Ferrari Is Laying A Big Electric Bet

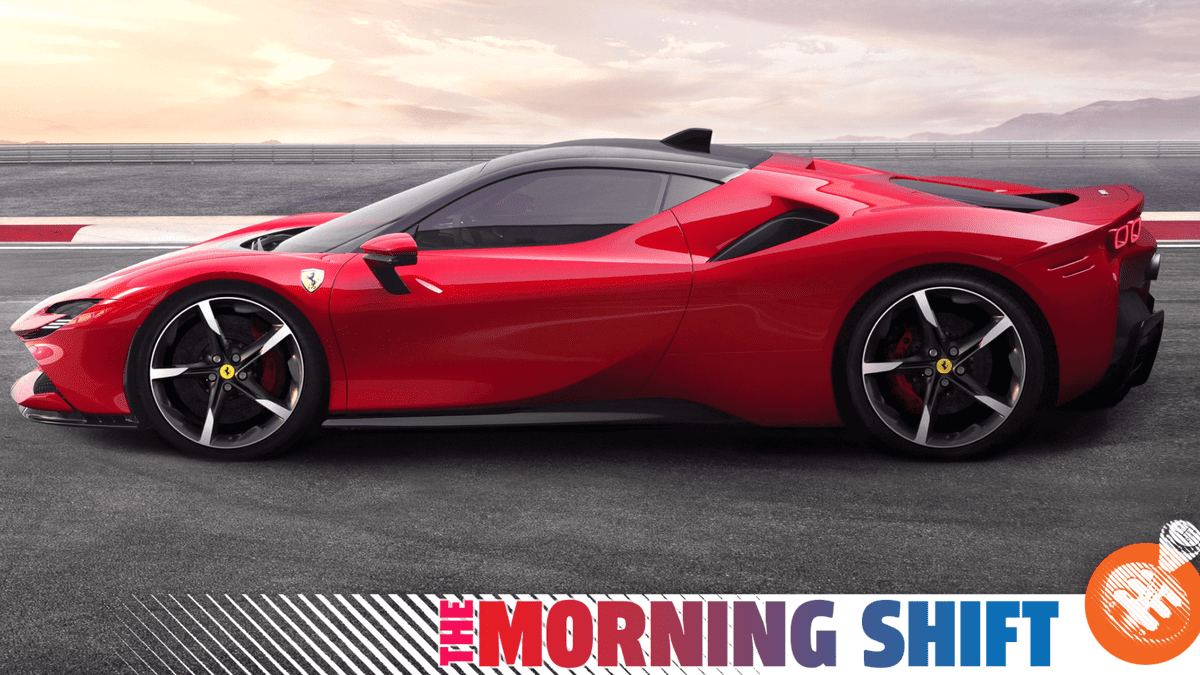

Photo: Ferrari

Ferrari is building out its electric production capacity, car dealers have guarded optimism, and Tesla. All that and more in The Morning Shift for June 9, 2022.

1st Gear: Ferrari

It took Ferrari more than a minute to admit that electric cars are the future, but it has, and, now, according to Bloomberg, is putting its money where its mouth is.

Ferrari NV plans to significantly expand its factory in northern Italy as part of the electrification strategy it will unveil during a highly anticipated briefing next week, according to people familiar with the matter.

The supercar manufacturer has snapped up space near its Maranello plant and started clearing the way for a third production line that will be dedicated to making hybrid and electric vehicles, said the people, who asked not to be identified because the information is private. The expansion will also likely include a new battery research-and-development center, they said.

Ferrari will highlight the project during its June 16 capital markets day, when Chief Executive Officer Benedetto Vigna is expected to shed light on Ferrari’s EV strategy and lay out his business plan for the next four years. The former STMicroelectronics NV executive was brought in to accelerate the shift away from the 12-cylinder engines and four-figure horsepower the carmaker is known for.

A spokesman for Ferrari declined to comment. The manufacturer’s US shares rose as much as 1.3% as of 1:15 p.m. Thursday in New York trading, reversing an earlier decline.

Ferrari has the hybrid SF90 Stradale, of course, and is expected to have an all-electric car by 2025. No more sacred cows, I guess.

2nd Gear: Dealers

Car dealers remain hugely profitable, because new cars are in heavy demand, because new cars are also in short supply, and thus the ancient rules of economics mean that dealers, therefore, are raking it in. But Automotive News says that their optimism about what happens from here to the future is guarded.

Franchised dealers’ expectations for their vehicle markets for the next three months fell from a score of 69 in the first quarter to a still-positive 64 in the second quarter, according to the latest Cox Automotive Dealer Sentiment Index results.

“The decline we’re observing with franchises here is not typical for this time of the year,” Cox Chief Economist Jonathan Smoke told Automotive News. Normally, franchisees’ three-month outlook holds steady heading into both spring and summer, Smoke said.

