Insurer MVP Projects Need to be Bolder in Thinking and Action

For decades, market tests have allowed firms to launch new products “safely,” without too much investment or the failure of a large, mistimed rollout. In technology, especially technology that is linked to retail market environments, a test is much more than a current view of market insights. Tests are also valuable as real training for how companies will deal with new processes as they meet new needs.

In insurance, we call these kinds of test pilots MVPs – minimum viable products. These projects are designed to improve our capabilities as they test markets and demand. There are right ways and wrong ways to pilot new technologies, products, services, channels, and more within insurance programs, but the first step is for insurers to recognize that MVPs are a welcome necessity that deserve a budget and high prioritization. It is through successful MVPs that insurers can become market leaders.

Expertly led MVP projects create knowledgeable and flexible organizations

Rapid, changing market trends have made MVP projects more vital than ever. New risks are continuing to emerge, climate and social unrest are impacting and complicating risk profiles, distribution expectations are truly multi-channel and expanding, and customers increasingly expect personalized products and expanding value-added services. An insurer that is adept at managing MVP projects will improve its market agility. As the market and technology continues to advance, insurer opportunities will grow as fast as customer demands and market trends.

For insurers to become players in the new insurance ecosystems, they will need to apply lessons from their tests and MVPs to their product and service rollouts. Majesco stays at the forefront of market and business trends in order to help our clients use their tests to navigate next-level market and tech changes. In our research report, A Seven-Year Itch: Changes in Insurers’ Strategic Priorities Defined by Three Digital Eras Over Seven Years, we have identified prioritization gaps in insurer pilot projects that insurers should address immediately if they aren’t already.

Business Trends

Majesco has tracked ten business trends impacting insurance that started or emerged over the seven years of the research. Of the ten, only four have consistently been in the Planning and Piloting stage with the others struggling at or around the Considering phase.

Planning/Piloting

Cyber risk/data security

Value-Added Services

New insurance business models

New, non-traditional data sources for pricing and underwriting

Considering

Telematic insurance

Sharing/Gig Economy

On-demand insurance

Embedded insurance

Microinsurance

Parametric insurance

The planning and piloting process needs to be bolder in thinking, and action, to experiment with these major market trends that will significantly shift DWP, customer acquisition of Millennials and Gen Z, customer loyalty of all generations, and ultimately business success. Just consider the following:

In our 2022 SMB research, nearly 30% of all businesses changed their business models and adopted digital technologies due to the pandemic, reflecting the potential new risks and insurance needs.

Embedded insurance is estimated to be over $700 billion by 2030, representing 25% of the market.[i]

Usage-based insurance is estimated to hit $125 billion by 2027.[ii]

Use of connected devices by customers – both individuals and businesses – increased by 30%-40% from 2019 to 2021, which will influence new product expectations.

Changes in customer behaviors and expectations, driven and reinforced by new capabilities unleashed by technology, demand new products, new services, and new business models to meet what is expected today and in the future.

Responses to Business Trends by Leaders, Followers and Laggards

Leaders, Followers and Laggards follow a similar pattern for the business trends, but Leaders pull significantly ahead in five key customer-influenced product trends: Sharing/Gig Economy, on-demand insurance, embedded insurance, microinsurance, and parametric insurance. And for telematic insurance, while Followers are relatively in line with Leaders, Laggards are well behind.

Leaders’ higher attention (25%-35%) on new insurance business models and non-traditional data sources underpins their drive to create new products and services to meet customers’ changing needs and expectations, leaving the Followers and Laggards perilously behind. Their lack of attention to changing customer needs, particularly for Millennials and Gen Z, as highlighted in our consumer and SMB research, could result in lost DWP as customers shift to these products.

Figure 1: Response to business trends by Leaders, Followers and Laggards segments

Insurer Tiers

Interestingly, both large and mid-small insurers follow a similar focus for these market trends. While large insurers had slightly higher ratings for most, they jumped significantly for three data-intensive areas: cyber risk; new, non-traditional sources of data; and telematic insurance. These areas, combined with their stronger internal focus on data and analytics capabilities, reflect larger companies’ increasingly strong focus on data for use across the value chain – from pricing and rating to underwriting and claims – again, meeting the changing customer needs and expectations. Just consider the rapid rise in telematics for both personal and commercial auto, reshaping market leaders.

