Canada’s largest P&C insurers growing larger: AM Best

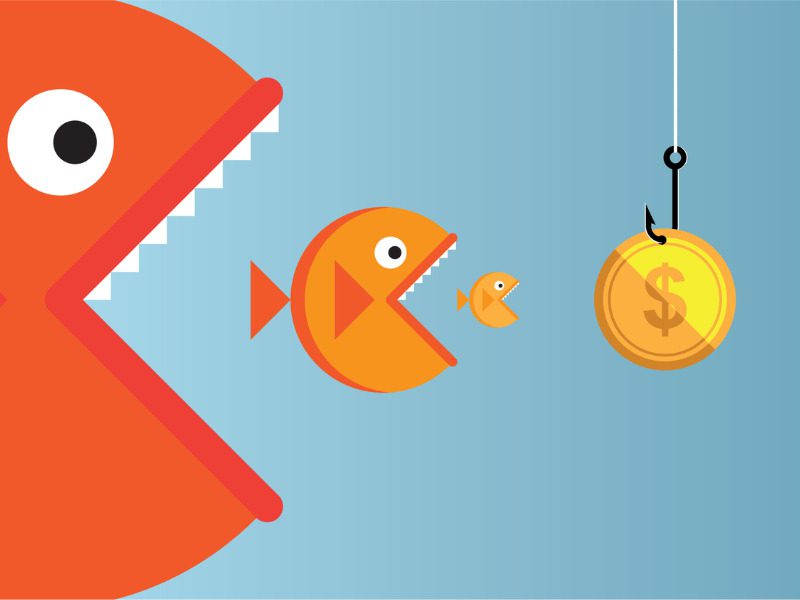

Canada’s Top 10 property and casualty insurers control nearly three-quarters of the market, with the remaining participants competing for the balance of available premium, ratings agency AM Best said during an industry event Friday.

The Top 10 P&C carriers control 71.9% of market premium, up from about 64% just one year ago, AM Best senior financial analyst Gordon McLean said during AM Best’s Canada Insurance Market Briefing – Toronto.

Intact’s June 2021 acquisition of RSA plc factored into the increase in market share. Already Canada’s largest P&C insurer, the acquisition increased its specialty line presence in North America by close to 30%, Intact Financial Corporation CEO Charles Brindamour said during a virtual fireside chat in January 2022.

As part of the deal, Intact acquired RSA Canada and some of RSA’s international operations (RSA was within the Top 10 insurers before the acquisition).

“Intact’s acquisition of RSA…not only provides Intact with size and scale, but it provided additional product and geographic diversification, not just in Canada, but abroad as well,” McLean commented during a market outlook session on the Canadian P&C industry.

What does AM Best expect for insurer M&A in the future?

“We have been indicating forthcoming consolidations,” McLean said. “I think what’s driving that, obviously, is the ability to buy distribution channels, premium channels, rather than growing that organically. [That’s] what has driven some of these acquisitions.

“I think we’ve reached a point…in the market where the largest companies continue to increase market share through acquisition.”

AM Best ranks the Top 10 insurers by direct premiums written. This makes the rankings somewhat different than Canadian Underwriter’s Stats Guide, which ranks insurers by net premiums written.

According to AM Best, the Top 3 Canadian P&C insurers by DPW are Intact Group (17.2% market share), Desjardins Group (7.6%) and Aviva Canada Group (7.5%). These carriers now control just over 32% of premium, up slightly from 30% last year.

The Top 5 (which includes TD Insurance Group and Lloyd’s Underwriters) now control 45% of the market, up from 41% last year.

“So, the market is becoming slightly more concentrated in recent years,” McLean observed. “As you would expect in a growing marketplace with firm- to hard-market conditions across most product lines, the overall market size has grown from a premium perspective.”

In total, market premium for the Canadian P&C industry is C$79.4 billion, with nine of the Top 10 reporting growth in premium. “Only Wawanesa has reported a slight reduction in premium here, and I think that’s just… maybe a little bit more of selective underwriting.”

Of note is that outside of the Top 10, the market contracts down to 28% of available premium, down from close to 37% last year.

“So, once you’re outside of that Top 10, the market has been increasingly fragmented as companies compete for premium volume,” McLean said. “And that’s a trend we’ve seen for quite some time.”

Feature image by iStock.com/Ja_inter