Hybrid work is the future of the London Markets: 5 key takeaways

The COVID-19 pandemic and ensuing lockdowns have changed how we work for good. Offices, once the bustling centre of company life, have for much of the year been home only to empty desks, unground coffee beans and unanswered questions…

With work-from-home having had ample chance to prove itself over the past 18 months, some are asking if the future is remote; after all, if it’s not really needed, commercial real estate is an expensive luxury to have. At the same time though, it’s clear that video calls are not really a like-for-like replacement for in-person relationships – especially in the London Markets, where business has traditionally been done face-to-face.

So, what does the future of work look like for the London Markets? To offer some provisional answers, Accenture and Munich Re Specialty Group conducted a first-of-its-kind survey of the Lloyds and Companies Markets from June 28th – July 14th.

We heard from almost 200 individuals – predominantly brokers in senior management and leadership positions – with key talking points around firms’ planned return to the workplace following the lifting of UK government restrictions, the challenges of remote working and the future of offices. Here we present our five key takeaways.

#1 Remote work is here – but the future of the London Markets is evolution, not revolution

Until recently, the London Markets relied almost exclusively on office-based working, so lockdowns have been a big break with tradition – 40% of our respondents said their firms had zero remote-working provisions before the outbreak of Covid-19.

However, this is set to change. Nearly all respondents expected their firms to retain the option to work remotely beyond their official office-return date, a large majority indefinitely so. And it’s not just the availability of the option that has increased, the absolute amount of time spent working remotely was also expected to rise.

Pre-Covid, respondents estimated their firms worked, on average, 4.4 days in the office and 0.6 days remotely each week; going forward, they expected this figure to be around 2.75 days in the office and 2.25 days remote, an increase in remote work of 1.65 days per week.

While these findings constitute a clear swing towards remote working, the situation we end up with is still one where the majority of the week is spent in the office. For this reason, the future of work in the London Markets is better characterised as hybrid rather than remote, an evolution rather than a revolution.

This means fears around the future of offices – which may still apply in other sectors – are likely overstated in the case of the London Markets.

This is not to say firms aren’t alive to the benefits of saving on office real estate. When asked about the greatest business benefits of remote work, our respondents ranked this factor in third place – but only third place. The top positions in fact went to soft factors not driven directly by profit: “better work-life balance for staff” and “higher employee satisfaction”.

Click/tap to view a larger image.

Source: London Markets Ways of Working Survey 2021

#2 The office return will come sooner rather than later, but it will be flexible

With the future of offices secure, at least in the London Markets, it’s time to consider more practical matters, like the timing and nature of firms’ return to the workplace.

As of mid-July, when our survey concluded, nearly every respondent believed that their firm’s office return would be underway by the end of September. Only 3% said their firms planned to wait beyond this point.

This suggests that government restrictions have been the blocker all along, not some deeper attitudinal shift. With the former largely lifted as of July 19th, there is little standing in the way of staff moving back into office spaces.

Click/tap to view a larger image.

Click/tap to view a larger image.

Source: London Markets Ways of Working Survey 2021

If the promptness of office returns was fairly uniform across respondents, the manner of that return was much less so.

Only 5% said their firms would mandate a return for everyone, with 40% splitting for free-for-all approaches (where anybody can come back in, but no-one is forced to) and 43% for partial returns.

Partial returns included first-come-first-serve (4%), policies of rotation (16%) and prioritising certain job roles (23%), in this case overwhelmingly client-facing positions.

#3 Face-to-face work remains central to life in the London Markets

The trend of putting client-facing staff back into the field as a priority takes us to the heart of life in the London Markets, where brokers and underwriters have, for centuries, done business face-to-face. And this isn’t showing signs of changing any time soon.

96% of broker respondents stated that face-to-face contact is important for transacting with underwriters, with a significant portion (34%) terming it very important (“face-to-face all the time”).

Click/tap to view a larger image.

Click/tap to view a larger image.

Source: London Markets Ways of Working Survey 2021

So, how do we reconcile this takeaway – the enduring importance of face-to-face work – with our earlier observation of a sharp swing towards remote working? Again, the answer is hybridity.