Data is its own area that needs testing and piloting. How can the company best integrate new, innovative third-party data sources? How can an insurer prepare to capture and analyze data as it exits telematic devices? How easy is it for insurers to connect their own APIs to the growing network of distribution partners that will assist with embedded offerings? For more on this topic, check out Majesco’s latest blog on the business case for API transformation.

What is holding back test and learn pilots?

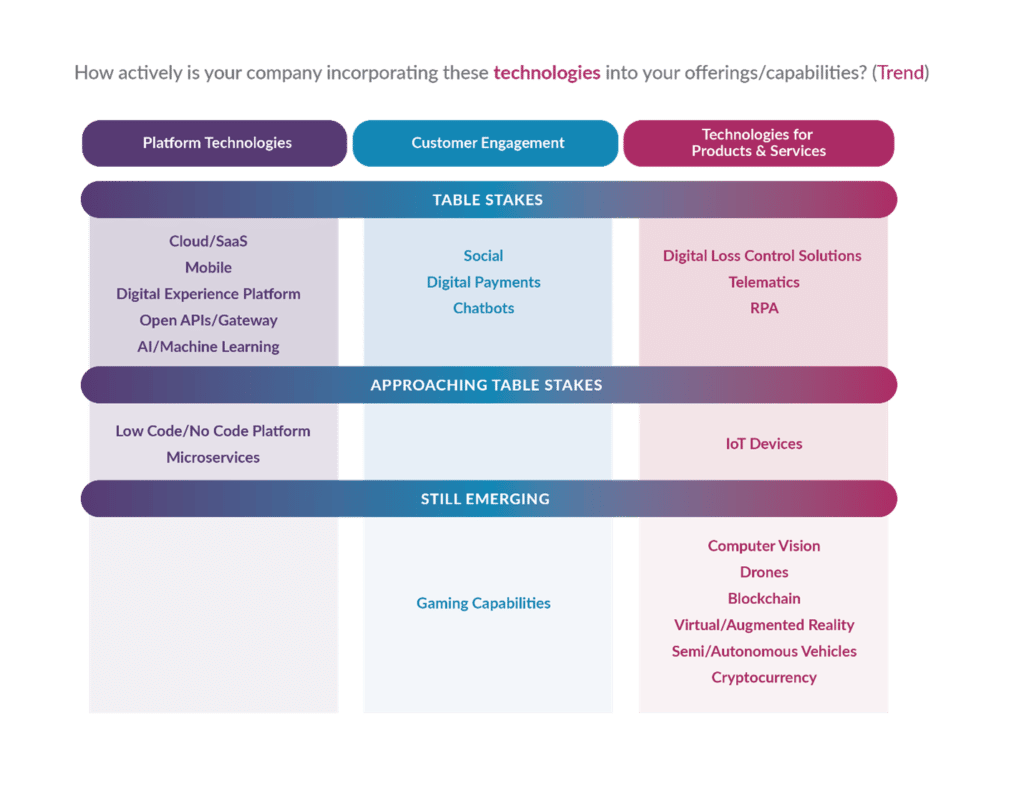

After tracking three categories of technologies, the pace of experimentation and adoption of each specific technology is aligning to either table stakes, approaching table stakes, or still emerging, as highlighted in Table 1 below. Yet, despite the evidence of new technology solutions becoming table stakes, many insurers remain behind the curve when it comes to leveraging the benefits of new technology due to significant legacy systems and a lack of progress in new business models to better leverage these technologies.

Many of these technologies are the ones that make MVP programs so relevant and efficient.

The lesson insurers seem to be learning is that the technologies that stand to propel them forward in every area are the same ones that enable MVPs to perform so well. SaaS platforms, for example, are reshaping business focus from policy to customer, from process to experience, from static to dynamic pricing, from point in time underwriting to continuous underwriting, from a historical view of data to predictive and prescriptive data, from traditional products to new, innovative products. These all speak to the level of flexibility and capability that are necessary to rapidly test new products and services in today’s insurance industry.

