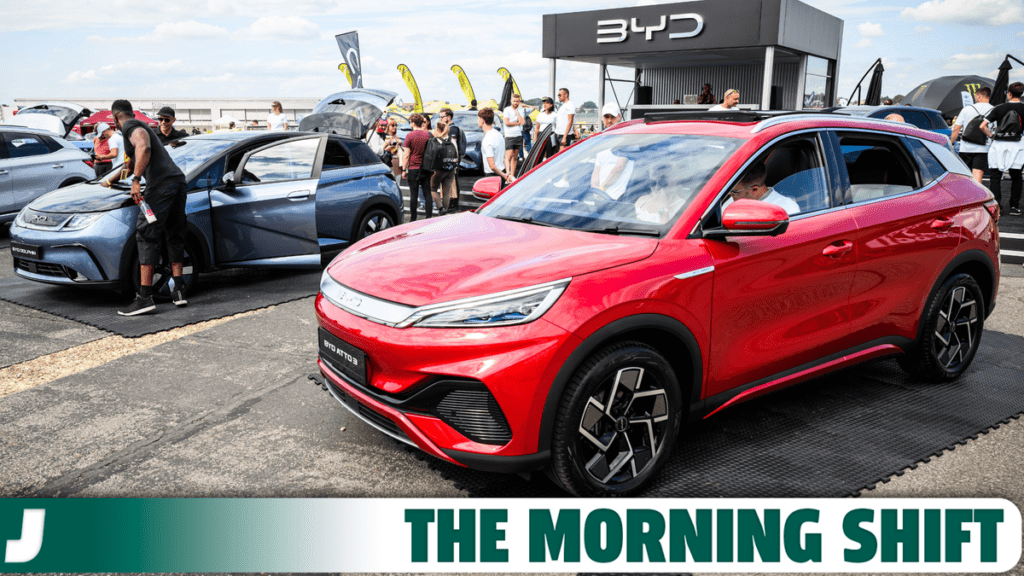

China’s BYD Is Set To Overtake Telsa

Good morning! It’s Friday, December 1, 2023, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

New York Joins California, Banning Non-Electric Vehicles After 2035

1st Gear: BYD Is Coming For Tesla

BYD’s electric and plug-in hybrid vehicle sales, aided by price cuts, hit a record pace in November as the Chinese company attempts to meet its annual sales target and beat Tesla in worldwide quarterly deliveries. From Bloomberg:

Still, last month’s sales of 301,378 passenger electric and hybrids were relatively flat compared with October, even as they registered a 31% increase from a year earlier, according to a company filing Friday.

China’s biggest auto brand sold 170,150 fully electric vehicles in November, taking its total for the first two months of the October-December quarter to 335,655. Tesla, which doesn’t release monthly numbers, sold 435,059 EVs in the July-September quarter.

The Shenzhen, China-based automaker aims to sell over 3 million hybrid and EVs this year. It’s going to end up being a photo finish, because November’s sales figures lifted its YTD sales to 2.67 million vehicles.

For Tesla, a refreshed Model 3 sedan and the official launch of the Cybertruck may provide enough lift for the automaker to hit its 1.8 million vehicle sales goal for 2023. To help in the effort, Tesla has been adjusting prices in the U.S. and China.

2nd Gear: GM Says EVs Will Be Profitable Soon

General Motors’ electric vehicles may be losing the automaker money right now, but by the second half of 2024, they should actually be profitable-ish. By 2025, those profit margins could reach mid-single-digits, according to a GM finance executive. From Automotive News:

The automaker expects its pretax EV margins to improve at least six-tenths of a point in 2024 from this year, CFO Paul Jacobson said at a Barclays investor conference. That’s mostly expected to stem from greater production volume, in addition to a more favorable vehicle mix and battery cost reductions, Jacobson said. That should get GM to a positive variable profit, which excludes fixed costs, on its EVs in the second half of 2024, he said.

GM expects to have mid-single-digit EV margins in 2025, including the benefit of federal Inflation Reduction Act tax credits, he said. The company previously had projected low- to mid-single-digit EV margins before factoring in the tax credits.

“It’s no secret that at the end of the day, our EBIT [EV] margins are substantially negative,” Jacobson said, adding that GM is investing in battery cell plants and other infrastructure to scale production. “We’re building for the future. So as we continue to ramp up, we’re going to see pretty significant benefits going forward.”

