Billionaires Had A Tough Time At Monterey Car Auctions

Will someone please think of the billionaires? It seems like even they are not immune from the rocky car market we’re currently in. There’s no better example of this than this year’s auctions at Monterey Car Week.

Cadillac Allanté | Jalopinions

According to Bloomberg, by the end of the weekend, total sales grossed a bit over $400 million across five auction houses, including after-sales. That may sound like a lot of money (because it is), but sales are actually down from $473 million last year. Adding to that, an average sell-through rate of 68 percent for 1,225 cars fell short of the 78 percent rate for 1,023 cars on the block last year. In fact, some bidders actually maligned the fact that there were “too many cars” this year. For reference, the outlet says a sell-through rate of over 80 percent is considered healthy for a car auction.

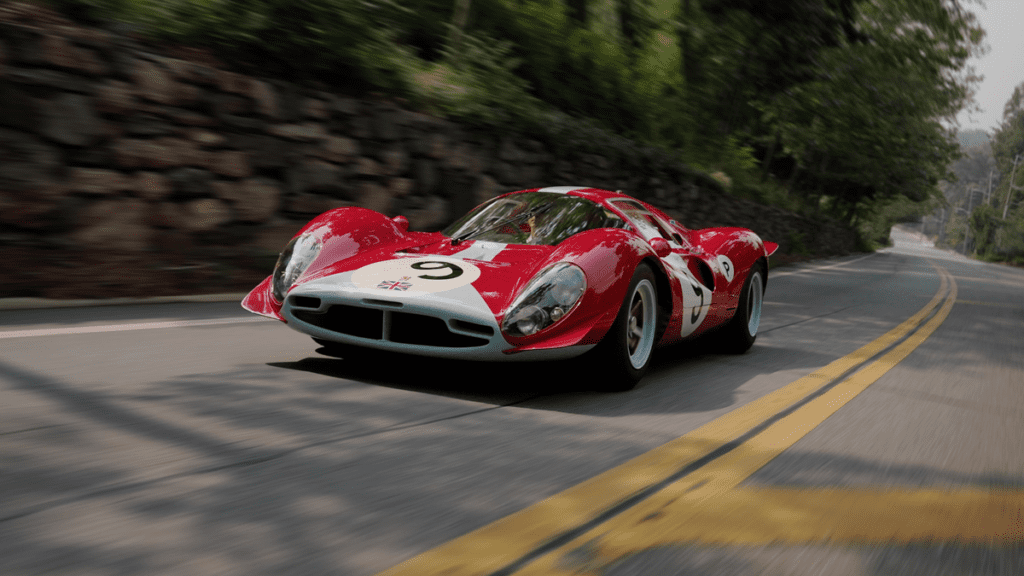

Average prices were also down at “just” $477,981 from $591,768 last year. Even Ferraris — cars considered to be market-proof — struggled. Bloomberg says that at Bonhams, a 1967 Ferrari 412 P sold for $30.2 million, which was actually far less than the expected $40 million it was supposed to sell for. A 1964 Ferrari 250 LM at RM Sotheby’s reached $17 million, but it never hit reserve and ended up not selling at all. Meanwhile, I’m sitting in my tiny one-bedroom apartment thinking about how $10,000 would change my life right now.

These are how the top sales shook out, according to Bloomberg:

The top sale of the week was that 1967 Ferrari 412 P Berlinetta. It was followed by a 1957 Jaguar XKSS Roadster that sold for $13.2 million at RM Sotheby’s and a 1962 Ferrari 250 GT SWB Berlinetta, which went for almost $9.5 million at Gooding & Co.

A 1959 Ferrari 410 Superamerica SIII Coupe did well at $6.6 million for RM Sotheby’s, as did a 1937 Bugatti Type 57SC Tourer that sold for almost $5.4 million. All told, Ferraris accounted for half of the top 10 sales, typical for Monterey.

Gooding & Co. (76% sell-through rate) and RM Sotheby’s (85%) each had four cars in the top 10 sales of the week, while Bonhams (73%) and Broad Arrow (80%) each had one. The top sale at Mecum Auctions (56%) was a 1966 Ferrari 275 GTB/2 Longnose Alloy Coupe that sold for $3.4 million.

The outlet asserts that these numbers mean there is plenty of money out there (duh), but buyers aren’t as likely to settle for less-than-perfect examples of vehicles they want.

One area that did pretty well at Monterey was prewar vehicles, and that doesn’t include the 1937 Mercedes-Benz 540K Special Roadster (Nazi car) that won the top prize at Pebble Beach. Three of Goodling’s top five sales were prewar cars. A 1937 Bugatti Type 57SC and a 1933 Packard were also strong sellers from RM.

Ferraris, as is tradition, also did fairly well according to Bloomberg, even if they weren’t in good shape.

RM Sotheby’s popular barn finds—a group of 20 derelict Ferraris displayed in a re-creation of a hurricane-damaged barn—also punched way above their weight. Some of them even took more money than comparable restored versions. A rusty 1956 Ferrari 250 GT Coupe Speciale by Pinin Farina sold for $1.6 million; a cracked 1964 Ferrari 250 GT/L Berlinetta Lusso by Scaglietti went for $907,000.

Most notably the empty, twisted carcass of a 1954 Ferrari 500 Mondial Spider Series I by Pinin Farina sold for almost $1.9 million—near the $2 million a similar one in far better condition took in 2022. The bill to restore the shell to its former glory will require an additional few million dollars.

So, what have we learned here? Well, there are a few lessons to be had. One, billionaires are apparently getting more picky. Two, you can sell a hunk of metal for nearly $2 million if it says Ferrari on it. And three, I really need Joe Biden to cancel student debt.