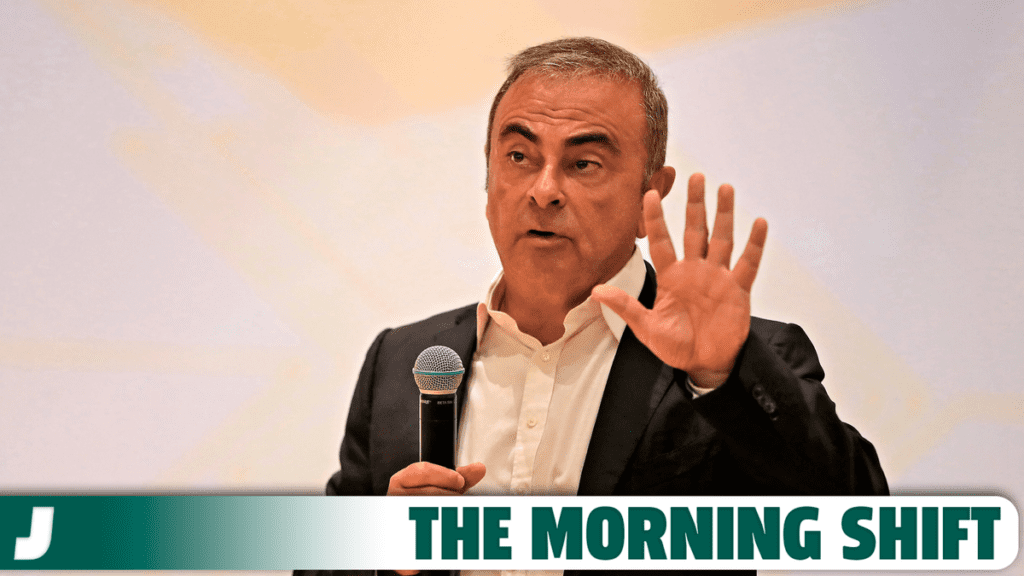

Carlos Ghosn Ordered To Give Nissan A Yacht and $32 Million

Good morning! It’s Thursday, September 26, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

The Plymouth Prowler Is Deserving Of Love | Jalopinions

1st Gear: Fugitive Ghosn Must Give Nissan 121 Ft. Yacht

Nissan just won the first round of its boat battle with disgraced former chairman and current indicted fugitive Carlos Ghosn. Basically, this fight was all about who owned the 121-foot pleasure cruiser Ghosn paid for with millions he is accused of illicitly taking from Nissan. Ghosn was ordered to give up the vessel to Nissan. On top of that, he, his wife, and a shell company they created to purchase the boat were ordered to pay $32 million in damages, according to the ruling by the British Virgin Islands High Court.

The Custom Line Navetta 37 built by Ferretti, an Italian boat maker, was christened “Shachou,” which is Japanese for “The Boss.” Carlos, that’s a little bit on the nose, isn’t it? It has seven bathrooms, five main cabins and four crew cabins. From Automotive News:

The yacht became a symbol of the alleged self-serving excesses at the crux of misconduct accusations against Ghosn, who was arrested in 2018 at the height of his power as chairman of the Renault-Nissan-Mitsubishi alliance, then the world’s biggest automotive group.

The boat also featured in the final of four criminal indictments brought against Ghosn by Japanese prosecutors. Ghosn has yet to stand trial in Japan on the criminal counts. After 140 days of lockup on two separate stints in a Tokyo jail, Ghosn jumped bail and fled Japan to his ancestral homeland of Lebanon. He continues to live there with an Interpol red notice seeking his arrest.

The British Virgin Islands court contest covered an alleged flow of some $32 million from Nissan’s CEO Reserve Fund through a complex chain of intermediaries, including a regional subsidiary, Nissan Middle East, into various entities controlled by Ghosn or his family members.

Some of the money was traced to Shogun Investments, a California company owned by Ghosn and his son, and to Beauty Yachts Pty Ltd., the company incorporated in the British Virgin Islands to buy the yacht and later owned by Ghosn’s wife, Carole, according to the court’s Aug. 9 decision.

