Former Wall Street darling Rivian suddenly has a lot to prove

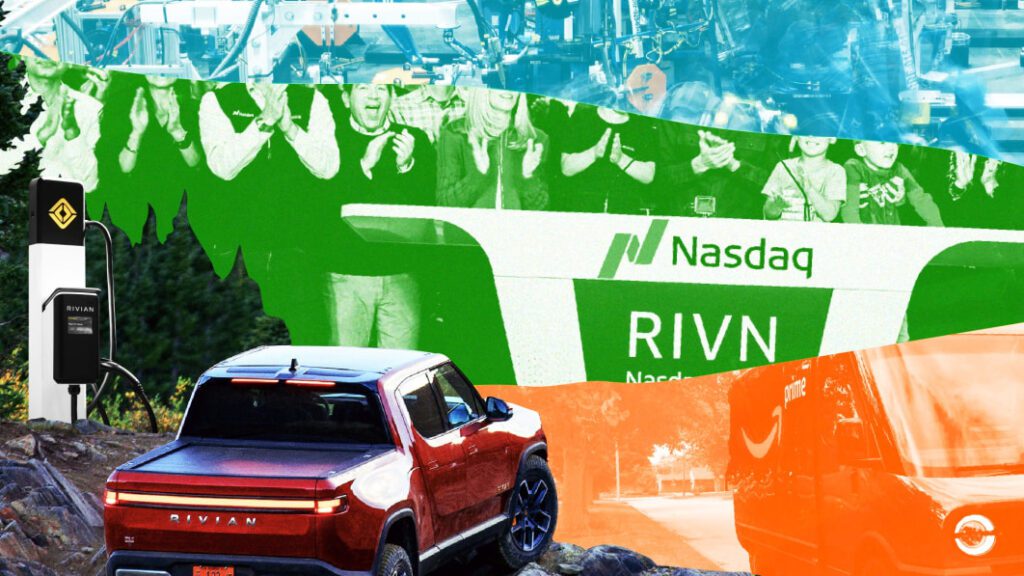

Rivian; Marianne Ayala/Insider

Rivian just underwent its second round of layoffs in 7 months.

It could be a sign the EV startup’s chief executive knows the need for focus.

In the meantime, customers and shareholders have been getting impatient.

Stuart Goldberg of Big Sky, Montana doesn’t think his Rivian orders are ever coming in.

An IPO Rivian stockholder, Goldberg put two deposits down on an R1T and an R1S in September 2019. The 53-year-old resident of the ski town says he’s a perfect example of a Rivian customer. He said he even offered to let the company film an ad for free on his property if they would just deliver his vehicles.

In February, Goldberg received an email that his delivery date was pushed back, yet again, to the second half of 2024.

“I read that as basically never,” Goldberg said. He’s embarrassed, he said, because he spent years hyping up Rivian to his friends and enthusing about his orders. Now, he dreads friends asking where his electric trucks are. “I’m the jerk who gets calls all the time like ‘you get your car yet?’ and I have to answer ‘no’ because at this point they’re never selling me a car.”

Goldberg’s plight — and newfound distaste with Rivian after waiting nearly half a decade for his vehicles — are an early sign to some that the company has made more promises than it can deliver upon.

The list is certainly long. Since its blockbuster IPO in late 2021, Rivian has attempted to launch three vehicles at once, deliver 100,000 electric vans to Amazon, and hammer out 25,000 vehicles in its first full year of production — all while standing up a second factory in Georgia.

While the company tries to keep all of these plates spinning, shareholders are losing patience. In its first full year as a publicly traded company, Rivian’s stock fell roughly 80% as it pushed back deliveries, changed pricing, and in the end, delivered just over 20,000 vehicles.

On top of the investor about-face, the company’s production troubles are starting to irk a once-fanatic customer base, which could spell real trouble for the startup. Another Rivian customer told Insider they placed a reservation last July. After not receiving any update about their order in more than six months, they canceled it this month. A Rivian spokesperson told Insider that timing is “based on a number of factors, including delivery location, configuration and original preorder or reservation date.”