When it comes to the specific technologies that power the insurance platform, mobile, Cloud/SaaS, Digital Experience Platforms, APIs, and AI/Machine Learning are now in the table stakes phase. Microservices and Low Code/No Code Platforms have advanced from the early adoption stage and are rapidly approaching table stakes. Three Customer Engagement technologies are also table stakes – Digital Payments, Social and Chatbots.

The combination of these critical technologies enables insurers to adapt quickly to new market opportunities, provide new experiences, and leverage new insights to change the insurance business model and processes, driving speed, agility, and innovation.

Table 1: Technology adoption categories

Still emerging technologies have many opportunities to accelerate their adoption, particularly given the increased comfort in touchless or digital capabilities for claims where drones and augmented reality can make a difference. Other examples include customer education through gaming or augmented reality and the rise in cryptocurrency demonstrated by the significant rise in SMBs accepting it and consumers using it, as shown from our recent research.

Which platform technologies are being prioritized by Leaders, Followers and Laggards?

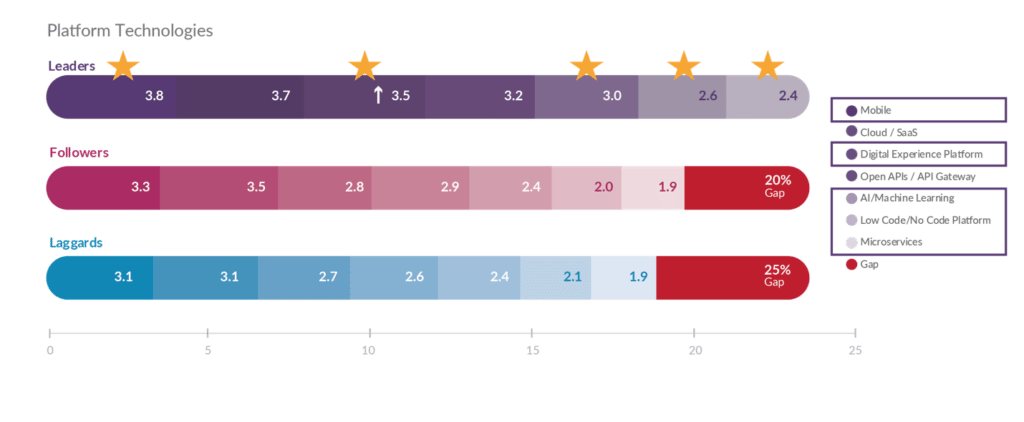

Since platform technologies are now table stakes, it is encouraging that Laggards’ and Followers’ gaps to Leaders are within just five percentage points of each other. However, the composition of their respective gaps is slightly different.

Unfortunately, Laggards are consistently behind Leaders, averaging a 25% gap across all seven platform technologies, but with a large gap of 32% for digital experience platforms. Followers have more variation with 8%-16% gaps in three platform technologies including mobile, Cloud/SaaS, and open APIs, which are foundational. However, they have significant gaps of 25%-30% to Leaders in microservices (30%), digital experience platform (29%), Low Code/No Code platform (27%), and AI/ML (25%) – all of which are crucial in creating new customer experiences, leveraging data, and creating greater flexibility for the business.

Figure 2: Response to platform technology trends by Leaders, Followers and Laggards segments