So, we’ve got all this new profitability information for 2024, but we still don’t know what GM’s EV volume target is for 2024. However, Jacobson did say it would be “a meaningful step up” from this year. Here’s hoping, because the rollout of Ultium cars has been, well, bad. GM will apparently have the capacity to build 1 million EVs in North America by the end of 2025.

GM has said it will delay three upcoming models — the Chevrolet Equinox EV, the Chevrolet Silverado EV’s first retail-oriented trim and the GMC Sierra EV Denali — by a few months. That followed a decision to defer at least $1.5 billion in spending by pushing back production of electric Silverados and Sierras at a second plant — Orion Assembly north of Detroit — until late 2025.

An automation equipment supplier issue also has slowed battery module assembly this year, and GM is working to add module capacity at more plants.

“While our execution has been somewhat challenged to date, we believe we’ve identified those challenges and we’ve got a portfolio of really, really strong vehicles coming forward that meet the range and charging characteristics that customers are looking for,” Jacobson said.

The automaker expects to build more Ultium-based EVs with higher variable profits next year, such as the GMC Hummer EV and Chevrolet Blazer EV, while making fewer Chevrolet Bolts, Jacobson said. GM is retiring the current Bolt, which accounts for most of the company’s EV sales and is built on an older battery platform, and launching an Ultium-based version that will cost less to make, though GM has not yet disclosed details or timing.

GM expects to reduce raw material costs by more than $4,000 per vehicle from this year to next. Jacobson says that’ll be done by scaling up GM’s joint-venture battery plants. Doing that will decrease the automaker’s reliance on more expensive imported battery cells.

Overall EV profitability includes parts and accessories, digital and software-enabled services, its BrightDrop commercial electric vehicle, GM Energy business and benefits from greenhouse gas credits and federal tax credits, according to the company.

3rd Gear: Fisker Is Having A Bad Time Right Now

Fisker cut its production target for the year… again. It now expects to move just over 10,000 units. It had an earlier forecast of 13,000 to 17,000 of its Ocean electric crossovers. From Reuters:

The company said it delivered 123 vehicles on Thursday, adding it plans to accelerates sale and deliveries despite the tough market conditions for EVs.

Some EV firms are facing dwindling cash reserves, pressured by high costs related to production ramp-ups and inflation and price cuts by rivals such Tesla.

Fisker’s most recent financial results were delayed because its accounting chief left the company after just a couple of weeks. Fisker reported a $91 million loss and a revenue of $71.8 million in the third quarter. Both of those figures missed expectations.

4th Gear: Hyundai/Kia Is Having A Good Time Right Now

Hyundai and Kia are killing it in the sales department right now. Both automakers saw record Novembers as inventory continues to improve and discounts rise.

Sales apparently rose 11 percent to 70,079 vehicles last month for Hyundai, thanks to fleet shipments. At the same time, Kia was up three percent to 58,338 vehicles. It was the 16th consecutive monthly increase for each brand. From Automotive News:

Sales of electrified models and crossovers continue to boost both companies. Kia reported a 45-percent increase in sales of electrified models while Hyundai said combined sales of hybrids and electric vehicles tallied 10,695 last month, a rise of 42 percent.

Hyundai’s retail sales last month talied 58,027, up 3 percent. The company said it ended November with 73,923 cars and light trucks in U.S. inventory, up from 69,951 at the close of October and 39,898 at the end of November 2022.

Kia said its November U.S. retail deliveries rose to 54,547, with year to date retail volume jumping 12 percent.

The record November results means Kia, with 11-month U.S. sales of 722,176, will easily surpass the record 701,416 vehicles it sold in 2021.

“New customers are shopping Kia like never before and our retailers are selling more vehicles than ever,” said Eric Watson, vice president of sales operations for Kia America. “We anticipate Kia’s winning streak will extend well into the new year.”

In the U.S., Kia was actually outselling Hyundai for the first five months of this year, and it led in overall sales through October. However, a late surge from Hyundai means it pulled ahead last month, and it now leads by 3,855 through November. Genesis also set a U.S. sales record of 5,987 vehicles. That works out to be a 20 percent gain, and its 13th straight monthly increase.

Reverse: Hank Ford’s Creation

Neutral: Leave George Alone!

On The Radio: Justin Bieber – “Drummer Boy” ft. Busta Rhymes

Justin Bieber – Drummer Boy ft. Busta Rhymes (Official Audio)