“Not having a history of buyers — and the reputation that brings along with that base — can mean you don’t have the momentum you need to get through the economic turmoil we’re about to go through,” Sam Fiorani, an analyst for AutoForecast Solutions, told Insider.

The word of the year at Rivian is ‘focus’

In CEO RJ Scaringe’s email to staff about a 6% reduction in workforce earlier this month — the second round of cuts in seven months — he mentioned “focus” three times.

“In 2022, we took steps to focus our product portfolio and drive a lower cost structure,” Scaringe said, according to a copy of the email obtained by Insider. “To deliver over the long-term, we must focus our resources on ramp and our path to profitability while ensuring we have the right set of future products, services and technology.

“The changes we are announcing today reflect this focused roadmap,” he added. Moving toward profitability “requires us to concentrate our investments and resources on the highest impact parts of our business.”

It’s clear that Scaringe knows just how much the next phase of the startup’s future depends on its ability to do exactly that. The Rivian spokesperson told Insider Scaringe’s language refers to “how we deliver over the long term.”

Despite having $13 billion in the bank (as of September 30), the fledgling EV-maker is struggling to build its flagship pickup line, an SUV, delivery trucks for Amazon, a charging business, and, most recently, a potential foray into the electric bike space — all while combating the same supply chain challenges hobbling the industry and racing to beat increasingly viable competitors to the market.

By the end of 2022, Rivian had delayed its next-gen R2 platform and missed its 25,000-vehicle production guidance for 2022, building 24,337 and delivering 20,332. For the cars the company has gotten in customer hands, the challenges of a direct-to-consumer sales model could be starting to materialize.

Still, Rivian is pushing to grow. It’s ambitiously expanding its domestic manufacturing footprint with a move in Georgia at a time when its current facility in Illinois isn’t yet operating at full capacity.

Meanwhile, a constant flow of new competition targeting the delivery market is vying for Amazon’s attention while Rivian rushes to fill orders for the crucial contract. Ford cashed out 90% of its stake in 2022, and a joint venture with Mercedes to build electric vans was recently put on hold. In a release about the paused partnership, Scaringe again pointed to the need for “focusing” on the consumer business and existing commercial business.

An employee laid off in Rivian’s first round of cuts last summer told Insider it felt like growing pains many other companies have experienced. But the latest wave surprised one impacted employee. Coupled with Scaringe’s comments, it indicates more challenges ahead.

“I think RJ knows what he’s doing: Focus on getting the product out and ramp up on the vans,” Martin French, managing director at consultancy Berylls, said. “They’ve got what looks to be a great product and the enthusiasm is still there.

“I don’t know if it’s panic time for Rivian,” French, of Berylls, added. “But at the end of the day, the expectation is, you’ve promised to make all these vehicles.”

History repeating itself?

The industry has seen this story before, perhaps with players that grabbed less investor attention than Rivian.

Arrival, a UK-based commercial EV startup, has gone through multiple restructurings resulting in layoffs. The company hemorrhaged cash while pursuing all sorts of ventures, from a delivery van to an electric jet and trying to reinvent the legacy auto factory.

Meanwhile, former employees at Xos have said the electric truck and van-maker’s bloated product line was also what spurred layoffs last summer. (Like Scaringe, a company spokesperson also said the cuts were part of efforts to “focus.”)

Rivian has distinct advantages over those and others. Despite its hefty quarterly cash burn, the company is still the most well-set financially to move forward – for now. Experts say it may have to raise more funds to make it past 2023.

While the executive team has undergone changes, Rivian hasn’t quite experienced the level of turnover to the extent other EV-makers have. Despite just missing the mark of last year’s production guidance, Rivian didn’t have to reduce its target like some peers did. And it still had a healthy 114,000 order backlog at the end of the third-quarter.

For these reasons, not all Rivian-watchers are anxious about the startup’s future. Another order-holder feels confident, telling Insider the delays aren’t a concern. Even Goldberg said he’s holding onto his orders on the off-chance they ever arrive.

Still, shareholders and analysts say, Rivian has a long road to prove it can deliver this year — and focus.

Are you a current or former Rivian employee, Rivian vehicle owner, or Rivian order-holder? Contact these reporters at nnaughton@insider.com and astjohn@insider.com.