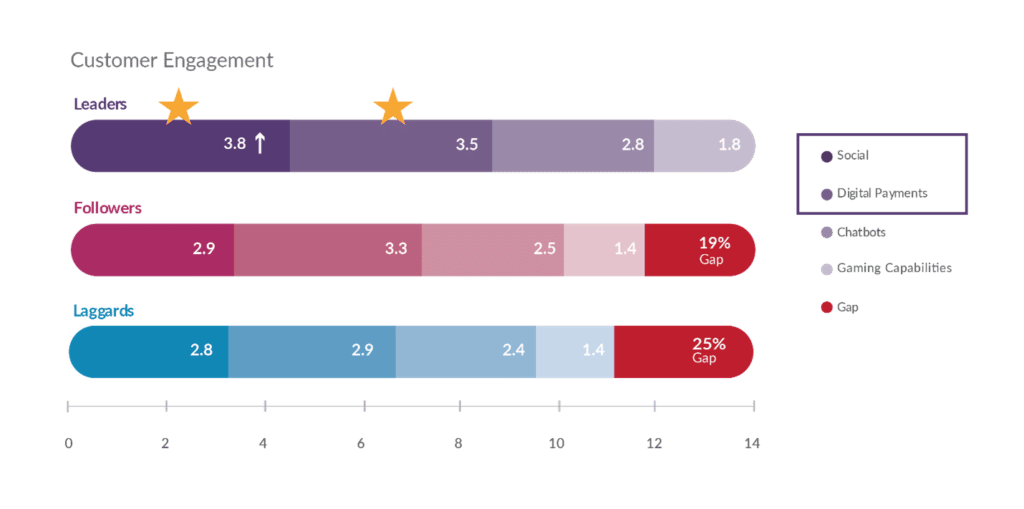

When looking at customer engagement technologies, the gap sizes of Followers and Laggards to Leaders mirror the platform technologies gaps, at 25% and 19%, respectively. The gaps across three of the four Customer Engagement technologies are within three points of each other, highlighting the lack of focus on creating new customer experiences as compared to Leaders.

However, digital payments deviate from the others, with Followers having only an 8% gap as compared to Leaders. But Laggards continue to remain behind as shown with all the Customer Engagement technologies with a 20% gap.

With improvements in technology and customer experience, coupled with a reduction in barriers for digital engagement, digital for everything across the entire value chain will continue to accelerate. Insurers must increase their priority on legacy transformation, providing digital, self-service capabilities throughout the lifecycle from sales and underwriting to service and claims, to enhance the customer experience. On a fundamental level, digital is crucial to growth but also for bolstering trust, loyalty, and retention.

Figure 3: Response to customer engagement technology trends by Leaders, Followers and Laggards segments

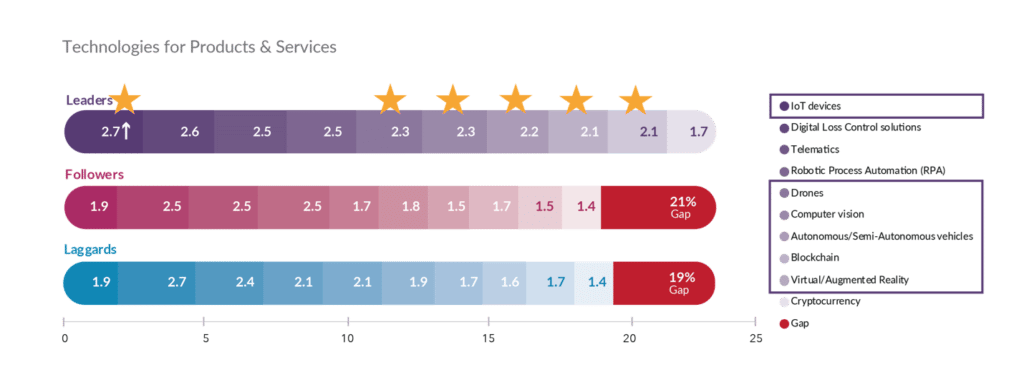

Regarding Products and Services technologies, Laggards and Followers have nearly equal gaps to Leaders. One of the most important gaps in terms of size, and in importance to the changing nature of the insurance business, is with IoT devices, showing 42% and 47% gaps for Laggards and Followers. With the significant increases over the last two years in the use of connected devices in vehicles, homes, commercial buildings, and on people’s wrists as shown in our consumer and SMB research, Laggards and Followers are not aligned to customer needs and expectations.

Whether used for personalized, improved pricing and underwriting — or for creating incredible opportunities for new risk prevention/mitigation services and new customer experiences — the use of the data from these devices is rapidly emerging as a mainstream customer expectation. Once again, as insurers prioritize pilot projects, consideration also must be given to those projects that will enhance an understanding about working with data.

Interestingly, for several other technologies, Followers are surprisingly behind both Leaders and Laggards (though by only a few points), including digital loss control, drones, semi/autonomous vehicles, virtual/augmented reality, and computer vision. Regardless, both Followers and Leaders once again are well behind Leaders from 30%-48%, highlighting significant gaps in adapting to a broader set of technologies embraced by customers.

Figure 4: Response to product and service technology trends by Leaders, Followers and Laggards segments

Technology prioritization across Direct Written Premium tiers.

