Buick's Latest Car for China Shows How Far the Brand has Fallen in its Biggest Market

The Buick Electra-X concept, of which the Envista bears a similarity.Image: General Motors

Buick, much like Chrysler, is a brand I’m continually impressed is still with us. Unlike Chrysler, though, Buick has historically enjoyed strong success in China. After all, China kept buying Buicks when the brand was nothing but rebadged Chevys in North America. Yet as EVs and home-market brands have gained favor in China, Buick’s standing has slid. GM is hoping to recapture that enthusiasm with the Buick Envista — a gasoline-powered crossover revealed a week ago with a sloping roof that appears to borrows cues from the marque’s Electra-X concept.

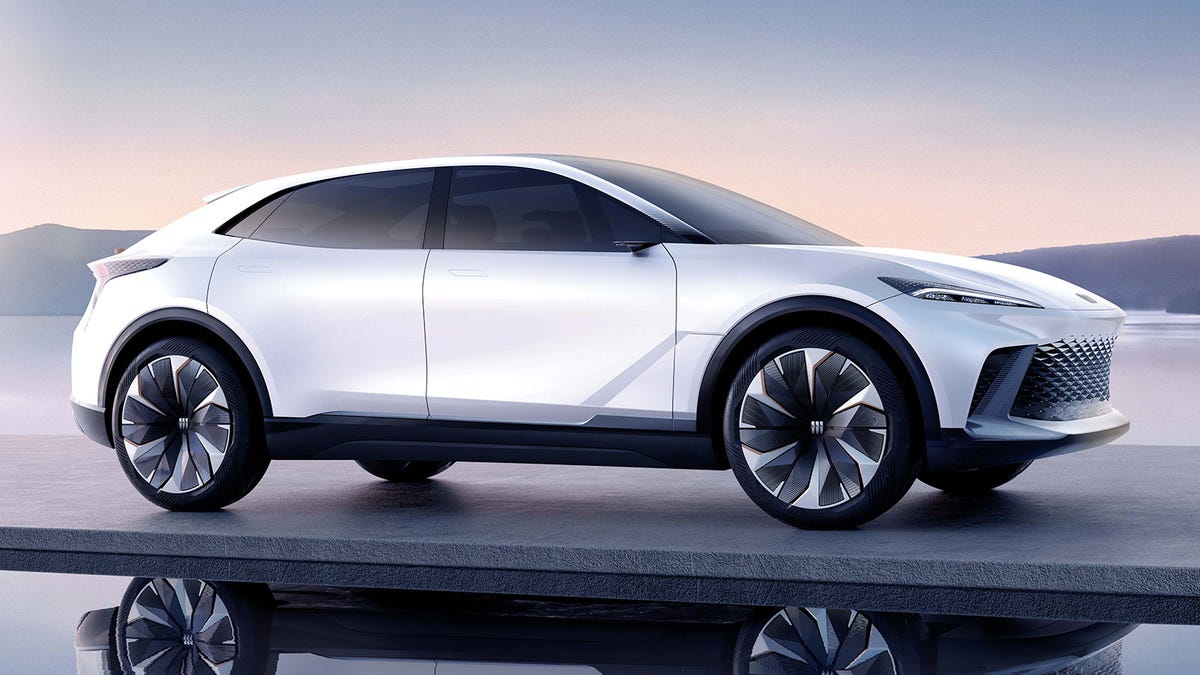

Images of the Envista were revealed in a filing by China’s Ministry of Industry and Information Technology, as first reported by Carscoops. It’s a step into a new era for Buick design, though perhaps not a very distinctive one, especially where the front is concerned. The slender, LED-accentuated daytime-running lights call to mind everything from the Lamborghini Urus to those ill-conceived, generic renderings of Dany Bahar-era Lotus.

Image: Ministry of Industry and Information Technology

Overall the Envista’s styling is a bit vague, an ultimate amalgamation of contemporary automotive design trends. Looking at the best-selling larger EVs in China, all from burgeoning startups, the Buick’s relentlessly generic styling is probably intentional. GM and its joint-venture partner SAIC seem to be hoping an ICE-powered crossover can blend in with the fashionable electric set, even as China’s aspirational consumers have started to turn away from the three-shield brand.

Image: Ministry of Industry and Information Technology

G/O Media may get a commission

Now we should note that Buick did enjoy a slight uptick in Chinese sales near the end of 2020, but GM has had little to say about how the brand is doing in that region since then. Besides, that was likely a blip in a larger trend over the past five years. From a 2019 New York Times story:

In China, sales have been dropping ominously. In 2016 and 2017, Buick and its partner SAIC Motor of Shanghai sold about 1.23 million vehicles. Last year, sales fell to 1.06 million, and they are expected to finish under 900,000 this year. China’s auto market is rapidly slowing from recession to near-depression, analysts say.

Besides headwinds from the trade war, the Chinese market faces oversaturation, said John Murphy, senior auto analyst for Bank of America Merrill Lynch, in his annual “Car Wars” industry outlook in June. He predicted a 7.5 percent sales drop this year.

This report obviously hails from a pre-pandemic time when the global economy looked a little different than it does today, but things haven’t exactly improved for China’s auto market since. Just last month, Reuters reported car sales in China in May 2022 were roughly half of what they were at the same time last year.

Buick is running out of steam, and while that doesn’t mean it’s a hopeless cause in a market that once loved it, it does mean GM can’t afford to bide its time catching up. Buick has a couple of EVs on sale in China, in the form of the Velite 6 and Chevrolet Bolt-based Velite 7; comically, it also offers a car called the Verano Pro that my browser’s built-in translator manifests as “Veyron Pro.” GM’s plan is to seemingly throw five new Buick-badged EVs at car shoppers over the next three years, while it looks to reinvent the marque on this side of the Pacific with products like the Wildcat EV. I’ve lost count of how many Buick rebrandings we’re up to now.