Global insurtech funding rises to $1.39B in Q1, Gallagher Re

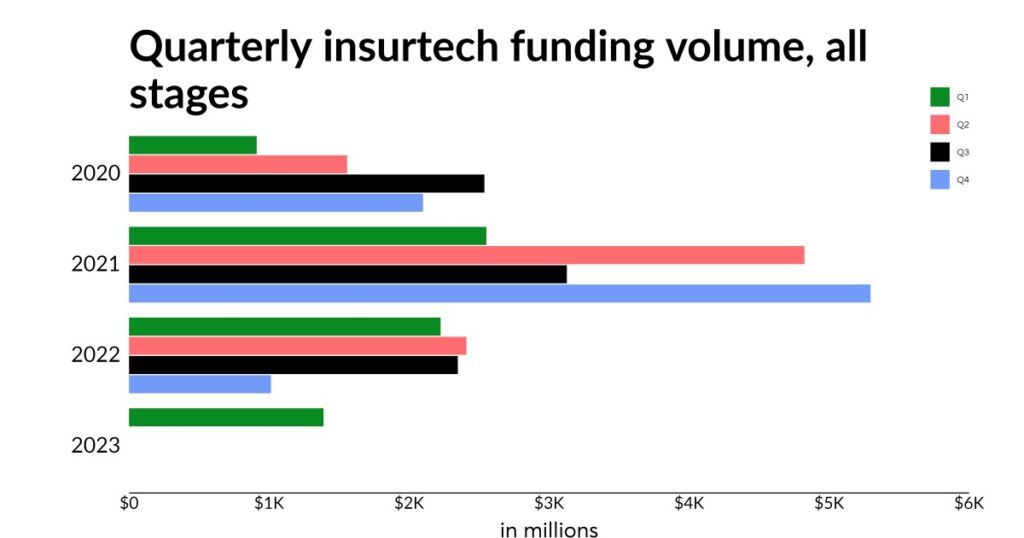

Total insurtech funding during the first quarter rose to $1.39 billion from $1.01 billion in Q4, 2022, up 37.6%, according to the Global Insurtech Report from Gallagher Re, a reinsurance broker.

Funding for property and casualty and life and health insurtechs drove the increased investment in the sector. Mega-rounds counted for only about 13% of total deals and the average early-stage deal was up 28%. The majority of reinsurer investments went to early-stage rounds, which has been noted for the last six quarterly reports.

Dr. Andrew Johnston, global head of insurtech at Gallagher Re, said in a press release that this year is a new era for the sector.

“2021 undoubtedly marked the funding peak, fuelled by Covid-19 uncertainty and an organically occurring crescendo. The sector came back down to earth in 2022, leading to some serious restructures, cost-saving actions, and new business strategies. A lot of companies did not make it through,” Johnston said. “Founders are now thinking about long-term sustainability and growth, and realizing their businesses will need to pull the plough themselves, reliant on their own capabilities and revenues. A significant upside seems to be the genuine willingness of many (re)insurers, brokers, and agents to adopt technology. The pressure is therefore on insurtechs to make their businesses palatable and value-adding.”

The report goes on to note the potential need to retire the term “insurtech,” because it typically refers to two types of startups – including technologically-enabled companies and those that offer technology or products to insurers. The report states that currently, more than half of global insurtechs fit into the technologically-enabled category.

“Given the complexity of this space (including issues around the label insurtech), it is very difficult to make too many predictions with much accuracy – rather than staying with pedestrian and trite statements about things that are almost inevitable, we would prefer to comment on what we are observing,” the report states. “We will certainly keep tabs on the 590 deals and the $8.5 billion that would be raised in 2023 if 2021 does in fact turn out to be an anomalous year. … If we can assume that each quarter will contribute approximately 25% to this annual total estimate for 2023, we are about $735 million and 42 deals adrift from the results of Q1. In other words, we are ‘only’ 16% funded and 18% in individual deal count for the year so far.”

The report, however, does suggest that there is likely to be more M&A activity this year.

Early-stage incubation companies raised $95.80M – or 6.9% of total insurtech funding – across 40 deals in Q1 2023:

Angel – 1 deal worth $100,000 Convertible Note – 5 deals worth a combined $7 million in fundingPre-seed – 3 deals worth a combined $800,000 in funding Seed – 9 deals worth a combined $13.71 million in funding Seed VC – 22 deals worth a combined $74.18 million in funding.

The report mentions the impact of the Silicon Valley Bank collapse on insurtech funding as the bank was the go-to financial institution for many startups.

“For early-stage insurtechs in particular, the effects of this foreclosure and failure could be significant. In an environment where funding is already increasingly difficult to come by, this has the potential to make the situation more challenging and protracted … The reality could be an increased foreclosure of more insurtechs. With venture capital and mega-round activity simultaneously drying up, there are far fewer places for insurtechs to go to get their necessary growth capital. This could result in accelerated M&A, or at least the stripping of technological assets from certain businesses,” the report states.

Gallagher plans to release additional reports throughout the year. This report focuses on the funding activity captured in and around angel, convertible note, pre-seed, seed and seed venture capital deals. The Q2 edition will focus on deals in and around Series A. Following that, Q3 will focus on deals at the Series B and C level and finally Q4 will focus its attention on those Series D, Series E+, growth equity, private equity, exits and corporate majority deals.