Insurers Search for SMB Synergy

Published on

March 9, 2023

Shop local. Eat local. Insure local? Well, maybe.

Or, maybe it’s the philosophy that matters. Maybe if insurers grow in their understanding of SMB companies, they may just take that local, unique, one-of-a-kind philosophy and apply it in unexpected ways that will thrill SMB owners. After all, many SMB owners are attracted to suppliers and customers that know them and their business. Insurers that are interested in expanding within the SMB market should ask and answer a few crucial questions.

What would it take for insurers to align themselves with companies by finding the synergies between them, then treating each business as if it is the only company around?

How can insurers grow large, act small, and better fill SMB insurance voids with precision sales and impeccable timing?

Is there a proper way to approach the insurance relationship that goes beyond product development and good service, reaching into the heart and soul of an SMB and the SMB culture?

Is today’s SMB business model ready to take advantage of insurance partnerships and embedded channels?

Answering these questions won’t be easy, but the answers may kick-start your company’s ideas on how it can adapt and grow in these changing times.

Each year, Majesco demystifies SMB customer sentiment with a valuable survey that results in an extremely informative report. Because we’ve been asking many of the same questions, plus adding new questions each year (See this year’s sentiment regarding the Metaverse. You will be astounded!), we have the ability to grasp short and long-term SMB trends. We then relate those trends and call out the highlights. It’s the background for answering our questions above.

This year’s SMB consumer report, Resiliency in Times of Change: Rethinking Insurance to Help SMBs Thrive, contains a host of insights on how insurers can position themselves, not just as knowledgeable, but as sought-after partners in the business. In today’s blog, we give a high-level overview of why these insights matter for insurers.

From an insurance perspective, a business is not just a business.

A November 2022 NFIB report encapsulates the state of the small-medium business market and the challenges they are facing. There are certainly pressures upon small businesses, but all is not bleak. In a poll conducted by Guidant Financial, 65% of small business owners reported being profitable, with 51.04% looking to increase staff. Even more promising, 41% are looking to expand or remodel their business, and 39% plan to invest in digital marketing.[i]

This presents an opportunity for insurers to provide the right products, value-added services, and experiences to help SMBs navigate these challenges and position their businesses for growth in a world of increasing climate, societal and technology risks.

Each business is its own little insurance nut to crack. Every business needs insurance, but they also need so much more. Just like insurers are growing more comfortable with experimentation, SMBs thrive on experimentation and flexibility — the very things that may open opportunities for risk coverage.

“Because they’re not bogged down by bureaucracy,” says SMB expert, Peter Boumgarden, Director and Professor of Practice, Washington University, “small businesses are often able to experiment and pursue new opportunities more easily. If I were a small business owner, I would be asking what kinds of small experiments I can run in the next six months that help me address the coming headwinds.”[ii]

It is more important than ever for insurers to have strategic discussions on how they will plan, prioritize, budget, and manage the changes needed in their business models, products, channels, and technology. The more SMBs are willing to experiment, the more ways insurance may find to get involved with products or services in support.

Resiliency in Times of Change

Small-medium business is the lifeblood and backbone for most markets. The SBA notes there are 32.5 million businesses in the US, representing 99.9% of all businesses. Likewise, SMBs have been crucial to the COVID economic recovery. And SMBs are no longer run by the older generation. Millennials and Gen Z are 188% more likely than Boomers to indicate they will likely create a side business![iii]

Together, these data points reflect SMBs’ resiliency – from economic to generational changes – by investing and adapting through accelerated digitalization, shifting to online channels, rethinking the business model, and offering new products. Their remarkable resilience and capacity to adapt and innovate their businesses have allowed them to survive and thrive today and in the future.

Identical Challenges but Divergent Views

Our survey reached two equally sized generational SMB segments, Gen Z and Millennials and Gen X and Boomers, to assess their business priorities, expectations, and insurance needs and how their unique characteristics influence them.

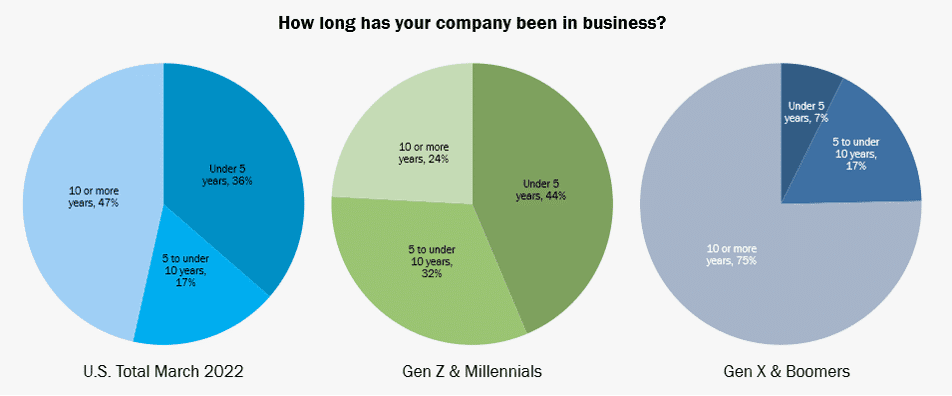

Gen Z and Millennial business leaders have younger businesses, with 44% of their businesses being less than 5 years old — compared to 7% for Gen X and Boomers as reflected in Figure 1. Gen Z and Millennial businesses under 5 years old are in line with the total U.S. statistic for this group of 36%. What is most interesting is that the younger generation has 76% with a business 10 years or less and the older generation has 75% ten years or more – a complete contrast between the two generational groups.

