Insurtech SPACs not spared amid sector's wider performance woes

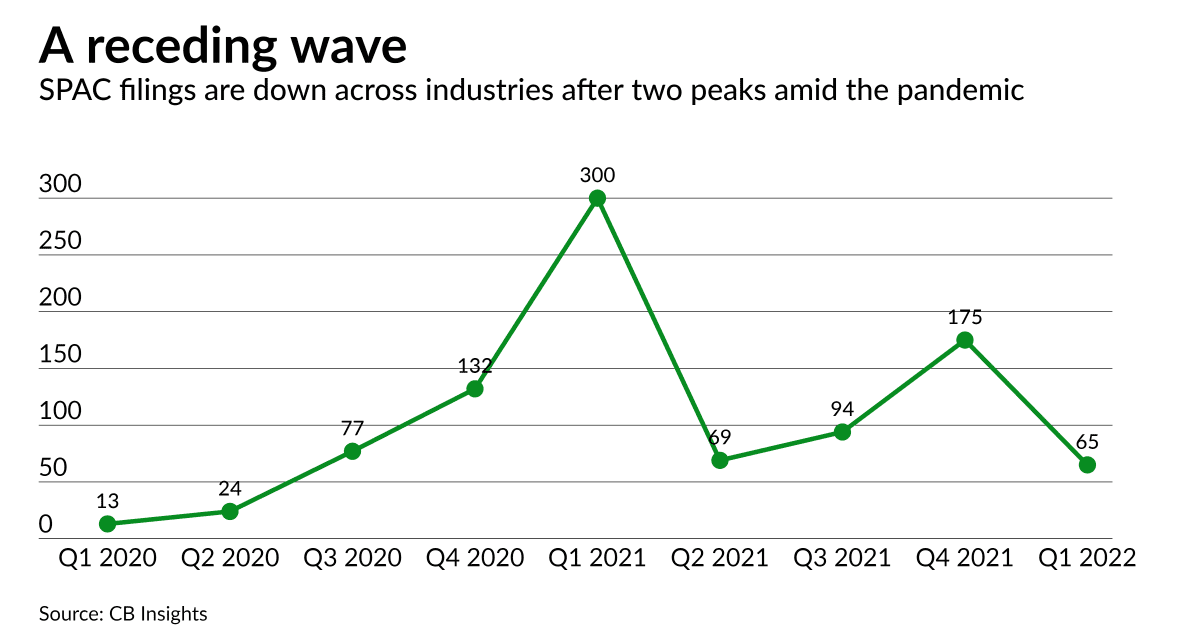

The proliferation of special purpose acquisition companies (SPACs) as a means to support expansion spiked in popularity in 2020 and 2021, and many insurtech companies came along for the ride. This year, however, many of the companies that pursued SPACs are finding that the vehicle hasn’t worked out like they hoped.

SPACs were used by insurtech startups as far back as 2018, when Sirius International Insurance Group merged with the Easterly Acquisition SPAC. Two years later, just after the COVID-19, pandemic began, the insurance industry joined the SPAC mini-boom.

A SPAC is a form of IPO in which an acquiring company is started for the express purpose of acquiring a target company to bring it to the public markets to raise capital. Once the SPAC itself is publicly traded, there is then a “de-SPAC” process in which the SPAC, its backer and the target company then merge, which effectively turns the private target company public in a reverse merger, explains Scott Kelley, vice president of underwriting at the Argo Group, a Bermuda-based specialty insurance company.

Here’s a sampling of the insurtech companies that began SPACs and either followed through with de-SPAC or reconsidered the arrangement, and what happened for them in the marketplace as a result.

Metromile, a telematics company founded in 2011, went public after being bought by SPAC INSU Acquisition Corp. in February 2021. Its stock traded between $10 to $17 per share from November 2020 until the SPAC, after which it began dropping to about $3 per share. In November of 2021, it was acquired by the insurtech Lemonade for $500 million –less than half its valuation when acquired by the SPAC.

Hippo, a home insurance startup, publicly expressed interest in a SPAC arrangement in fall 2020 after reaching a $1.5 billion valuation ratified by investors Ribbit Capital and Dragoneer. In March 2021, the company announced a SPAC with Reinvent Technology Partners Z, projecting it would raise $230 million in capital. When investors pulled out early, however, the SPAC only raised about $37 million. The company’s stock went from over $10 per share before the SPAC announcement to under $5 per share by August 2021.

