General Liability Insurance: What Contractor Damage is Covered?

Does General Liability Insurance Cover for Contractor Damage?

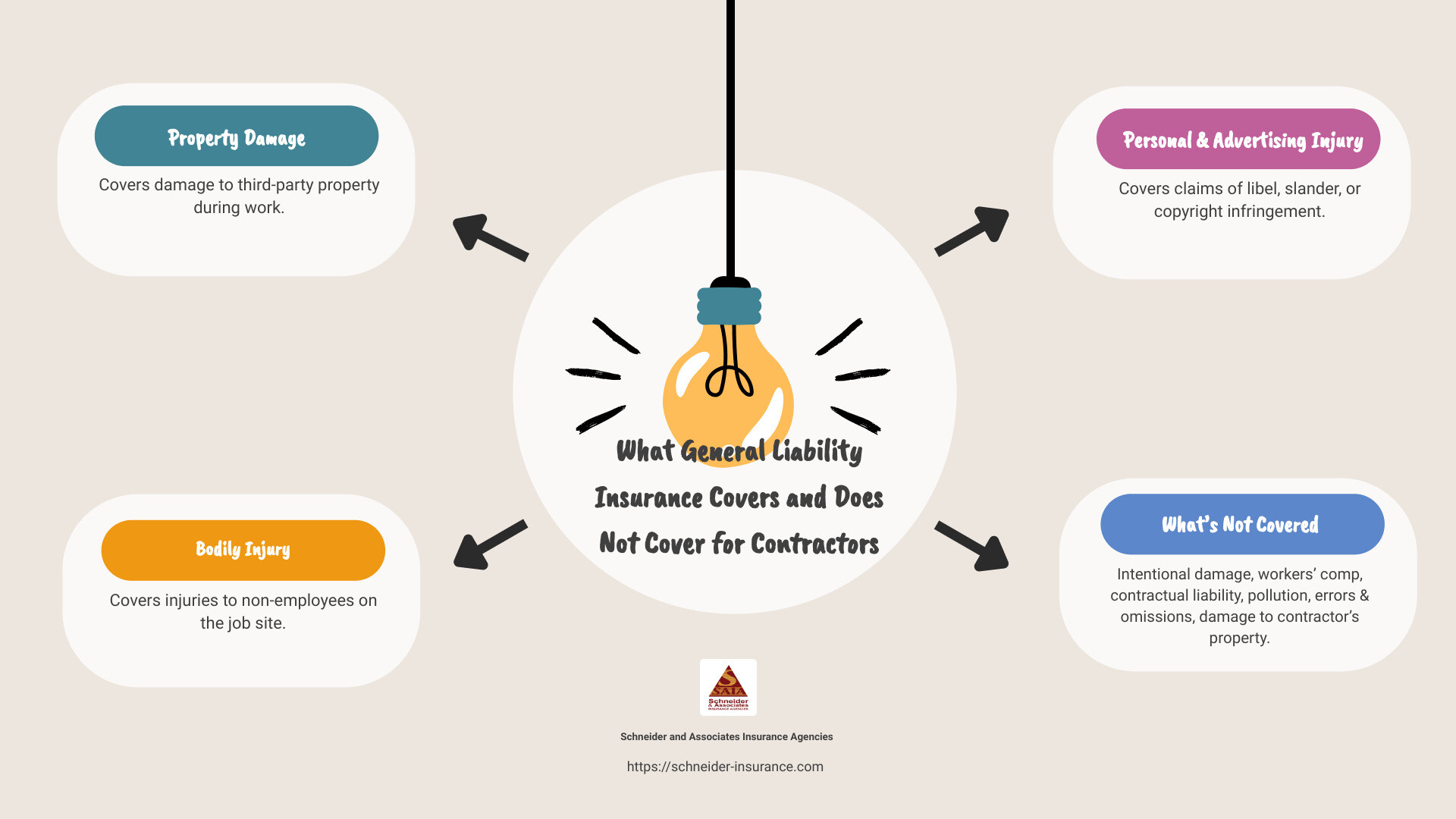

Yes, general liability insurance does cover for contractor damage, but it depends on the specific circumstances. Here are key points summarizing what is covered and what is not:

General liability insurance is crucial for contractors to protect against unexpected financial risks. For a contractor, having adequate insurance can mean the difference between staying in business and facing significant out-of-pocket expenses.