This contrast is important for insurers in terms of the products and customer experiences they deliver. The younger generation has started and grown their business fully in the throws of the digital age whereas the older generation did not. Their needs and expectations as a result are vastly different in terms of their operations, the use of technology, and much more.

Figure 1: Distributions of business ages, total U.S. and by generations

When we further look at the industries they comprise and compare between the two generation segments, a few key differences emerge. These differences further reflect their age and experience distinctions which influence their business priorities, expectations, and insurance needs.

The top three industries for Gen Z and Millennials respondents are Construction/Home Improvement, Computers (Hardware, Software), and Retail. For Gen X and Boomers, it is Construction/Home Improvement, Business/Professional Services, and Other. A key contrast between the two segments is Computer (Hardware and Software) and Retail, reflecting the digital differences between the generations. And the need for different products given their businesses are likely highly digital.

Top-of-Mind Issues

The survey results reflect the challenging and uncertain times SMBs are facing, including inflation, supply chain challenges, rising interest rates, and low unemployment. Those who survived the economic fallout of COVID did so by pivoting and adapting their business models to operate digitally, expand channels and products, and rethink staffing requirements.

As new economic challenges continue or intensify, the priority for adapting, innovating, and accelerating digital transformation with technology increases. These priorities impact business risk and insurance needs for SMBs.

At the top of the list is inflation, at 79% for Gen Z and Millennials and 85% for Gen X and Boomers as shown in Figure 4. Millennials and Gen Z are wrestling with sharp price increases for the first time since they’ve been old enough to notice, as reported by the New York Times.[iv]

Related to this is the impact of inflation on business finances and profitability at 73% and 83%. As a result, SMBs will be looking at operational cost savings and the proven value of products and services, including insurance. Insurers must focus on products that adapt to their needs, ensure pricing is perceived as fair, transparent, and accurate, and offer value-added services that help them in their daily operations or reduce risk and cost to their business.

Figure 2: SMBs’ top of mind issues

Further challenging SMBs at number three is talent retention and availability (70%, 71%). The Great Resignation continues to aggravate talent recruitment and retention, pushing employee benefits and 401k plans to a strong top-of-mind concern (64%, 65%), at number six.

The changing risk landscape, particularly for societal and technology risk is reflected in the number four issue of Crime (66%, 69%) and the number five issue of Cyber/Data Security (66%, 63%). With the cost of insurance rising and a major expense item for most businesses, the increase in crime rates and cyber incidents and the related increase in insurance costs have become a key concern for SMBs. Insurers who provide value-added services around risk management to help SMBs invest in loss prevention, proactive HR practices and aggressive claims management will be viewed extremely favorably. It will differentiate them in the market.

Interestingly the biggest gaps between the generational segments are views on ESG factors (19% gap), use of Gig/contractor workers (24%), and employees wanting to choose how they work (22%). In response, some insurers are developing risk appetites based on net-zero and carbon reduction pathways, the introduction of sustainable insurance products, and investments into funds that back or support insurance products.[v]

The key insight to these priorities is that there will be a greater focus on the types of insurance products and how they are priced to ensure they align to their broad risk and financial needs. This is where their use of digital technology and other trends are influencing their insurance expectations.

Interestingly, both generational groups’ usage patterns for insurance, financial, and business products and services are nearly mirror images of each other, with a few exceptions as reflected in Figure 5.

In the P&C Insurance category, the foundational product, Business Insurance, has strong usage by both generations (80%, 75%) with Workers Comp following (64%, 68%) as the top two. Gen Z and Millennials have lower usage of liability insurance by 11% (54% vs 65%) and commercial umbrella by 13% (25% vs 38%) but lead Gen X and Boomers in business income/business interruption insurance by 12% (47% vs 35%). Given the impact of COVID, climate, and societal risks the lack of business income/interruption insurance is very low and offers a market growth opportunity for insurers.

With the acceleration of digitalization of SMB business models noted previously, it is concerning that nearly two-thirds of SMBs do not have data breach/cyber insurance, particularly given cyber risk/data security is a top-five top-of-mind issue. This highlights the market opportunity for insurers to educate and offer cyber insurance to SMBs.