We envisage a future where firms achieve shorter working weeks not through the sacrifice of valuable in-person connections but by facilitating, or even encouraging, remote completion of routine activities. This will require a sharper triaging of tasks to extract flexibility for staff wherever possible – as a recompense for continued in-person commitment when this is business-critical.

#4 Attitudes in the London Markets differ in degree compared to the wider UK insurance sector

We saw in the first graphic that “better work-life balance for staff” and “higher employee satisfaction” were deemed the biggest benefits of remote working. Indeed, there is talk more broadly about this becoming a major draw for progressive firms – with existing and prospective employees potentially willing to wield the hatchet over home-working allowances.

In a separate UK-wide survey of 500 insurance workers, also conducted over the summer, we found that workers within UK insurance more generally were very open to leaving the office behind, with 1-in-4 indicating they would prefer to work entirely from home in future.

We’ve seen that the London Markets are embracing remote work too – though in a noticeably more tempered way.

Respondents expected their firms to work an average of 2.75 days in the office per week after Covid-19, with fully remote weeks seldom in contention. Indeed, only 9% intended to work in the office two days or less per week going forwards. By comparison, 72% of respondents in our survey of the wider UK insurance sector said two days or less would be their preference.

This difference in degree is neither surprising nor necessarily a bad thing. After all, doing business in the London Markets – with the larger, less standard risks that are involved – is fundamentally different from doing it in, for example, personal lines.

For this reason, brokers and underwriters in the London Markets should be informed, but not led, by what is going on with remote working in other sectors. Ultimately, it needs to be about what’s best for their business and staff specifically – most likely some level of hybridity. Indeed, they have the luxury to pick and choose the best aspects of remote working, experimenting over time rather than jumping, all or nothing, into risky “big bets” on the future of work.

#5 For hybrid success, the benefits of remote and office work must be balanced

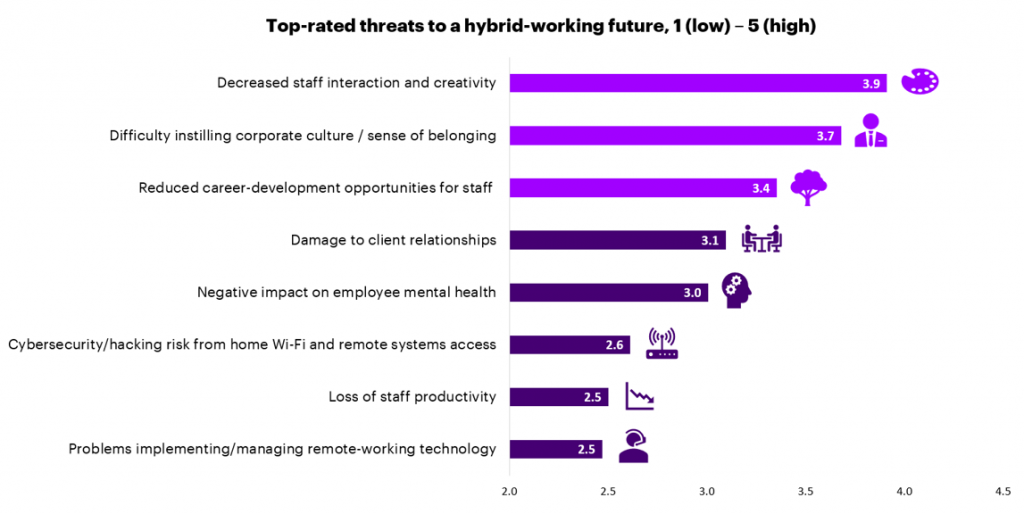

We’ve talked already about the perceived staff benefits of remote working like better work-life balance and higher job satisfaction. So, what are some of the risks?

There has been much discussion more widely of the technological hurdles of managing a remote workforce, especially around cybersecurity and remote systems access. However, our respondents in the London Markets were more likely to point to interpersonal factors such as “decreased staff interaction and creativity”, “difficulty instilling corporate culture” and “reduced career-development opportunities for staff” when asked to rate the leading threats to a successful hybrid future.

Click/tap to view a larger image.

Click/tap to view a larger image.

