How carriers get real-time info on property (and other) risk exposures

Carriers in the small business space are increasingly turning to technology to understand exposure changes and help insureds manage their own risk, an expert said recently.

By relying on things like sensor technology, carriers can get real-time information on changes in exposure, which they can pass back to the insured to help them manage their own risk, said Mike Bond, senior vice president of innovative risk partnerships at Hartford Steam Boiler.

“I think [technology] can play a very significant role in how we address risk in the future,” Bond said in an interview with Canadian Underwriter. “Maybe more effectively than relying on historical data that’s quickly out of date as things constantly change.”

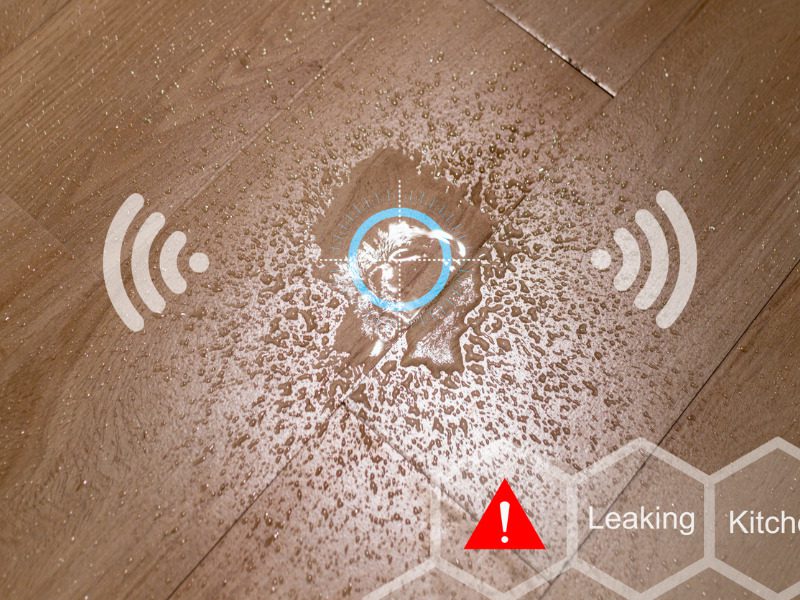

One example of sensor technology is a water sensor that advises a homeowner if they have a frozen pipe, water leak or freeze risk. But while data shows consumers are increasingly turning to technology like usage-based insurance, there needs to be a value to the insured, Bond said.

“We learn from some of our testing that, even if you’re offering the technology to the insured for free, typically they’re not necessarily going to install it unless they see what type of benefit [there is] for them.”

Consumers were initially skeptical about installing sensors that monitor their activity because it was deemed intrusive. But now they see they can have a hand in mitigating their own water damage, for example.

Telematics is one type of technology that is more advanced and quickly becoming foundational, Bond said.

“As soon as that sort of installation becomes foundational — within the actual asset within the property itself — it becomes much more reliable for things like carriers and insureds to utilize that data to help mitigate risk,” he said. “So, I think that’s a development that’s impacting all lines of insurance, especially in the property market, whether you’re talking about small business, homeowners, or whatever the case may be.”

Bond added there was initially some concern in the industry about insurtechs and tech start-ups looking to disrupt or otherwise cause problems for existing traditional carriers, but that has transitioned into more of a partnership approach.

At the same time, some carriers are in the middle of their own transformation and trying to overcome legacy challenges. “They are struggling with a changing marketplace; they have to compete against digital insurers and direct-to-consumer insurers.”

For insurers of small business, most don’t want to lose the consulting guidance they’re giving to insureds about how to protect their businesses, Bond said.

“And so, they have to find a way to deliver products efficiently in digital formats, but in a way where they’re still retaining that connection with both the agent/broker and maybe even more direct contact with the insureds themselves,” he said. “I think the solution to that has emerged through some of the technology enhancements in the industry.

“It’s been partnerships and ecosystem engagements with insurtechs and other provides that can enhance that digital experience for an insured, and get the insurance companies closer to that insured.”

Feature image by iStock.com/Toa55