Final Look 2022: The Massachusetts Private Passenger Auto Insurance Marketplace

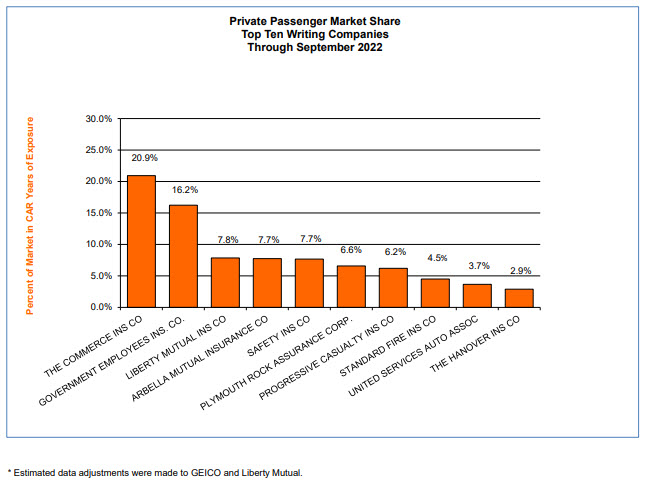

For our last look of 2022 with respect to the current state of the of the Private Passenger Automobile Insurance marketplace, the numbers reflect market share data as of September 2022, the latest date for which complete data is available.

As always, many thanks to the Commonwealth Automobile Reinsurers which acts as the statistical agent for motor vehicle insurance in the Commonwealth of Massachusetts and provides Agency Checklists with all the data presented here.

The Private Passenger Auto Insurance Marketplace

Exposures & Market Share as of September 2022

CompanyExposuresMarket Share1. COMMERCE795,19620.97%2. GEICO617,35416.28%3. ARBELLA294,3757.76%4. SAFETY291,5267.69%5. LIBERTY MUTUAL290,0947.65%6. PLYMOUTH ROCK250,2106.60%7. PROGRESSIVE235,8906.22%8. STANDARD FIRE171,2304.51%9. U S A A139,3143.67%10. HANOVER109,9312.90%11. AMICA MUTUAL105,7492.79%12. METROPOLITAN98,7222.60%13. ALLSTATE77,9582.06%14. QUINCY MUTUAL62,6731.65%15. NORFOLK AND DEDHAM MUTUAL48,8641.29%16. AMERICAN FAMILY47,7191.26%17. VERMONT MUTUAL40,1761.06%18. FOREMOST18,2410.48%19. STATE FARM16,5760.44%20. PREFERRED MUTUAL13,0540.34%21. GREEN MOUNTAIN12,7180.34%22. BANKERS STANDARD10,1240.27%23. PURE9,9950.26%24. TRUMBULL8,5590.23%25. ELECTRIC7,5010.20%26. FARM FAMILY6,0870.16%27. CINCINNATI4,8830.13%28. MARKEL AMERICAN2,9900.08%29. AMERICAN INTERNATIONAL1,9540.05%30. MIDDLESEX1,1490.03%31. TOKIO9150.02%32. HARLEYSVILLE WORCESTER7430.02%33. AMERICAN BANKERS1110.00%34. AMERICAN FAMILY HOME640.00%35. FIREMEN’S INS CO120.00%TOTAL3,792,657100.00%

The Marketplace in Massachusetts by Exposures and Market Share Over The Years

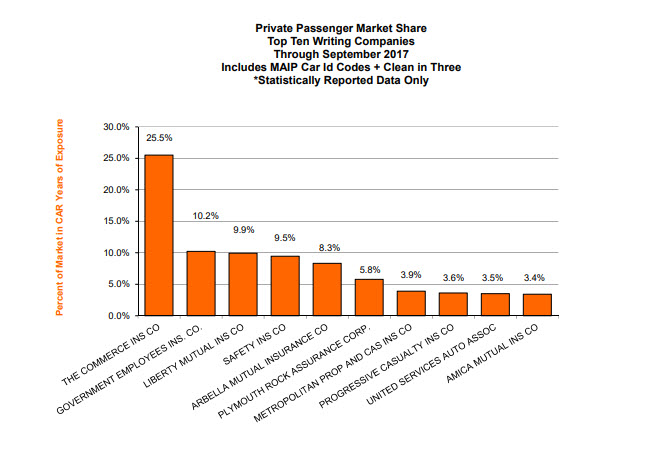

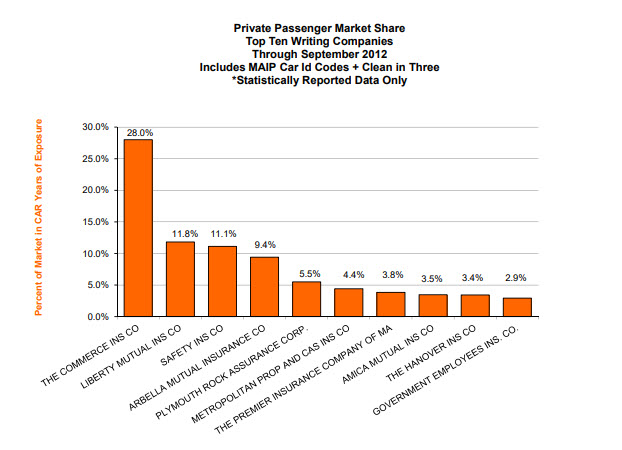

While it may appear that little changes in the Massachusetts private passenger auto insurance marketplace from our bi-monthly reports, it is a little bit deceiving. In retrospect, a lot has changed over the past decade since Agency Checklists first began publishing its bi-monthly updates and as can be seen in the snapshots provided below.

For example:

MAPFRE (Commerce), which is celebrating its 50th Anniversary this year, continues to be the number one Private Passenger Auto Insurance in Massachusetts with a 20.97% as of September 2022. Five years ago in September 2017, the insurer had a market share of 25.5%, while 10 years ago in July 2012, it was 28.0%

As for GEICO, the direct writer continues as the second largest private passenger insurer in the Commonwealth with a 16.2% market share. Just five years ago, however, GEICO was the third largest insurer with a 10.2% market share as of September 2017. Looking back to July 2012, it was ranked the 10th largest with just a 2.9% market share in Massachusetts.

Liberty Mutual continues as the third largest auto insurance writer with a 7.8% share of the marketplace. This is slightly less that the market share it held as of September 2017, when it held a 9.9% market share. In July 2012, it was also the second-largest writer with a 11.8% market share.

Six of the top 10 Private Passenger insurers continued to be based in Massachusetts: MAPFRE; Liberty Mutual; Safety; Arbella; Plymouth Rock; and The Hanover.

As of July 2022, the top 10 insurers have a combined market share of 84.20%.

The following side by side comparisons depict the Top Ten Private Passenger Insurers for during the month of September, followed by the same graph for the same month, from five years earlier in September 2017, and then finally from a decade ago in September 2012.

Together, they provide an opportunity for a side-by-side comparison of how the Private Passenger Auto Insurance Marketplace is evolving. Unlike past updates, all of the past years included in this review have now been after the advent of “Managed Competition”.

September 2022

September 2017

September 2012

ppa SEP2012

September 2022/September 2017 Comparison

September 2022/September 2012 Comparison

How to view all of the 2022 updates on the Private Passenger Auto Insurance Marketplace in Massachusetts