Inflation Provides Auto Insurers with a Data-Fueled Pricing Opportunity

Since 1980, the Federal Reserve has monitored the price of eggs, milk, beans, orange juice, and other common staples of the fridge and pantry. If you want to compare the year-over-year cost of bananas in your area of the country, you can do it using the Federal Reserve Economic Data (FRED) site. There are dozens of items listed. Scan through the graphs and you’ll notice some very clear trends. Whether you look at the cost of bread, beer, or broccoli, prices are rising.

The talk of a recession seems to be dissipating[i] and the monthly inflation rate is currently in decline, but it is still higher than it was in 2020 and 2021, and consumer and business costs are still on the rise. This is directly affecting consumers and businesses, and their spending choices. It is indirectly affecting all companies that compete for personal and business customers.

However, cost pressures in any area of life can be beneficial to companies that supply the necessities of life, like auto insurance. “How?” you might think, “Inflation causes the shopping-around syndrome that doesn’t always work in our favor.” But customers, especially those that are looking for value, would rather make adjustments and stay within their current company than reach out into the unknown. That places the ball in the court of insurers to create new, simple, attractive products and pricing that will assist their customers with value-based options while helping reduce claims and administration costs. Insurers can redefine themselves and their value to customers, and they can use cost pressures to their advantage by acting on the right strategic priorities for their businesses.

How are personal and commercial auto insurers prioritizing?

The automotive world is rapidly changing in all dimensions due to the shift in how other companies and industries are changing, such as ridesharing, changing views of vehicle ownership, changes in fleet management, advancements in automotive technology, and a growing plethora of transportation options like car sharing.

Companies outside insurance are coalescing around a shift to “mobility.” Mobility options are important, but they can be fulfilled by many means beyond traditional vehicle ownership. This is a significant shift, impacting business models within both automotive companies and insurance companies.

Nearly every automotive company is or is considering offering insurance with the purchase of their vehicles, either as an insurer or through partnerships with insurers. This trend has major implications for commercial and personal auto insurance. Their largest book of business may be at risk if they do not adapt to a changing marketplace and customer expectations.

In Majesco’s Strategic Priorities report, Game-Changing Strategic Priorities Redefining Market Leaders, we look at insurer priorities in light of both market drivers and technology capabilities. Do insurer priorities meet or exceed customer desires? Are they aligned? If not, are insurers considering and implementing the technologies needed to meet their demands? Let’s look at current insurer priorities.

Personalized pricing with data

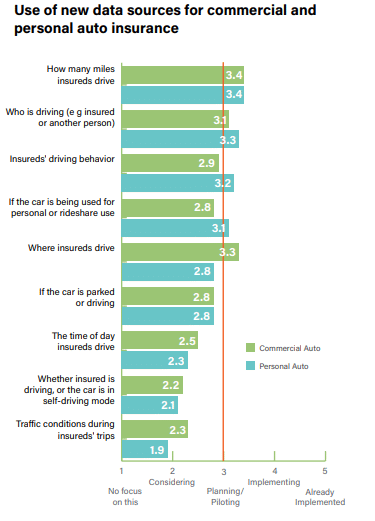

Encouragingly, commercial, and personal auto insurers are much more innovative in their views on new data sources than most other lines of insurance. Six of nine (67%) data sources or technologies are very close to the Planning/Piloting phase as shown in Figure 1. This aligns with both generational consumer segments (Gen Z & Millennial SMBs), with over 60% expressing interest in most of these options.

Insurers need to accelerate their pilots of these six data sources and technologies and look more closely at the remaining three hovering around the consideration phase. Telematics technology has advanced greatly, and it makes new data sources available for innovative pricing, as well as for value-added services. It is this data and pricing capability that will be the market opportunity during inflationary times.

In a Motley Fool article from May 2022, they noted that Progressive’s telematics and pricing of insurance policies, using technology that was rolled out in 2010, is a huge advantage over other large automotive insurers. Since then, they have collected significant amounts of driving data including mileage, speed, braking time, and time of day when driving so that they now can develop personalized rates for drivers as well as discounts for safe driving. With over 10 years of driver data, they have better models to manage risk, keep ratios low and meet increasing customer expectations. This is an example of leaders creating a significant market advantage. Other insurers may now be looking at competing against a 10-year data and experience advantage.[ii]

Figure 1: Use of new data sources for commercial and personal auto insurance

Majesco also tracks priorities based on whether an insurer is traditionally a leader, follower or laggard, based on their previous track record for tech adoption.

Increasingly, insurers are breaking out of their traditional categories. For example, in this year’s survey, Laggards are on par with Leaders on five of the nine overall auto insurance pricing/underwriting data options, putting Followers at risk as shown in Figure 2. Because the collection of data over a long period of time is crucial, this puts Laggards in a potentially competitive position to challenge others in the market with new, innovative products using these options.

While Leaders are ahead of the other segments in their breadth of consideration of the options, they can take this advantage to a new level by taking a holistic view of driving behaviors and conditions across the spectrum. This will not only provide personalized pricing but will also help improve loss ratios and customer experiences. This will be more important than ever in the coming days. Insurers will need to up their game to succeed in an increasingly crowded auto insurance marketplace, where auto manufacturers are becoming competitors by leveraging the data generated by their vehicles.

This will mean that insurers will need to use their greater understanding of telematic data AND improve their data gathering to give customers data-fueled value in their policies. Auto manufacturers will be attempting to keep their insurance acquisition process as simple as possible. But auto insurers have levers to pull that manufacturers don’t, such as vast historical data, auto/home bundling, refined claims processes, and potentially wider channels of service that still include local agents. Data is, for both insurers and manufacturers, the lever that must be employed quickly and properly to win and keep customers while they may be reacting to inflation.