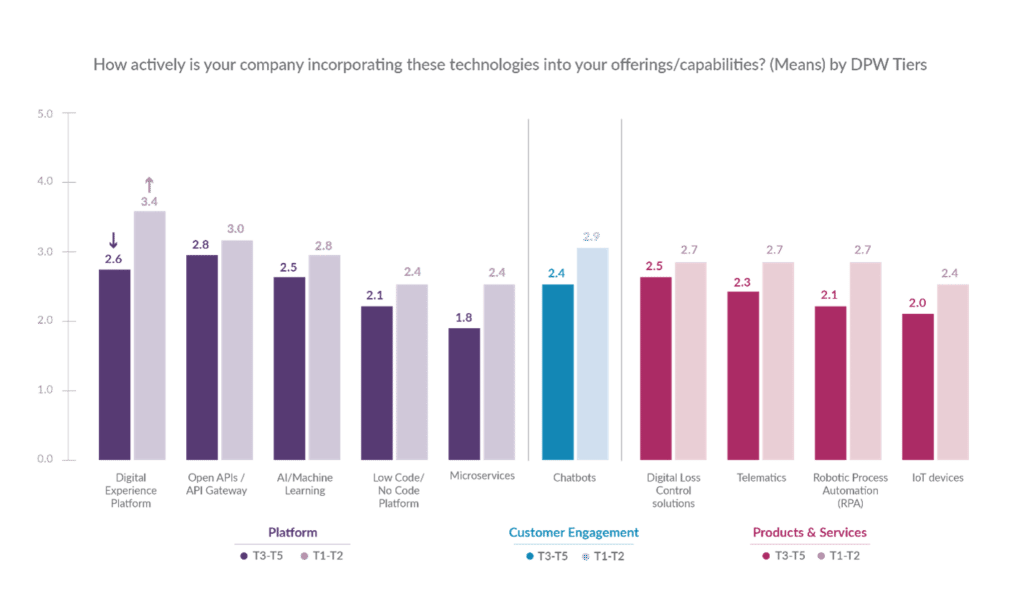

Large companies lead mid-small companies by significant margins in nearly half (10 of 22) of the technologies across the three categories as seen in Figure 5. Specifically, large companies lead in five of the Platform Technologies, with the most significant gaps in microservices (31%) and digital experience platform (30%). When looking at Products and Services and Customer Experience technologies, large companies’ most significant leads are in robotic process automation (29%), IoT devices (21%), Telematics (19%), and chatbots (22%). This once again is reflecting a focus on new, innovative products and customer experiences to capture a new generation of buyers who are highly interested in digital-related offerings.

Figure 5: Response to technology trends by company size segments

Yet here is an instance where tech piloting can be the great business trend equalizer. In decades past, a product rollout might have been enhanced by the pre-built framework of a legacy system. But today’s differentiated products can undeniably roll out faster on SaaS frameworks, which are equally fast and efficient for players large or small. Any organization can now accomplish their pilot goals in an environment that is entirely suited to test and learn scenarios.

The question used to be, “Can we afford to take time away from our core business of today to launch something new?” Today’s question is, “Can we afford to ignore the business and technology trends that are re-imagining the value proposition for insurance and the future business model? The AM Best Innovation Rating looks at both today’s business model and tomorrow’s. Why? Because the market is changing, and insurers must as well. The question is are you changing and how do you compare to leaders? To answer this question, you might begin by reading Majesco’s Strategic Priorities report.

Every day, Majesco partners with insurers to create the most effective pilot project as they consider how to make their next step now. Pilot projects are now easier and more effective than ever. Is it time to add some emerging technology pilots to your strategic priorities? Contact Majesco today to find out more.

[i] Torrence, Simon, “Embedded Insurance: a $3 Trillion market opportunity, that could also help close the protection gap,” December 10, 2020, https://www.linkedin.com/pulse/embedded-insurance-3-trillion-market-opportunity-could-simon-torrance/

[ii] “Usage-based Insurance Market to reach $125 billion by 2027,” Global Market Insights Inc., June 3, 2021, https://www.globenewswire.com/news-release/2021/06/03/2241169/0/en/Usage-based-Insurance-Market-to-reach-125-billion-by-2027-Global-Market-Insights-Inc.html