance.

The share of fully electric and plug-in hybrid vehicles will remain roughly stuck at between 19% and 21% of Mercedes’ sales this year. The manufacturer also pared back its medium-term outlook for the technology, and now expects EVs to account for half of sales in the second half of the decade rather than in 2025.

Mercedes is betting on its next-generation EVs due from around mid-decade to make a real difference, with variable costs for the platform expected to be 30% lower. Models include an electric version of the CLA, a medium-segment sedan rated to go more than 750 kilometers (466 miles) on a charge, beating Tesla’s refreshed Model 3.

I’m not a smart man, so I don’t know what is going to fix this cooling demand for EVs. However, I’ve got a hunch that lower prices, lower interest rates and a better infrastructure are good places to start.

3rd Gear: CA Regulators Slow To Decide On Waymo Expansion Plan

Autonomous driving company Waymo is going to have to wait just a little bit longer to hear whether California regulators will approve of its ambitious expansion request.

The Golden State’s Public Utilities Commission has postponed its decision in regard to Waymo’s expansion. It now has until June 19 to make a decision. From Automotive News:

Waymo seeks to offer its commercial, driverless robotaxi service in unprecedented scope across California. With approval, the Google subsidiary would expand beyond its current San Francisco home to most of the San Francisco peninsula and throughout Los Angeles.

CPUC staff had until Tuesday to decide whether they’d approve, deny or delay their decision.

In the case of the latter, a procedural “order of suspension” allows that decision to be pushed for as long as 120 extra days, according to a commission spokesperson.

Waymo’s robotaxi service in San Francisco remains ongoing and is unaffected by its pending application.

Previous applications by Waymo and competitor Cruise have faced similar postponements and ultimately been approved. But this one comes amid increasing safety scrutiny and hostility toward self-driving cars.

[…]

Dozens of organizations have written letters to CPUC officials in support of Waymo’s expansion. But five have protested such plans, including the Los Angeles Department of Transportation and San Francisco County Transportation Authority.

Maybe I’m a hater, but I just do not think the inherent risk of these self-driving robotaxis is worth the reward. To be honest, I’m not even sure what the reward is. Putting cabbies out of business? I don’t know.

4th Gear: UAW Will Spend $40 Million To Organize Nonunion Workers

The United Auto Workers union says it is going to spend $40 million in new funds to support the organizing of non-union workers at auto plants and battery facilities throughout the U.S. (but mostly in the South) through 2026. From The Detroit Free Press:

The United Auto Workers union, in a news release Wednesday, said its top decision-making body, the International Executive Board, voted Tuesday “to commit the funds in response to an explosion in organizing activity among nonunion auto and battery workers, in order to meet the moment and grow the labor movement.”

UAW spokesman Jonah Furman said the board vote was unanimous, and the figure represents $40 million that has yet to be spent. It wasn’t immediately clear what the union normally outlays on this type of organizing or how much has been spent in recent months. The board is made up of 14 members, including the union’s president, secretary-treasurer, three vice presidents and regional directors.

The union made a splash following last year’s Detroit Three bargaining when it announced a major push to organize more than a dozen nonunion auto companies in the United States. The UAW said more than 10,000 autoworkers have signed union cards, including a majority at Volkswagen in Chattanooga, Tennessee. Public campaigns have also been announced at Hyundai in Montgomery, Alabama, and Mercedes-Benz near Tuscaloosa, Alabama.

The Free Press recently reported that UAW President Shawn Fain expects to organize at least one nonunion auto plant in 2024.

Organizing the Southern nonunion plants, many operated by foreign-headquartered automakers, has been a long-elusive goal of the UAW, but the results of last year’s widely watched bargaining with Ford Motor Co., General Motors and Stellantis, owner of Jeep, Ram, Chrysler, Dodge and Fiat, helped fuel a belief from some that a change in that story is possible. The contracts that followed the targeted strike strategy against all three automakers secured wage gains and other improvements for workers as well as the return of cost-of-living adjustments, something lost during previous concessionary bargaining.

Go get ‘em, fellas! Solidarity forever.

Reverse: We Should Give It Back

Neutral: The Honda Prologue Is Fine

The 2024 Honda Prologue is a fine EV, but a bad Honda

On The Radio: Royal Otis – “Murder On The Dance Floor”

Murder on the Dance Floor (triple j Like A Version)