Is distracted driving the reason car insurance prices are increasing?

Before the pandemic, car insurance prices were skyrocketing. While we still haven’t actually emerged from under the covid curse, rates are once again creeping up. A commonly cited reason is distracted driving. Here at ValChoice, we tend to be skeptical of simple explanations, so we took a look into the data. Here’s what we found.

First, want to find a fair price for your car insurance? Just click the button below.

Indeed, it’s true. Distracted driving is a significant contributor to the rapidly increasing car insurance prices. It’s not the only cause, but it’s a major one. Here’s a summary of our analysis.

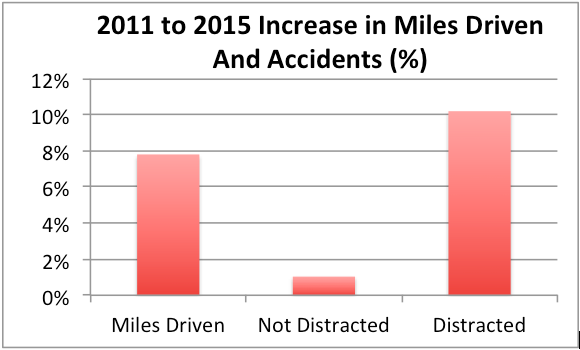

Changes in Miles Driven Compared to Injuries From Distracted Driving

Since 1970 the average number of vehicle miles driven has steadily increased. The increase has been relatively constant, with the exception of during economic downturns. See image 1 below. Image 1 can also be found at this link.

Image 1: U.S. Federal Highway Administration data published by the Federal Reserve Bank of St. Louis (FRED) data on average miles driven per year, 1970 – 2021.

From June of 2013 through March of 2020, miles driven steadily increased on both a monthly and an annual basis. During the same time, the number of accidents related to distracted driving was relatively flat. See image 2 below.

Image 2: People Injured in All Crashes and Distraction-Affected Crashes, 2014–2018. Data for the chart is from the NHTSA, but uses different data collection methods. Therefore, these isn’t an exact analysis.

Find out how good your car insurance is. Get a free ValChoice rating on your car insurance company.

Other Significant Factors Affecting Car Insurance Prices

More miles driven contributes to more accidents. Without question, more cars on the road leads to more accidents. Another important factor in the cost of insurance is the cost of repairing cars is increasing. The many safety features that are helping keep passengers safe also lead to higher repair costs.

What Consumers Can Do

First, don’t drive distracted. Second, don’t let friends drive distracted. Third, if you’re a safe driver, make sure you’re with an insurance company that specializes in low risk drivers. This is important because any company that includes high risk drivers in the risk pool will have to spread the cost of those poor drivers across all policyholders. This means you can save money and get better protection by making sure you’re properly placed with the right type of insurance company. This is easy to do. Simply click the button below to get a free car insurance rating that compares your company to one of the best in the state.

About ValChoice

Note: ValChoice does not receive any form of compensation from insurance companies for presenting them as a good option in our car and home insurance reports. Our analysis is completely independent of the industry.

![]()

About Dan Karr

Dan has been a CEO or Vice President for high-technology companies for over 20 years. While working as a Senior Vice President of Marketing and Sales for a technology company, Dan was seriously injured while commuting to work. After dealing with trying to get insurance companies to pay his significant medical bills, or to settle a claim so Dan could pay the medical bills, he became intimately aware of the complexity of insurance claims. Dan founded ValChoice to pay forward his experience by bringing consumers, insurance agents and financial advisors easy-to-understand analysis needed to know which insurance companies provide the best price, protection — claims handling — and service.