Kin Insurance, a home insurance company, announced in January that it would terminate a SPAC agreement made with Omnichannel Acquisition Corp. that it had entered in June 2021. Kin then closed a $82 million Series D financing round in March.

Qomplx, a cyber risk analytics management platform, entered a SPAC agreement with Tailwind Acquisition Corp. in March 2021, but also terminated the agreement before proceeding that August.

BlackSky, a global monitoring services provider, began a SPAC agreement with Osprey Technology Acquisition in February 2021 and completed the merger to go public in September 2021. Opening at $10 per share, the typical stock price for a new SPAC IPO, the stock is now under $3 per share, an increase over its lowest price to date, $1.30 per share on May 20. The company recently reported record revenue but a net loss, and landed a contract with the U.S. National Reconnaissance Office.

Insurtechs may have been particularly poorly suited to SPAC arrangements, explains Mark E. Watson, founder and chairman of Aquila Capital Partners.

“Insurance related businesses targeted by SPACs weren’t ready to be public companies. They weren’t mature enough or big enough,” he says. “SPAC sponsors, in many instances, convinced management teams they were ready for prime time, even if they weren’t – if they’d go public back in Q4 2020 and Q1 2021, back when SPACs were the rage. The reason why SPACs were so popular in Q4 2020 and Q1 2021 was because investors felt that all the opportunity was going to big institutional and private equity investors. … It’s hugely profitable for the SPAC sponsor, but dilutive to the company going public.”

According to data from SPAC Research, covering from September 2020 onward, 34 companies in the financial category (which, as defined by SPAC Research, includes insurance) successfully used SPACs for funding and 121 financial companies tried SPAC arrangements but did not complete funding with this method.

The key is setting the value of the target company reasonably and accurately, so that the investors who originally backed the target company support the SPAC arrangement.

“In a healthy deal, the SPAC signs a merger agreement with a business at a reasonable valuation that can attract outside investment,” says Ben Kwasnick, founder of SPAC Research. Investment may come through either private investment in public equity (PIPE) or public investors who own shares. “In a healthy SPAC deal, the PIPE commitment from institutional investors helps public investors see the deal is being done at an attractive valuation and they should stick around for shares in the new company, rather than redeeming them for cash.”

Insurance companies were a small portion of the financial category as SPAC Research defines it. Of the 34 SPACs identified, Sirius International, Hippo and digital classic vehicle insurer Hagerty were the only insurance companies. Hagerty went public in December 2021 through a SPAC with Aldel Financial. Of the 121 not completed, also just a few involved insurance companies, namely Delwinds Insurance’s SPAC with target company Foxo, and Kairos Acquisition, a SPAC still seeking a target.

“In the insurtech space,” says SPAC Research’s Kwasnick, “publicly listed comparable companies experienced a period of weakness and the valuations where deals were struck no longer seemed attractive. So many of them decided to call it off. Ones that had already closed or were pending with locked-in valuations, then didn’t do very well.”

There are numerous reasons why companies that go through with a SPAC may not be seeing success or the outcome they expected, from a lack of experience or background on the part of the startup seeking financing, to insufficient financial prospects, to the nature of startup businesses.

“If you’re going to be a publicly traded company, your financials have to be up to snuff,” says Kelley of Argo Group. “The market reacts instantly to your guidance or misses. It’s not necessarily about generating revenue but being very close to break even. A lot of these small private companies are losing money for the first 10 years of their life. The management team is also a huge part of what people look at – who are these guys, where have they been, what have they done before?”

Companies with good fundamentals should view this as a lesson, Kelley adds: The traditional path forward to public listing will yield success and reward patience rather than the additional pressures of the SPAC route.

“If a company was probably in a good position to go public, they most likely would have filed and taken the traditional route at some point in the 18 months forward from when they engaged the SPAC,” he says. “But the SPAC comes in and says, ‘it’s an easier lane to get publicly traded on the exchange,’ then it’s not always up to the target company. They have institutional investors who are looking to cash out that investment.”

For companies that are still choosing the SPAC route or have already completed one, Kelley advises, “an insurtech startup using a SPAC needs to find and show a market opportunity they can use to outgrow whatever previous ceiling there was on their idea, product or business.”

In the insurtech space, he says, “there’s a lot of room for improvement.”

“While the SPAC bubble has deflated from its recent peak, becoming a less attractive option for many, good technology tends to find a home regardless of the specific funding mechanism,” he says. “Companies may just have to adjust their funding schedules.”