Falling Work Comp Rates: The Good, the Bad, and the Ugly

This article was updated on February 17th, 2025 with fresh statistics. It’s the same story as was originally published in 2019, just more intense!

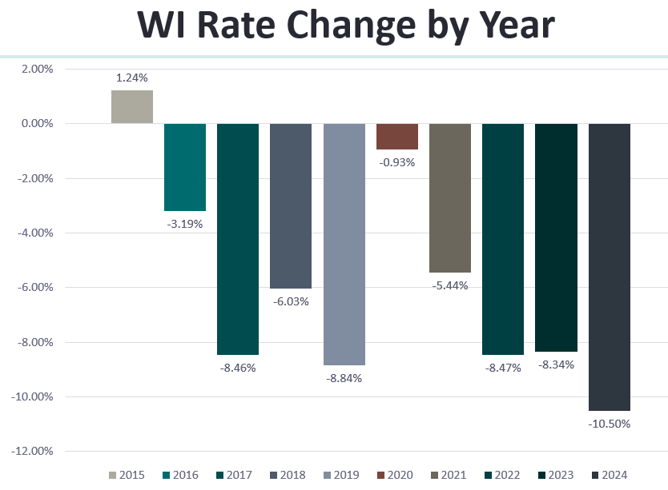

On October 1, 2024 Wisconsin continued its trend entering a ninth consecutive year of reduced workers’ compensation insurance rates. Rates in 2024 fell an average of 10.5% compared to 2023, which is the most dramatic reduction in over a decade. This rate reduction will affect work comp policies with renewal dates between 10/01/24 to 09/30/25.

Workers’ compensation rates are state mandated in Wisconsin, meaning all insurance carriers must use the same rates resulting in premiums from one carrier to another are basically the same.

While at first glance, this appears a “boon” to the bottom line for Wisconsin contractors as work comp premium makes up the lion’s share of insurance costs.

When it comes to the 9th consecutive year of reduced work comp rates there’s “the Good, the Bad, and the Ugly…”

… the Good …

In general, a reduction of work comp rates result in reduced premium costs to contractors.

In 2024, the Wisconsin construction industry will see the greatest reduction in work comp premium compared to other industries:

Overall 2024 Wisconsin work comp rate reduction: -10.5%

Construction

-14.17%

Goods & Services

-10.41%

Manufacturing

-9.34%

Within the various Construction industry class codes, the 2024 WC rate reduction ranges from:

Highest Changes

Mid Changes

Lowest Changes

-24.6% HVAC Installation

-14.6 Landscaping

-6.3% Cleaner-Debris Removal

-17.5% Roofing

-13.2% Sewer Construction

-5% Excavation

-16.6% Concrete Construction

-12.7% Plumbing

-2.4% Street or Road Const.

… the Bad …

To understand the downside of falling work comp rates, a snapshot of the last 10-years is needed. Overall the new 10/1/24 rates are 46.6% lower than the rates that were in effect on 9/30/16. In the last nine years there has been nearly a 50% reduction in the potential work comp premium dollars available to the insurance market.

The effect of nine consecutive years of work comp rate reductions is a continued reduction in insurance carrier loss holding capacity for writing this line of insurance, which will eventually lead to:

Insurance carriers scaling back % of Dividend Offerings (an action that insurance carriers have historically been reluctant to take for fear of a loss of market share)

Potential of reduced insurance carrier interest in writing WC coverage (especially standalone WC markets)

Potential of rate increases in non-work comp coverage lines to support the overall account profitability

Hardening of the insurance market, that already has been seen rate increases over the past few years in Business Auto and capacity limitations on Umbrella/Excess

… and the Ugly …

Construction companies may be surprised to learn that significant WC rate reductions have an inflationary impact on the Experience Modification Rate (EMR).

It should be noted that this inflationary impact to the EMR will offset to some degree the premium reduction created by reduced WC rates.

Of the many variables that affect the EMR, the below example illustrates the inflationary pressure created by reducing WC rates:

“Expected Losses” are the amount of losses that the State of Wisconsin expects to result from the state mandated work comp rate.

As the state mandated work comp rates have reduced over the past 9 years, the “Expected Losses” that will result from the reduced WC rates also reduce.

“Expected Losses” are compared to each construction company’s “Actual Losses” in the calculation of the EMR.

The lowering of the “Expected Losses” through reduced WC rates when compared to the “Actual Losses” results in inflationary pressure to the EMR.

The only way to offset this inflationary pressure on the EMR is for contractors to reduce their “Actual Losses”.

Contractors familiar with competitively bidding on large projects know all-too-well the importance of having an Experience Modification Rate below 1.00. Most contractors have seen their EMR increase over the past several years, due in part to the last 9 years of WC rate reductions.

Medical Inflation is also negatively affecting experience mods and ultimately increasing Workers Compensation costs. This is especially true in Wisconsin, because we are one of the six states in the US not on a fee schedule and have seen the highest growth in Workers Compensation medical costs in the country.

What can Contractors do?

Competitive pressure on insurance carriers

Start the renewal process early (120 days prior to renewal)

Evaluate insurance carriers:

WC Dividends Plans

Analysis of carriers coverage enhancements and/or restrictions

Evaluation of Carrier Support Functions (Loss Control / Safety Services & Claims Service)

Carrier dedication to the construction industry (Most national carriers have construction dedicated Underwriting / Loss Control / Claims functions)

Pre-Loss – Safety:

Identify who is accountable at each job site for administering safety?

Involve the insurance carrier and insurance broker to create an annual service plan addressing:

Training (employees / supervisors & foremen / safety director)

Jobsite inspections (Are we following our policies and documenting all inspections and corrective action?)

Post-Loss – Controlling Costs:

Claims should be reported immediately

Statistics confirm a direct correlation between immediate reporting of a WC claim and minimizing the cost of that WC claim

Keeping WC claims “Medical Only”

“Medical Only” claims (without Loss of Wages and or Disability) are discounted by 70% for the purpose of the impact on the EMF

Partnering with an Occupational Medical Provider

By having a medical provider familiar with your business, there tend to be fewer hang ups in getting employees to return to work as fast as possible

Regularly scheduled mid-term and year-end claim reviews with broker and insurance carrier

Applying for available work comp credit programs:

Wisconsin Contractors Premium Credit program (up to a 10% Premium Reduction that has no impact on the EMR)

Wisconsin Apprentice Credit Program (up to $ 2,500)

NOTE: Some insurance brokers (including R&R Insurance) have dedicated Construction divisions to serve the needs of Wisconsin’s construction industry.

To sum it up, while at first glance the continued workers’ compensation rate reduction that took effect on 10/01/24 may create the appearance of saving “A Fist Full of Dollars” on reduced WC premiums, in reality an objective evaluation would indicated that there is “The Good, the Bad & the Ugly..”.