Defining Your Location on the Distribution Management Maturity Curve

This is the second in a series of blogs featuring a dialog on Distribution Management between Denise Garth, Chief Strategy Officer at Majesco, and Brad Denning, Principal at PwC.

Denise Garth: Welcome back to our ‘Two-Minute Q&A Chat Series’ exploring distribution management, where we ask the tough questions on how to get the most out of your transformation. In our previous discussion, we introduced the DM Maturity curve and what value it can bring to carriers. Today we will be discussing how you can define your current position on the curve as a carrier. Let’s get into it! Brad, what questions do you have for me?

Q1: Denise, why should carriers understand where they are on the DM Maturity Curve?

Denise Garth: As we discussed last week, when considering a distribution transformation for your organization, it is critical to first understand what strategies, goals and objectives are crucial for your team to be successful in today’s rapidly changing market. Most carriers continue to deliver significant value for their customers and distributors while staying at the early stages of the Distribution Management maturity curve, through a mix of heroic efforts by operations team members and relationship management with key distribution partners at the executive level. But heroics are not sustainable, let alone scalable and ultimately will limit growth. Understanding where your organization stands on the maturity curve will help further evaluate what goals and objectives your organization should achieve in order to be a market leader.

Q2: How should insurers use the curve to measure their current maturity?

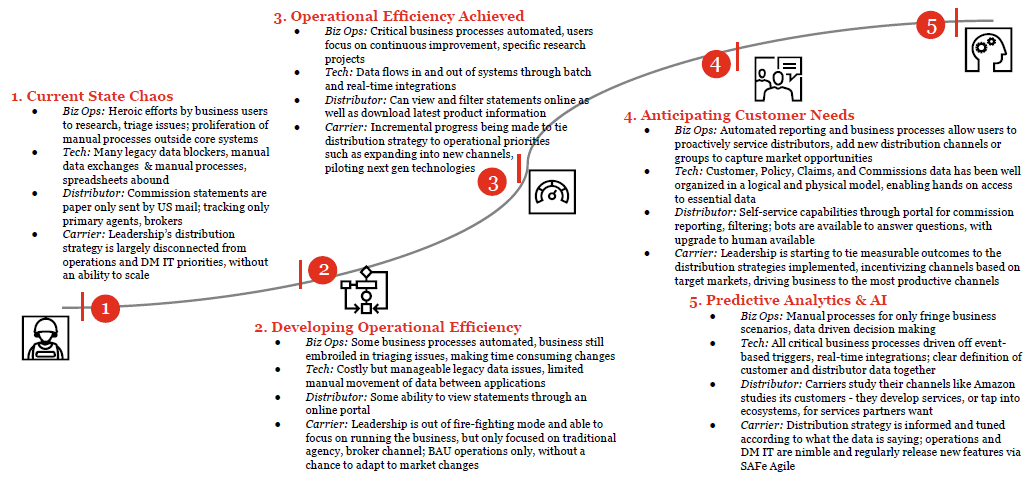

Denise Garth:The 5-stage Distribution Management Maturity Curve is a spectrum. Not every insurer’s organization fits perfectly into just one of the five stages. In this framework, we provide a “day-in the life” view of an organization at each of the five stages. An insurer should reference this while focusing on the key dimensions of where you feel your organization is today, and where you aspire to be going forward to effectively compete.

We believe that carriers have a significant opportunity to differentiate themselves in the marketplace by stretching for capabilities higher-up on the maturity curve and using these capabilities to steer their transformation visions and channel expansion opportunities going forward.

Q3: What happens as a carrier moves from one stage on the curve to the next stage?

Denise Garth: As a carrier moves from one stage to the next stage, they will experience alleviation from firefighting mode. Instead of focusing on day-to-day business activities, carriers and their business users will be able to focus on both today’s and tomorrow’s market demands, and they will eventually be able to predict their distribution channel and customer needs.

As carriers move up the DM maturity curve, they start to deliver value across three key dimensions.

These are the three strategic drivers we touched on before:

First, carriers will increase their productivity and next-gen distributor experience. To illustrate, a carrier may upgrade and/or implement next-gen portal capabilities that provide a broader, holistic experience from onboarding, quoting and servicing policy transactions to access to commission statements and more. Self-service becomes more ubiquitous across the organization.

Second, carriers will experience increased operational efficiency and effectiveness. Streamlining licensing and compensation processes and improving data transparency allows the operations team to have more bandwidth dedicated to looking ahead rather than fighting fires in order to consistently onboard or pay distributors accurately, and on time. More efficient integrations and effective processes will drive down operational expenses while increasing distributor satisfaction and loyalty.

Lastly, carriers will improve their ability to adapt to change. By improving the rules engine used to set up new channels and manage rates, carriers gain the ability to flex compensation rules related to both existing and new products. Distribution Management is no longer an organizational silo limited to hierarchies and commissions.

We believe that the real value of a Distribution Management transformation lies in a carrier’s ability to rise above the competition by enabling key capabilities in order to climb the maturity curve.

Q4: Once you know where your organization is on the curve, what comes next?

Denise Garth:Once an organization identifies where they are on the Distribution Management curve, they must ask themselves the right questions to make a journey effective. Such questions include:

What will a successful transformation look like?

What are the key metrics to track throughout the journey?

Is this something to go alone on, or should we seek a partner?

Do we have the needed time/resources to/buy-in from key stakeholders to undertake this transformation?

Q5: This last question can ultimately serve as a go/no-go decision but can only be answered once the full context of the transformation has been evaluated.

Denise Garth: I hope we answered your questions on how to define your current location on the maturity curve. In our next session, I will be asking Brad more tough questions on the maturity curve stages, including where your organization should be and why based on your organization’s goals and objectives. If you have a question on the current chat or want to include your question in the next session – just drop it into the comments section.