I’m Paul Schneider. With over 15 years of experience in providing insurance solutions for contractors in Florida, I’m well-versed in the ins and outs of does general liability insurance cover for contractor damage. This topic is important because understanding your coverage can help you avoid costly mistakes.

What is General Liability Insurance?

General liability insurance is essential coverage for contractors. It protects against claims of property damage, bodily injury, and personal and advertising injury that arise from the contractor’s operations. This insurance not only covers the costs of these claims but also the legal fees associated with defending against them.

Definition

General liability insurance is a type of insurance policy that provides financial protection to businesses, including contractors, from claims resulting from normal business operations. These claims can include property damage, bodily injury, and personal and advertising injury.

Coverage

A basic general liability insurance policy for contractors typically covers:

Property Damage: Damage to someone else’s property due to the contractor’s work.Bodily Injury: Injuries to third parties (not employees) that occur on the job site.Personal and Advertising Injury: Harm caused by false statements, copyright infringement, or misappropriation of advertising ideas.

Contractors

Contractors of all types need general liability insurance. This includes:

Construction Contractors: Carpenters, roofers, electricians, handymen, general contractors, and engineers.Other Contractors: Business consultants, hair stylists, app developers, editors, house cleaners, bookkeepers, and tax preparers.

Protection

General liability insurance protects contractors from financial loss due to claims of negligence. For example, if a contractor accidentally damages a client’s property or if a visitor is injured at a construction site, the insurance covers the costs associated with these incidents.

Example: Imagine a painter working on a client’s home accidentally spills paint on an expensive carpet. The general liability insurance would cover the cost of cleaning or replacing the carpet.

Quote: “General liability insurance is a safety net for contractors, ensuring that one mistake doesn’t lead to financial ruin,” says Melody Bell, Director of Underwriting at Procore.

Additional Coverage

Contractors can customize their general liability insurance to meet specific needs by adding extra protection such as:

Data Breach Coverage: For costs associated with the theft or unauthorized access to computer systems and customer information.Equipment Coverage: For costs related to the repair, replacement, or theft of tools and equipment.

By understanding and securing the right general liability insurance, contractors can focus on their work with peace of mind, knowing they are protected against potential financial risks.

Next, we’ll dive deeper into why contractors need general liability insurance and the specific types of damages it covers.

Why Contractors Need General Liability Insurance

Liability Claims

In contracting, accidents and mistakes can happen. When they do, liability claims can arise. These claims can be costly and damaging to your business if you’re not adequately covered. General liability insurance acts as a financial safety net, helping contractors manage the costs associated with these claims. For example, if a contractor accidentally damages a client’s property, the insurance can cover the repair costs, preventing a significant financial setback.

Bodily Injury

Bodily injury claims are another crucial reason contractors need general liability insurance. Imagine a scenario where a client or third party slips and falls at a job site. The medical costs and potential legal fees from such an incident can be overwhelming. General liability insurance covers these expenses, ensuring that contractors aren’t left paying out-of-pocket for medical bills or legal settlements. This coverage is essential for maintaining a business’s financial health.

Property Damage

Contractors often work on or around valuable property, whether it’s a client’s home or commercial building. Property damage can occur due to negligence or accidents. For instance, if a plumber accidentally causes a water leak that damages a client’s home, the repair costs can be substantial. General liability insurance covers these costs, protecting contractors from financial ruin and maintaining their reputation with clients.

Legal Fees

Legal disputes can be time-consuming and expensive. Whether it’s a claim of negligence, property damage, or bodily injury, the legal fees can quickly add up. General liability insurance helps cover the cost of hiring lawyers, court fees, and settlements. This allows contractors to focus on their work rather than being bogged down by legal battles.

General liability insurance is not just a safety net; it’s a crucial part of running a contracting business. It protects against unforeseen events that can lead to significant financial loss. By having the right coverage, contractors can operate with confidence, knowing they are protected against potential risks.

Next, we’ll explore the specific types of damages covered by general liability insurance for contractors.

Does General Liability Insurance Cover for Contractor Damage?

You might be asking, does general liability insurance cover for contractor damage? The short answer is yes, but let’s dive into the specifics.

Property Damage

General liability insurance covers property damage caused by a contractor’s work. This includes damage to a client’s property due to negligence, like a dropped tool breaking a window or a mishandled piece of equipment damaging a floor. If a contractor accidentally causes a fire that destroys part of a client’s home, this insurance can cover the repair costs.