“It is in the Court’s respectful judgment clear as a matter of fact that the sums paid away from Nissan/NME [Nissan Middle East] were for purposes other than the proper purposes of Nissan or NME; and the payments to Mr. Ghosn, Beauty Yachts and Shogun were made in order to benefit Mr. Ghosn or his nominees,” High Court Judge Gerhard Wallbank wrote in the 56-page judgment.

The 70-year-old denied any wrongdoing to AutoNews and said he was “obviously appealing” the decision. Neither he nor his wife attended the trial or were represented there.

Here’s a little more background on this whole boat saga and Ghosn’s legal issues:

Ghosn was arrested in November 2018 in a sting after he landed at Tokyo’s Haneda airport on a regular business trip. He says the charges of financial misconduct were concocted to block Nissan’s fuller integration with its longtime French partner Renault, a plan he was working on at the time.

Nissan applauded the decision as confirming its claims that Ghosn misappropriated funds.

“This is a part of Nissan’s efforts to recover damages suffered due to Carlos Ghosn’s misconduct, including the misappropriation of Nissan’s assets and etc. through legal proceedings including lawsuits in Japan and overseas,” the Japanese carmaker said in a statement.

“Nissan will continue such efforts to make Carlos Ghosn accountable for his misconduct.”The British Virgin Islands case is one of several ongoing civil and criminal showdowns that continue to grab headlines as they grind through courts worldwide, nearly six years after Ghosn’s stunning arrest upended the Franco-Japanese alliance he spent two decades building.[…]French authorities issued an arrest warrant for Ghosn in 2022, alleging he diverted millions of euros from Renault for his personal gain through a scheme with an auto distributor in Oman. That charge mirrors a similar allegation made by Japanese prosecutors regarding Nissan.Ghosn is also fighting a ¥15.5 billion ($102.5 million) civil claim leveled by Nissan in a Yokohama court. And for his own part, Ghosn has filed suit against Nissan in a Lebanon court claiming $1 billion in damages and lost compensation.

Since December of 2019, Ghosn has been living in Lebanon after fleeing Japan in a dramatic dark-of-the-night escape while being hidden in an audio equipment case. Despite the fact he’s wanted in both Japan and France, he holds a Lebanese passport, and that country does not extradite its citizens.

2nd Gear: Automakers Struggle To Hire, Keep Tech Talent

As cars become more and more reliant on technology, a tech-savvy workforce becomes even more invaluable. Unfortunately for automakers, their outdated HR and hiring practices are hurting their chances of attracting and keeping these folks. From Automotive News:

Automotive companies are unprepared to meet the growing demand for software skills, Josh Bersin Co., an HR and hiring research and advisory firm, said in a report Sept. 24.

The firm examined four primary categories: recruitment, retention, redesign and reskilling. The automotive industry’s overall ranking was close to the bottom.

“Compared to all other industries, automotive manufacturers are lower and less mature,” Stella Ioannidou, senior director of research at Josh Bersin, told Automotive News. “Automotive manufacturers are required to swiftly embrace these cutting-edge technologies and offer no less than computers on wheels.”

Workers with the skills to develop software-defined vehicles are in high demand, and industries such as consumer banking, aerospace and professional services are competing for top talent. Failing to build a digitally skilled workforce in the next five to 10 years could spell economic trouble for auto companies, Ioannidou said.

“It’s increasingly difficult to, as we say, hire your way out of this challenge,” she said.

“More of the EV talent is heading out than in,” said Adam Zellner, a partner at Heidrick & Struggles consulting. Once considered a burgeoning field, the allure of working with EVs has diminished in recent years, he said.

It isn’t just American manufacturers either. Automakers across the globe are facing similar issues. That being said, U.S.-based carmakers are facing the most significant tech worker shortages. In the U.S., there are currently about 187,000 job openings. Germany has 63,000 and the UK has 15,000.

