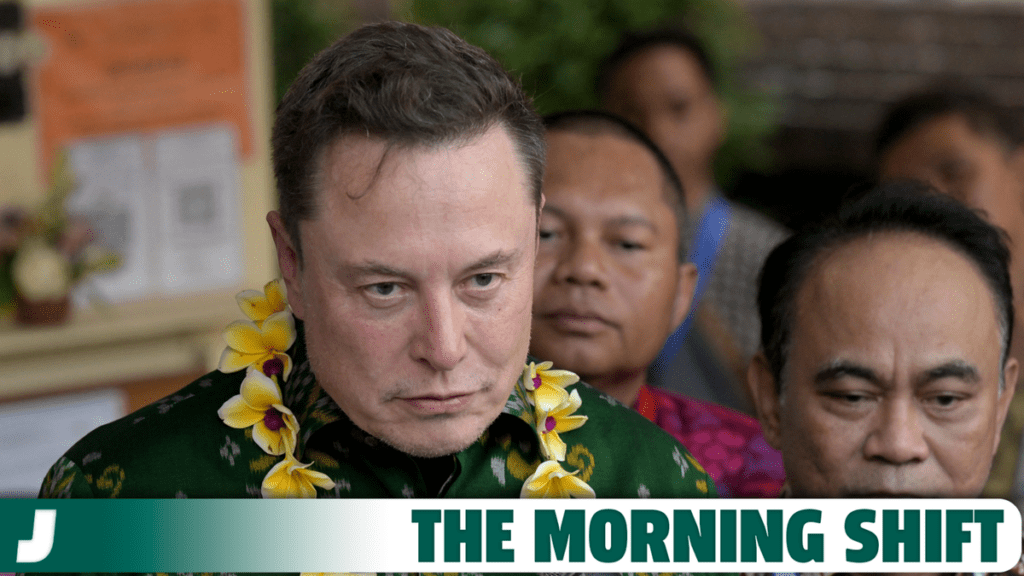

Elon Musk’s $56 Billion Tesla Pay Package Is An Uphill Battle He Is Going To Fight

Good morning! It’s Thursday, May 30, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

Walter Isaacson On Elon Musk(s)

1st Gear: Elon’s Tesla Pay Package Faces A Ton Of Legal Hurdles

In just a few weeks time, Tesla shareholders will vote on whether or not to reward CEO Elon Musk with a $56 billion pay package. It’s the same one that was voided by a judge in Delaware back in January because she found Musk had improper influence over the process.

Along with the pay package, the shareholders will also vote on whether or not to move the automaker’s legal home from Delaware to Texas. Here’s a layout of the sorts of legal fights Tesla and Musk could be facing before the June 13 vote. From Reuters:

What Impact Will The Shareholder Vote Have?

If shareholders reject the move to Texas and Musk’s pay, it will vindicate the court’s ruling that described Musk’s pay as “unfathomable,” and would be a stinging defeat for a board that critics say is dominated by Musk.

If shareholders vote to pay Musk, it will likely set off another legal challenge. Where that challenge takes place might depend on the vote to move Tesla’s legal home to Texas.

If Tesla Becomes A Texas Corporation

Lawyers for Richard Tornetta, the shareholder who sued in Delaware in 2018 over Musk’s pay, have said in court filings they fear the shareholder vote is a bid to use a Texas court to undo the January ruling.

For her part, the judge in Delaware, Chancellor Kathaleen McCormick, said on May 28 she was assured by Tesla’s attorneys the company will not litigate any dispute over the shareholder vote outside Delaware.

If Tesla Remains A Delaware Corporation

The judge in Delaware still has to decide how much to award to Tornetta’s legal team as a fee payable by Tesla before Musk and Tesla can appeal. The shareholder legal team requested $6 billion. A hearing is scheduled for July 8.

Tesla’s legal team has said a vote ratifying Musk’s pay would materially affect the Delaware proceedings, although they did not explain how. If the pay package is ratified at the shareholder meeting, it will almost certainly be challenged by shareholders opposed to it.

McCormick could include such a challenge in the ongoing Musk pay case or create a new lawsuit. If it were a new case, that would allow Tesla and Musk to appeal the January ruling to the Delaware Supreme Court while the Court of Chancery sorted out challenges to the shareholder vote, which could take months or even years.

Tesla’s Novel Use Of A Ratification Vote

Tesla’s ratification vote is based on Delaware law that is meant to allow companies to clean up technical defects in corporate transactions, like sales of stock that were not properly authorized. The company described its approach as “novel” in its proxy filing.

No one has filed a legal challenge, but Charles Elson, a former University of Delaware professor who specialized in corporate governance, said in a court filing that ratification cannot be used as Tesla is applying it – to correct a breach of fiduciary duty by a board.

Challenge To The Vote

Tesla shareholders could also challenge the vote, citing Musk’s efforts to sway voting. Musk on May 18 responded “yes” to a post on X that said if Musk gets the 25% equity stake he has demanded along with incorporating the company in Texas and his 2018 pay package reinstated, then AI and robotics stay with Tesla.

As you can see, there are a whole lot of variables at play here. I suppose if I also had $56 billion up for grabs, I’d also fight very hard for it whether or not I deserved it.

That being said, I probably wouldn’t hold the future of the company hostage like Musk (who is worth about $200 billion already) is. He has said that he will withhold future plans for AI from Tesla if the pay package isn’t approved. What a guy.