Bodily Injury

Another critical aspect is bodily injury. If someone gets hurt on a job site, like a client tripping over materials left out by a contractor, general liability insurance steps in. It covers medical expenses and legal fees if the injured party decides to sue. However, it’s important to note that this does not cover injuries to the contractor’s employees, which requires workers’ compensation insurance.

Negligence

Negligence is a key factor in many claims. General liability insurance covers situations where a contractor’s carelessness leads to damage or injury. For example, if a plumber fails to properly install a pipe, resulting in water damage, the insurance would cover the repair costs. This protection helps contractors avoid financial ruin from lawsuits and claims.

Personal and Advertising Injury

The policy also covers personal and advertising injury. This includes claims of libel, slander, or copyright infringement. For instance, if a contractor is accused of making false statements about a competitor, the insurance can cover the legal costs associated with defending against the claim.

General liability insurance is a safeguard for contractors, providing essential coverage for various types of damages. It allows them to focus on their work without worrying about the financial implications of potential mishaps.

Next, we’ll explore the specific types of damages covered by general liability insurance for contractors.

Types of Contractor Damage Covered by General Liability Insurance

General liability insurance covers a range of damages that contractors might face. Here’s what you need to know about the types of contractor damage covered:

Property Damage

Property damage is one of the main coverages under general liability insurance. This includes any damage caused to someone else’s property during the course of your work. For example:

Negligent Performance: If a contractor accidentally breaks a window while installing it, the insurance can cover the repair costs.Theft: If tools or materials are stolen from a job site, the insurance can help cover the loss.

These protections ensure that contractors aren’t burdened with hefty repair or replacement costs due to accidental damage.

Bodily Injury

Bodily injury coverage is crucial for any contractor. This includes injuries to third parties (not employees) that happen on the job site. Examples include:

Slips and Falls: If a visitor to the site slips on a wet floor and breaks a leg, the insurance can cover medical expenses and legal fees.Falling Debris: If a passerby is injured by falling debris from a construction site, the insurance can cover their medical bills and any legal claims.

This coverage helps contractors manage the financial impact of accidents that might occur during their projects.

Personal Injury

Personal injury protection covers non-physical injuries that a contractor might be accused of causing. This can include:

Libel and Slander: If a contractor is accused of making defamatory statements about a competitor, the insurance can cover legal defense costs.Invasion of Privacy: If a contractor is sued for unintentionally violating someone’s privacy, the insurance can help with the legal fees.

This type of coverage is essential for protecting contractors from lawsuits that can arise from their business operations.

Advertising Injury

Advertising injury covers damages related to the contractor’s marketing efforts. This includes:

Copyright Infringement: If a contractor uses a copyrighted image in their advertising without permission, the insurance can cover the legal costs.Misappropriation of Advertising Ideas: If a contractor is accused of stealing a competitor’s advertising concept, the insurance can help with the defense.

This coverage ensures that contractors can promote their services without the fear of costly legal battles over advertising disputes.

General liability insurance provides a safety net for contractors by covering these various types of damages. Next, we’ll delve into the common liability risks that contractors face and how to mitigate them.

Common Liability Risks for Contractors

Contractors face many risks every day. Accidents happen, and when they do, they can be expensive. Let’s look at some common liability risks that general liability insurance helps cover.

Worksite Accidents

Worksites are full of hazards. Workers can fall from ladders, trip over tools, or get hurt lifting heavy items. For example, an employee might trip over a nail gun and break an arm. Without insurance, the contractor would have to pay for medical bills and lost wages out of pocket. With general liability insurance, these costs are covered.

Faulty Workmanship

Sometimes, things go wrong even with the best intentions. Imagine a contractor installs new plumbing, but a pipe bursts a month later, flooding the client’s basement. The client might blame the contractor for the damage. General liability insurance can help cover the repair costs and any legal fees if the client sues.

Client Property Damage

Accidents can also damage a client’s property. For instance, a contractor might accidentally knock over a valuable vase while working. Or a piece of heavy equipment might fall and break a window. These incidents can be very costly to fix. General liability insurance helps cover the costs of repairs or replacements.

Legal Claims

Contractors can face legal claims for many reasons. Clients might sue for not completing work on time or using low-quality materials. Subcontractors might claim negligence if they get injured. Without insurance, legal fees can add up quickly. General liability insurance helps cover these legal costs, so contractors don’t have to pay out of pocket.

These are just a few examples of the risks contractors face. Having the right insurance can make a big difference when things go wrong. Next, we’ll explore the different types of contractor damage covered by general liability insurance.

