Does my U.S. car insurance cover my car in Canada?

Many people routinely drive into Canada without thinking if their car insurance will provide coverage in the event of an accident, or be sufficient proof if stopped for a traffic violation. However, although our northern neighbor is “right there”, it is still a separate country, with its own rules and regulations. So if you drive into Canada regularly or plan to in the future, read on to get the facts and be better prepared.

Let’s talk about coverage territory first

So all car insurance policies have a section that discusses where the coverage is valid. It may say “Coverage Territory” or “When and Where this policy applies”, but it specifically addresses how the policy works if you’re somewhere else than in the state it’s issued.

It was pretty typical when I first started that the most common coverage territory included the U.S., its possessions (think Puerto Rico, Guam, U.S. Virgin Islands for example), and Canada.

However, it’s very important to note that things change over the years and it’s really important to confirm this coverage territory with your agent or company. Because if the accident or violation occurs outside of the coverage territory, there’s no coverage.

U.S. car insurance and Canada

So once we’ve found out that Canada is an acceptable place for us to take our car, our next job is to figure out what we need to bring with us as acceptable proof of insurance.

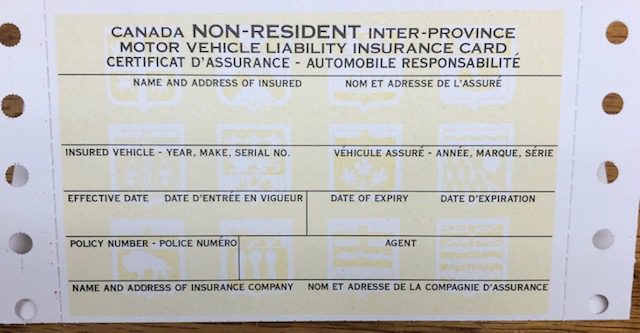

Canada has its own ID card for people who are non-residents. These cards are called Canadian Non-resident Inter-provincial Motor Vehicle Liability cards (often shortened by us in the industry to “Canada cards).

These cards can be issued by U.S. insurers who issue motor vehicle liability policies outside of Canada. They have completed a Power of Attorney and Undertaking form whereupon they agree to certain conditions if the insured is involved in a motor vehicle accident in Canada. You can also read some additional history about the Canada Non-Resident Inter-Province Motor Vehicle Liability Insurance Power of Attorney and

Undertaking (“PAU”).

What you need to do before you drive into Canada

First, contact your insurance agent (or company if you don’t have an agent). Ask if your car insurance is valid in Canada. Once you’ve confirmed this, ask if the insurance company provides Canada cards. Some don’t and instead advise that you carry your vehicle insurance ID card, as well as your declarations page in your vehicle as proof. You can get these documents from your agent, or company.

If your insurance company DOES use Canada cards, request yours. A few important points to note:

Cards are specific to each vehicle, so if you’re taking more than one car, you’ll need one card per vehicle.

Some insurance companies may provide a supply to an agent to process in-house. Other companies may require you to call them directly.

Don’t call the day before you leave and expect to have one in time, especially if the insurance company has to create it. There are no electronic versions, so a paper card must be mailed. Call 2-3 weeks before your scheduled departure to allow enough time for it to arrive.