Cox surveyed 591 franchised and 555 independent dealers from Jan. 24 to Feb. 7 for the first-quarter index and 568 franchisees and 531 independents from April 25 to May 9 for the second-quarter study. In addition to asking dealers their outlook on the three months ahead, Cox asks about the past 90 days and identifies factors affecting dealers’ optimism or pessimism. Cox weighs responses by dealership type and sales volume to calculate a diffusion index. An index number greater than 50 indicates that dealers view conditions as positive.

Smoke noted that the current three-month outlook is “still a very good number.” Franchised dealers are still more optimistic heading into summer than they were in 2019 before the coronavirus pandemic started, he said.

G/O Media may get a commission

Free Mounting Service

Samsung 65″ QLED Smart TV QN95B

The ultimate 4K experience

Brilliant details shine even in daylight with Quantum Matrix Technology. Powered by a huge grid of Samsung’s ultra-precise Quantum Mini LEDs, it takes exact control of the individual zones of light in your picture for breathtaking color and contrast.

That is telling that dealers are more optimistic now than in the summer of 2019, in that it suggests that the market for new cars will remain strong.

3rd Gear: Tesla Hurting In China

China has been in the midst of various pandemic-related lockdowns, which have complicated things for Tesla. Reuters now reports that Tesla production is expected to go down by over a third in April, May, and June, compared to January, February, and March, mainly because of the lockdowns.

Production at Tesla Inc’s (TSLA.O) Shanghai factory is on track to fall by over a third this quarter from the first three months of the year as China’s zero-COVID lockdowns caused deeper disruptions to output than Elon Musk had predicted.

The U.S. automaker is aiming to make more than 71,000 vehicles at its Shanghai plant in June, according to an internal production memo seen by Reuters.

Together with the 44,301 units it produced in April and May, according to data from China Passenger Car Association (CPCA), that would add up to around 115,300 units in the second quarter.

In the first three months of the year, Tesla Shanghai manufactured 178,887 cars, according to the CPCA.

Tesla did not immediately respond to a request for comment on Thursday.

Tesla, these days, never responds to a request for comment from anybody.

4th Gear: Denso

Denso is a Japanese supplier that makes lots of semiconductors for Toyota, products that have been in high demand for over a year now, because of shortages. In related news, Denso said Friday that it was considering spinning off its semiconductor business, because sometimes parts of businesses are worth more when they stand on their own.

From Automotive News:

Denso ranks second on the Top 100 suppliers list and has also quietly built up a presence in automotive chips.

Now, with semiconductor-related capital expenditures totaling around 160 billion yen over the past three years, Denso ranks as the world’s fifth-largest supplier of automotive chips by sales.

“We need to think about whether the time will come when we sell semiconductors, alone, externally,” CTO Yoshifumi Kato said in an interview at Denso’s headquarters in Aichi prefecture on Friday. “It’s worth looking into whether that kind of structure is possible,” he said.

[…]

According to Kato, demand for automotive semiconductors, on a tear amid the industry’s shift to electric, internet-connected and autonomous cars, is likely to continue going from strength to strength.

Denso said at a briefing earlier this month that it’s targeting 500 billion yen in sales from its in-house power and analog chip business, up from around 420 billion yen currently.

5th Gear: Car Sales In Russia Expected To Drop By Half in 2022

Reuters says in a brief article that this is because of supply-chain issues:

Russia’s Industry Ministry expects car sales to halve in 2022 as the country’s automobile industry grapples with supply issues, a senior official said.

“We saw a sharp fall (in car sales) in April and May,” Tigran Parsadanyan, deputy head of the ministry’s automotive and railway engineering department, said on Thursday.

“We expect that some 750,000 cars will be sold on the market by the end of the year.”

That figure represents a 51% drop in sales year-on-year.

Reuters’ story doesn’t even bother to mention the war in Ukraine, which may be because that goes unsaid, or may be because an editor was in a bad mood, or may be because … well, I don’t know. But obviously the war is the primary factor, scrambling supply chains as it did and leading to sanctions against Russia.

Here’s Bloomberg from May:

Russian car sales plunged the most on record last month as sanctions undermined domestic production and most foreign automakers suspended operations in the wake of President Vladimir Putin’s invasion of Ukraine.

Sales fell 79% to 32,706 vehicles in April compared to a year earlier, the Association of European Businesses said in a statement Wednesday. That is the biggest drop since the European trade group began reporting the data in 2006. The April figures didn’t include sales from BMW AG, Mercedes-Benz AG or General Motors Co.

Reverse: This Was A Thing

Neutral: How Are You?

My weekend plans include firing up the Fit for the first time in two weeks, probably the only car I’ve ever owned that I’ve never had to worry about starting. Dangerous thing to get used to.