Additional Coverage Options for Contractors

While general liability insurance is essential, contractors often need more comprehensive coverage to protect against various risks. Here are some additional insurance options that contractors should consider:

Builders Risk Insurance

Builders Risk Insurance (also known as Construction Insurance) covers buildings under construction. It protects against risks like fire, theft, vandalism, and weather damage.

For example, if a storm damages a partially built structure, builders risk insurance would cover the repair costs. It also covers materials, equipment, and property related to the construction project.

However, it’s important to note that this policy typically excludes damage from earthquakes, floods, and faulty workmanship.

Commercial Property Insurance

Commercial Property Insurance covers the contractor’s owned or rented buildings and equipment on premises. This includes tools, equipment, and computers. It protects against theft, fire, and other hazards.

For instance, if a fire destroys a contractor’s office and equipment, commercial property insurance would cover the replacement costs. This policy is crucial for protecting a contractor’s physical assets.

Professional Liability Insurance

Professional Liability Insurance (also known as Errors and Omissions Insurance) covers claims related to negligence, mistakes, or oversights in performing professional services.

Imagine a contractor fails to deliver a project on time, resulting in a breach of contract. Professional liability insurance would help cover the legal fees and any settlements. This insurance is especially important for contractors who provide design or consulting services.

Workers’ Compensation

Workers’ Compensation Insurance covers work-related injuries and illnesses sustained by a contractor’s employees. This insurance is legally required in most states.

If an employee gets injured on the job, workers’ compensation covers medical expenses and lost wages. For example, if a worker falls from scaffolding and breaks a leg, this insurance would cover the hospital bills and rehabilitation costs.

Having the right combination of insurance policies can significantly reduce the financial risks contractors face. Next, we’ll delve into the common liability risks for contractors and how to mitigate them.

Frequently Asked Questions about General Liability Insurance for Contractors

Does General Liability Insurance Cover Subcontractors?

General liability insurance primarily covers your business. However, it does not automatically cover subcontractors. Subcontractors are considered separate entities, and they need their own general liability insurance policies.

Imagine a situation where a subcontractor accidentally damages a client’s property. If they don’t have their own insurance, your policy won’t cover the costs. Always verify that your subcontractors carry their own insurance to avoid gaps in coverage.

What is the Cost of General Liability Insurance for Contractors?

The cost of general liability insurance varies based on several factors:

Business Type: Different trades have different risk levels. For instance, a roofer may pay more than a painter due to higher risk.Annual Revenue: Higher revenue can mean higher premiums.Coverage Limits: Policies with higher limits cost more.Claim History: Businesses with a history of claims may face higher premiums.Employee Headcount: More employees can lead to higher premiums.

On average, contractors might pay between $300 and $1,000 annually for $1 million in coverage. It’s essential to get quotes from multiple insurers to find the best rate for your specific needs.

How is General Liability Insurance Calculated for Contractors?

Insurance companies use underwriting criteria to calculate premiums. Here are the main factors:

Business Type: What kind of work do you do? High-risk jobs, like electrical work, tend to have higher premiums.Claims History: If you’ve had many claims in the past, your rates will likely be higher.Location: Where you operate can affect your premiums. Some areas have higher risks, like natural disasters.Coverage Limits: Higher limits mean higher premiums.Employee Count: More employees can mean higher risk, affecting your premium.Annual Revenue: Higher revenue can indicate a larger operation, which may increase risk and premiums.

Understanding these factors can help you better manage your insurance costs and ensure you have the right coverage for your business.

Next, we’ll explore the common liability risks for contractors and how to mitigate them.

Conclusion

At Schneider and Associates Insurance Agencies, we understand the unique needs of contractors. That’s why we offer personalized solutions to ensure you have the right coverage for your business.

Our team works closely with you to tailor your coverage. Whether you need general liability insurance, builders risk insurance, or workers’ compensation, we craft policies that fit your specific requirements.

Being a local agency, we bring local expertise to the table. We know the specific risks associated with different areas, from flood zones to wildfire-prone regions. This knowledge allows us to offer solutions that are both comprehensive and cost-effective.

By choosing Schneider and Associates Insurance Agencies, you’re not just getting an insurance policy; you’re gaining a partner who cares about your peace of mind. Let us help you safeguard your business so you can focus on what you do best—building and creating.

For more information on how we can help protect your business, visit our General Liability Insurance page.

Next, we’ll explore the common liability risks for contractors and how to mitigate them.