CoreLogic rolls out climate risk analytics for real estate

CoreLogic has announced the full rollout of analytics aimed at helping government agencies and enterprises model physical risks to real estate from climate change.

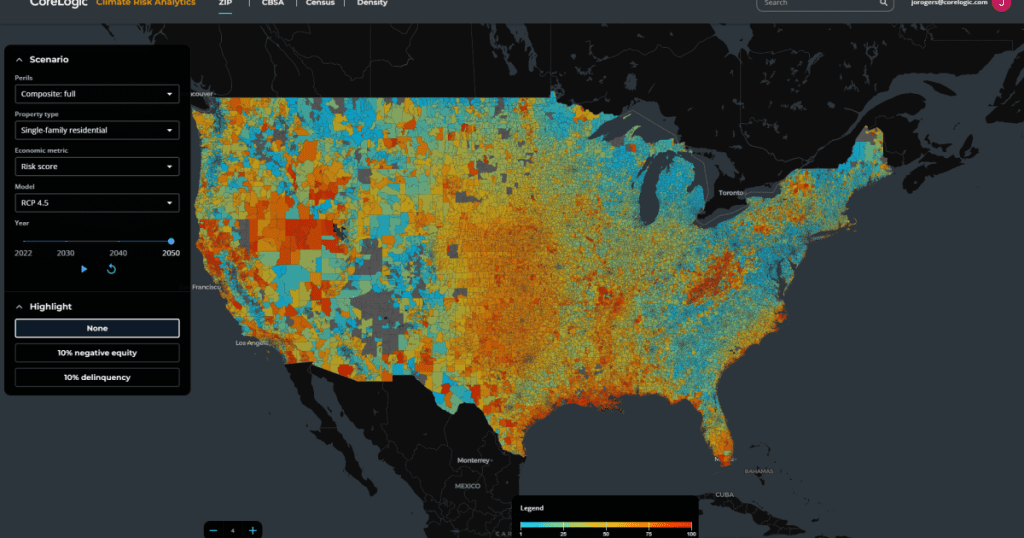

In addition to incorporating climate risk scores for hurricanes, storms, floods, fires and earthquakes, the cloud-based technology includes overlays for delinquencies, average median household income and other data. Its projections to date extend out through at least 2050, approximating a 30-year mortgage term.

The analytics, which were built on CoreLogic’s spatial data/analytics platform and include property-level financials, are in line with a growing trend toward quantifying climate risk as policymakers in the housing finance industry, and more broadly, have become focused on it.

“At this point in time, it’s primarily for government agencies to help their constituents — originators, servicers and other companies — assess risk for every single structure in the United States,” CoreLogic Chief Innovation Officer John Rogers said in an interview.

For any given peril, the technology runs 300,000 different scenarios and its impact on an individual property, Rogers said. Data points are incorporated in that analysis, which generally break down into four categories: property information for 200 million structures across the United States, financial metrics for things like reconstruction or repairs, models for various perils from the insurance industry, and the United Nations’ greenhouse gas emissions measures, which have a bearing on the degree of disaster risk.

The technology can provide a heat-map showing the degree of this risk in different areas, adjusted for a particular variable chosen by the user, he said.

Collectively, CoreLogic’s analytics could be used to address future regulations, such as a pending proposal by the Securities and Exchange Commission that would require public companies to disclose detailed information on climate-related risks.

Cloud servers, which handle a high volume of data without on-site information technology infrastructure, played a key role in making it possible to automate the analysis of the granular and multidimensional information used in climate risk analysis, Rogers said.

Creating models with enough data to sufficiently size up climate risk at the same level as other industry concerns has been a challenge, according to a report issued earlier last year by a Mortgage Bankers Association think tank, the Research Institute for Housing America.

Mortgage servicing rights investors could make use of the climate risk analysis the author of that report, former Freddie Mac Chief Economist Sean Becketti, said in an interview earlier this year.

“You have differences in the risk exposure to different natural disasters. If you’re in a forested area in the Western United States that is getting wildfires, that’s going to mean something to you. If you are on the Atlantic Coast and the Southeast (where more hurricanes or flooding may occur), that has got to mean something to servicing,” said Becketti.

While some MSR investors count on geographic diversity to address climate risks that differ by region, it’s an analysis that may become increasingly important due to future public policy or the increased prevalence of natural disasters.

The primary users of CoreLogic’s technology have been government-related entities, but mortgage investors and other market participants like servicers are part of its second wave of clients, said Rogers. He declined to identify specific companies. Although the full rollout is only occurring now, CoreLogic has quietly been testing the technology with select clients this year, Rogers said.

Other experts have suggested that more quantifiable climate risk on a property-by-property basis could have a greater impact on consumer perspective on home prices.

When home prices were rising, data on whether climate change affected consumer perceptions of property values was mixed, but with the housing market cooling and some policymakers promoting the idea of climate risk scores in conjunction with home sales, that could change.

“What I would hope would change so that [climate risk] becomes more real for folks is, when homes are listed for sale, there is a climate risk score that’s attached to that listing,” said Danetha Doe, an economist and spokesperson for Clever Real Estate, in an interview earlier this year. “I think if we implement those types of changes, then it’ll become more present and real for home buyers and home sellers.”

The concept gained some traction with officials in parts of Oregon, for example, but has drawn some opposition from Realtors.

Unlike some other providers of climate risk assessments like Quoll, CoreLogic currently only works with business-side clients, but Rogers does see potential implications for consumers.

“As these policies emerge, and as companies mature in their understanding, I think you are right in asking that question in terms of how do we help the homeowner?” Rogers said.