Source: London Markets Ways of Working Survey 2021

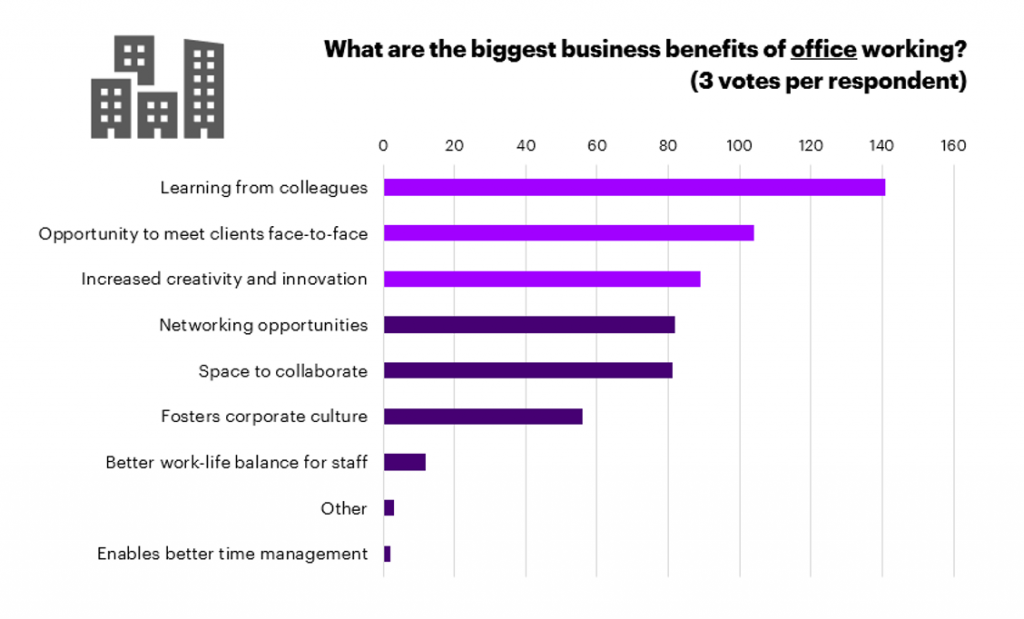

In these cases, the lack of personal contact usually provided by a day in the office may start to make itself felt. Indeed, the top benefit of office working, as voted by our respondents, was “learning from colleagues”.

Click/tap to view a larger image.

Click/tap to view a larger image.

Source: London Markets Ways of Working Survey 2021

The primacy of interpersonal factors is important to note, since a temptation for many firms with remote-working initiatives may be to regard the job as done once the relevant collaboration tools and security protocols are implemented. This could not be further from the truth though: in reality, a remote workforce requires continuous upkeep.

Some of this upkeep is achieved through a hybrid set-up, where employees maintain regular in-person contact with colleagues and clients alongside their home-based activities. But the basic point is clear: firms must maintain an open dialogue with remote workers, and not simply leave them to fend for themselves. Indeed, in our 500-person survey of the wider UK insurance sector, 1-in-4 said they’d felt disconnected from their firms following the Covid-19 outbreak.

In the London Markets, respondents were relatively positive, for now at least, regarding mental health in the context of remote work, rating this in the bottom half of the eight threats to a hybrid future we presented to them (shown in the earlier graphic). However, the threats they ranked highest – loss of creativity, career development and culture – all have the potential to damage workforce mental health in the longer term, so this must not be taken for granted.

Insurers migrating to the cloud at scale are gaining savings and agility across the insurance enterprise. Find out more in our latest report: Reimagining insurance: The new cloud imperative.

LEARN MORE

So, in summary, remote work is absolutely part of the future of the London Markets. However, it’s not going to swallow the sector just yet, playing out more as evolution than revolution.

We expect a compromise between traditional face-to-face and new remote channels; offices and in-person meetings will remain in place, but staff will benefit from an uptick in flexibility. Sweeping changes may well not be necessary, but firms that choose to ignore the incremental staff benefits of home-working likely do so at their peril. The same applies to firms that see remote work as a one-off fix and ignore its on-going human implications.

And the most exciting part: with people now returning to the office in ever larger numbers, the hybrid future is here already. If you’d like to learn more about these perspectives, or our recent survey, please get in touch.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Subscribe