For the Life/Health category, Gen Z and Millennial SMBs lag behind their older counterparts by 11% in offering group health insurance (54% vs 65%), and by 5% in voluntary benefits (38% vs 43%). Surprisingly, less than half of both SMB segments offer voluntary benefits or group life insurance. Given that talent availability and retention is their third most top-of-mind issue, this should be a higher priority and represents an opportunity for insurers to grow business in these lines.

Figure 3: Insurance, financial and business products and services used by SMBs

Digital Technology and Enabled Business Products & Services

With today’s heightened customer demands as well as exciting new products and services and non-insurance offerings, new billing and payment methods are vital. Billing and payment solutions must be built to adapt and flex as the market, product, services, and customer expectations continue to shift. Insurers need the flexibility to deal with anything new that might be thrown at them.

This demand is very clear with Gen Z and Millennials accelerated acceptance of digital payments through digital wallets like Apple Pay, Samsung Pay, or PayPal (70% vs 64%) and through fund transfer services like Venmo or Zelle (68% vs 56%) (Figure 6) as compared to last year. They also extended their lead over Gen X and Boomers in the use of these digital payments, now at 21% and 22% compared to gaps of just 7% in last year’s survey.

Additionally, use of smart devices is on the rise for both generational groups, the Millennials and Gen Z at a higher level. Whether in vehicles, on properties or wearables the increased use of these devices offer insurers tremendous opportunity for innovative new products and value-added services, as well as personalized underwriting based on their specific risk. The problem is that insurers (a preview of our Strategic Priorities research) are not keeping up with these expectations.

Figure 4: Use of technologies and participation in trends, 2021-2022

Insurance on the Edge

This year we added three additional categories of business-related activities and technologies as seen in Figure 7: Sharing Economy, Metaverse, and Mobility. Gen Z and Millennials have double-digit leads over Gen X and Boomers in 10 of the 13 specific areas. Standing out are gaps of 20% or greater in owning/using an electric vehicle and, interestingly, two Metaverse-related activities, using an avatar to virtually connect with customers/businesses and purchasing or selling digital property in a virtual setting.

Within Mobility, Gen Z and Millennials far outpace the older generation is usage across the board. In particular, options beyond owning and using their own vehicle play a growing role in their usage – particularly rental of a short-term vehicle like Zipcar, bike, electric scooter, or renting someone else’s vehicle. There is continued strong usage of Uber or Lyft – which for some businesses has become a staple for delivery.

Metaverse erupted in the market in the last year with a lot of fanfare, yet not a lot of activity relative to insurance. However, according to PwC, the pervasiveness of the metaverse and the corresponding increase in social and economic activities conducted via avatars will create new customer needs and require insurance companies to take a different approach to serve their customers. The metaverse will accelerate the digitization of administrative procedures from contracting to asset management in the form of NFTs. Crypto assets may become more common too.[vi]

Nearly a third of Millennials and Gen Z are interested in using an avatar to connect with customers/businesses, purchasing or selling in a virtual setting, and buying or selling an NFT. This highlights the need for potential new insurance products and the increasing demand for cyber products that specifically address the usage of metaverse assets for younger SMB owners.

Figure 5: Use of technologies and participation in trends, 2022

Strategizing for Synergy

In light of these trends, the focus for insurers needs to be, not just on capturing this year’s crop of new businesses, but on creating a foundation for future growth into new areas of products and value-added services within the SMB space, particularly the younger generation who have diverging needs and expectations from the older generation. It is a market ripe for growth because there is a growing need indicated by SMBs, but we need to rethink our approach to the market.

If this overview has your interest piqued, get a closer and more informative look by reading Majeso’s full thought-leadership report, Resiliency in Times of Change: Rethinking Insurance to Help SMBs Thrive. It will give you and your teams food for thought on how, when, and where you can create product, service, and cultural synergies with the millions of SMBs that need insurance — both across the country and in your own neighborhood.

[i] “2022 Small Business Trends,” Guidant Financial, https://www.guidantfinancial.com/small-business-trends/

[ii] Savat, Sara, WashU Expert: Building small business agility for 2023 volatility, The Source, January 13, 2023

[iii] Mohsin, Maryam, “10 Small Business Statistics You Need to Know for 2023,” Oberlo, January 1, 2022, https://www.oberlo.com/blog/small-business-statistics

[iv] Smialek, Jeanna, et al., “Millennials Confront High Inflation for the First Time,” New York Times, November 28. 2021, https://www.nytimes.com/interactive/2021/11/28/business/economy/high-inflation-millennials.html

[v] Tripathy, Prashant, “Integrating ESG into insurance products,” Financial Express, July 6, 2022, https://www.financialexpress.com/money/insurance/integrating-esg-into-insurance-products/2584104/

[vi] “The impact of the metaverse on the insurance industry,” PwC, July 15, 2022, https://www.pwc.com/jp/en/knowledge/column/metaverse-impact-on-the-insurance-industry.html