Figure 2: Use of new data sources for auto insurance by Leaders, Followers, and Laggards

The potential for value-added services to tip the balance.

Majesco’s survey data shows that commercial auto insurers are more innovative than their personal auto counterparts regarding the use of value-added services. Several of these involve providing alerts based on data that insurers already have or that can be obtained relatively easily, like reminders about licenses and registrations, alerts about recalls, and updates on vehicle market values as shown in Figure 3.

This range of value-added services offers “low-hanging fruit” options to strengthen customer relationships and meet customer expectations. And they can be implemented quickly. As insurers offer telematic programs or insureds have vehicles with such devices, the ability to extend value-added services to customers becomes easier, allowing insurers to promote safety and risk avoidance, and help speed up claims. As an example, in its Q4 2022 earnings call, Progressive highlighted a new app-based Accident Response feature that includes Crash Detection, extending its pioneering use of telematics beyond improving pricing and underwriting.[iii]

Figure 3: Development of value-added services for commercial and personal auto insurance

Laggards must close the gap on Leaders and Followers with value-added services.

Leaders and Followers still have a great advantage over Laggards when it comes to value-added services. They have nearly twice as much focus on offering a wide range of services. (See Figure 4) This massive gap puts them behind and at serious risk of not being able to catch up in an already highly competitive and crowded auto insurance market. In addition, with the emergence of automotive players offering insurance, this will intensify the pressure on growth and profitability.

More importantly, as our consumer and SMB research shows, customers are looking for these value-added services to help simplify their lives, but also to address concerns about price and value. No longer can insurers rely just on the lowest price to win business, as it leads to a slippery slope of low profitability as well as a shrinking and unhappy customer base. They must achieve balance, part of which can be done through compelling value-added services. Value-added services are also “inflation fighters.” Inflation drives people to hold onto their existing cars a bit longer, especially if they have previously had payments and now the vehicle is paid off. Updates on renewals, recalls and recommended services are all value-added services that personal and commercial auto owners will appreciate. Data on auto value will also be of high importance so that owners can judge when the time might be right to switch cars.

None of these services will be possible, however, without the right framework for gathering, ingesting, and using the data to communicate.

Figure 4: Development of value-added services for auto insurance by Leaders, Followers, and Laggards

Keeping pace with channel options

Commercial and personal auto insurers are closely aligned on most of the traditional and new distribution channels, reflecting their awareness of customers’ expectations for multichannel purchase options as shown in Figure 5. Personal auto insurers are more likely to utilize insurance marketplaces (33% gap with commercial insurers) like Compare.com and others, which have grown significantly in use.

Both personal and commercial auto insurers are equally considering embedded or partnership channel options as well. While personal auto insurers are hovering around the consideration phase for the High-Tech GAFA companies, they are still ahead of commercial insurers between 13% and 43%.

Our consumer and SMB research indicates very high interest in all channel options among Gen Z and Millennials, including the embedded options and several of the GAFA companies. While insurers are in the consideration phase on many of these, they need to move rapidly into Planning/Piloting if they want to keep up with customer expectations and a growing competitive landscape with new and existing competitors.

Figure 5: Distribution channels used by Commercial and personal auto insurers.

Leaders, Followers and Laggards are closely aligned in their use of the traditional agent/broker, company website, and insurance marketplace channels as shown in Figure 6. However, this is where Leaders separate from the rest of the pack.

Leaders have sizable leads over both (32%, 35%) in using affinity groups. Leaders also dominate over both in the High-Tech channels. Followers keep pace with Leaders in all new channels.

However, even Leaders shouldn’t see their position as a cause for comfort. Customer expectations for these multichannel options are well ahead of insurers’ current levels of planning and implementing them, putting them at risk to new competitors entering insurance.

Figure 6: Commercial and personal auto insurance distribution channels used by Leaders, Followers, and Laggards

Personal and commercial auto insurers are facing a new world of competition, but at the same time, they are facing new opportunities to refine products, services, and channels to meet their customer’s desire for value during these inflationary times.

Majesco helps auto insurers to shift gears, moving from traditional technology frameworks, to our P&C Intelligent Core that embeds and leverages our advanced Data Solutions, Digital Solutions, and our ecosystem of partners. Whether it is for traditional auto products, shared car service, telematics or other options, we have worked with insurers who are innovating and leading the way. These are the answers to swiftly meeting the market with competitive offerings that improve services and products as they reduce costs. Majesco brings your strategic priorities to life by moving your company from consideration to action. Is it time to compete at the next level?

For more information on Strategic Priorities across all P&C lines, be sure to download Game-Changing Strategic Priorities Redefining Market Leaders.

[i] Bartash, Jeffy, The U.S. isn’t in a recession — and it may not be headed for one, MarketWatch, June 6, 2023

[ii] Carlsen, Courtney, “Does Berkshire Hathaway Think Progressive Is a Better Auto Insurer Than GEICO?” The Motley Fool, May 8, 2022, https://www.fool.com/investing/2022/05/08/does-berkshire-hathaway-think-progressive-is-a-bet/

[iii] “Progressive (PGR) Q4 2022 Earnings Call Transcript,” Motely Fool Transcribing, February 28, 2023, https://www.fool.com/earnings/call-transcripts/2023/02/28/progressive-pgr-q4-2022-earnings-call-transcript/