The most in-demand jobs center around robotics, machine learning engineers, data scientists and cybersecurity experts among others. A big part of the problem stems from outdated hiring and promotion structures. These companies have traditionally used a system based on tenure rather than skill.

“If there’s something that’s an anchor to the auto industry, it’s that there still is a very slow pace around hiring, bringing in external talent and developing internal talent,” Zellner said.

Companies should partner with universities that teach graduates the right skills, Ioannidou said. In 2022, 1,022 U.S. schools graduated students in fields relevant to automotive engineering, including universities with specific programs such as Purdue and Georgia Tech, according to the report.

Another potential solution is to upskill workers in machine learning and AI.

Automakers, you folks really need to shape up if you want to get these nerds on your teams. Sure, they’re geeks, but you’re going to need them.

3rd Gear: Nissan Buys Back 5 Percent Of Shares From Renault

Nissan is buying back 79.9 billion yen ($552 million) worth of shares from Renault in an agreement that would rebalance its alliance with the French automaker.

It’s planning to buy about 195.5 million shares using its net cash position. The deal will give Renault additional funds its needs to develop electric vehicles as it struggles to compete with Chinese automakers entering Europe. From BNN Bloomberg:

Renault will get as much as €494 million ($552 million) as a result of the deal, supporting its ambition to return to an investment-grade rating, it said in a separate statement. Nissan and Renault decided last year to reshape their decades-old alliance following years of acrimony.

Renault Chief Executive Officer Luca de Meo said in November that selling Nissan shares would give him additional options to speed up development of more affordable EVs. The company in January canceled the listing of its software and EV unit Ampere due to slowing demand for battery-powered cars and a weak IPO market.

Renault sold an initial tranche of Nissan stock late last year, netting €765 million, and sold a second tranche in March. The company plans to lower its stake in Nissan to 15%, from an initial 43%. Nissan will cancel all the acquired shares on Oct. 3, it said.

In July, Nissan slashed its operating-profit outlook for the year through March 2025 to ¥500 billion due to weak sales in Japan and North America. The automaker has also been struggling in China, where it faces intensifying competition from local EV makers led by BYD Co.

“Given Nissan’s tough business situation and cash liquidity, I think the ‘buyback & cancel’ plan will proceed gradually, not all at once or in a large portion,” Bloomberg Intelligence senior auto analyst Tatsuo Yoshida said Thursday.

This is a rare power move from Nissan, a company that has been struggling for quite some time. Good for those guys.

4th Gear: GM Recalls Van Its Been Making Since 1996

General Motors is recalling certain 2013-2019 Chevy Express and GMC Savana cutaways that were produced with faulty brake lines that might not meet the recommended clearance from body mounts. That could turn into a real issue if the lines make contact with those mounts and start to wear. From GM Authority:

“General Motors is voluntarily recalling certain model-year 2013-2019 Chevrolet Express and GMC Savana cutaway vehicles for a condition that may result in a brake line fluid leak. Dealers will inspect affected vehicles and make necessary repairs. The safety and satisfaction of our customers are our highest priorities and we’re working to remedy this matter as quickly as possible.”

The problem: 2013-2019 Chevy Express cutaway models that are affected by this issue were built with body mounts too close to the brake lines.

The hazards: if brake lines come into contact with the body mounts, the extra wear could cause a brake fluid leak.

The fix: dealers will inspect the brake lines of affected vehicles and replace them if necessary.

Affected components: brake lines and body mount cushions.

Affected vehicles:

2013-2019 Chevy Express cutaway

2013-2019 GMC Savana cutaway

About 18,320 vehicles in total, between the GMC Savana cutaway and Chevy Express cutaway, are impacted by this recall. About 11,960 of them are Expresses, and 6,360 of them are Savanas.

I really really really need to know how GM bungled something so simple on a vehicle it has been making for a longer time than I’ve been alive, but hey, at least it’s being taken care of now.

Reverse: Nixon, That Poor, Sweaty Bastard

Neutral: Lol RIP Bozo

Eric Adams, buddy, you are boned.

On The Radio: “New York Groove” – Ace Frehley

New York Groove