2nd Gear: A $25,000 Electric Jeep Is On The Way

Jeep is getting ready to roll out a $25,000 electric vehicle in the U.S. “very soon,” according to comments from Stellantis CEO Carlos Tavares. This news, of course, comes as many other automakers scale back their EV plans. Here’s more from the Wall Street Journal:

Tavares, speaking at a Bernstein conference in New York, said that a $25,000 all-electric Jeep is achievable in part because the company is already selling cheaper EVs at a profit in other parts of the world. In particular, he mentioned the Citroën e-C3, a hatchback being sold in Europe at €23,300. This model will eventually be offered at a lower price of €20,000, or $21,500.

“The same way we brought the €20,000 Citroën e-C3, you will have a $25,000 Jeep very soon, because we are using the same expertise,” Tavares said in response to a question about EVs in the U.S.

An electric Jeep priced in the mid-$20,000 would be a major statement for the brand. The cheapest EV the parent company currently sells in the U.S. is the subcompact Fiat 500e with a price tag of about $32,500.

Tavares has previously described the $25,000 price point as a target for an entry-level EV in the U.S., but his comment at an event in New York pins it to one of the carmaker’s most important brands.

If I was a betting man, I’d guess that a cheap Jeep electric crossover would sell very well as long as it wasn’t dogshit.

3rd Gear: NHTSA Wants Tesla Records In Power Steering Loss Probe

The National Highway Traffic Safety Administration is looking for more records from Tesla as it investigates why Model 3 and Model Y electric vehicles are dealing with power steering loss issues. From Reuters:

The auto safety regulator, which upgraded its investigation in February, said in a letter dated Tuesday to Tesla and posted on its website that it wants Tesla’s records by July 24 about the steering components.

The request includes Tesla’s process for identifying problems and creating solutions for potential defects. The agency also wants to know whether Tesla has made any changes to power steering components or plans any in the next four months.

[…]

The investigation covers about 334,000 Model 3 and Model Y vehicles from the 2023 model year and comes after the agency received 115 reports of loss of steering control.

NHTSA said reports include issues like the steering becoming “stuck,” “locked” or “immovable” which is less than ideal. Sometimes, the steering is able to move, but it requires a whole lot of effort to do so. Other folks have reported things like “notchy” or “clicky” steering that go along with steering-related warning messages on the dash. The regulator is aware of at least 50 vehicles that were allegedly towed because of a steering problem.

NHTSA, which had opened a preliminary evaluation in July 2023 into loss of steering control reports in 280,000 Tesla Model 3 and Y vehicles, said in February it identified a total of 2,388 complaints.

Reuters reported in December that tens of thousands of owners had experienced premature failures of suspension or steering parts since 2016, citing Tesla documents and interviews with customers and former employees.

The Tesla documents showed that the automaker sought to blame drivers for frequent failures of suspension and steering parts it has long known were defective, Reuters reported.

Since 2018, electric vehicles made by the Austin, Texas-based automaker have seen nine separate recalls in the U.S. for issues involving the cars’ steering and suspension.

4th Gear: A New Round Of Layoffs Has Hit Fisker

Fisker is continuing its quick march toward death with a new round of layoffs. Dozens of now-former Fisker employees took to social media on May 29 to share their dismissals with the world. Just to make matters uglier, when news outlets reached out to Fisker for comment, the California-based automaker wouldn’t offer one. From Automotive News:

“Was part of the last big wave of layoffs at Fisker, and while it’s not ideal, I had the honor and pleasure to work directly with some of the smartest, hardest working, and talented individuals there,” Freddy Boyd, a sales adviser, said in a post on LinkedIn.

[…]

In its fourth-quarter earnings report in late February, Fisker said there exists “substantial doubt about its ability to continue as a going concern” after reporting a net loss of $463 million and announcing a 15 percent cut in its workforce. Additional rounds of mass layoffs have followed.

“I’ve read many posts like this over the past months from people impacted by layoffs,” Kerrie Roberts, Fisker’s social media manager, said Wednesday on LinkedIn. “Today, after several rounds and seeing my colleagues and direct reports get plucked one by one at Fisker, my turn came.”

Business Insider reported Wednesday that Fisker intends to bring its staff down to about 100 employees.

Among the departments affected were sales, service, design, software, marketing and engineering, according to Fisker employees who announced their layoffs on social media.

Because Fisker is dying a painful death, it seems to have forgotten to let everyone who was laid off know that they lost their jobs. Casey Millstein, an engineering manager, posted that he didn’t know he lost his job until after he wasn’t able to log in to the automaker’s computer system.

“Today, I was let go without any heads-up. Not even a call from HR,” Millstein wrote. “As I sit here and reflect my (almost) 2 years of hard work and dedication, it dawns on me that this company has never, and will never, care about their employees. Especially in this time of uncertainty, it was all crickets.”

That’s a big yikes from me, dog. If I had to guess, it is going to be just a matter of time before you see a “Dead: Fisker” post on this here website.

For those of you who are wondering, Fisker’s stock price is down over 96 percent on the year to just… six cents. Damn.

Reverse: Let’s Go Racing

Neutral: I Deserve A Lexus LC500

I Love The 2024 Lexus LC500 | Jalopnik Review

On The Radio: Scott McKenzie – “San Francisco (Be Sure TO Wear A Flower In Your Hair)“

San Francisco (Be Sure to Wear Flowers In Your Hair)