AI deployment, development and other issues in the insurance industry

Enjoy complimentary access to top ideas and insights — selected by our editors.

The insurance industry has not always been the quickest to change and adopt new, more streamlined ways of doing things. Cumbersome paperwork and manual processes have burdened insurers for decades, but the industry is finally ready to embrace new technologies like artificial intelligence to improve efficiency and client satisfaction.

The potential benefits are clear. AI helps insurers accelerate underwriting and claims processing by analyzing historical data to evaluate risk. Insurers are also using AI to detect fraud and to generate accurate loss reports. As a result, the effective use of AI can improve claims accuracy by up to 99% and increase efficiency by around 60%. That means customers get policies settled and claims approved faster, resulting in a greatly improved customer experience.

Some of the more visible uses of AI in health insurance include chatbots, with software like ChatGPT and Google’s Gemini helping them become more understanding of the needs and complaints of customers, and enabling insurers to offer more personalized assistance on their websites. A chatbot could even guide a customer through the steps of submitting a claim, including what documentation the customer needs to include.

Read more: How AI is reshaping insurance underwriting

Deployment, however, remains an issue. While many organizations are using and testing various forms of traditional and advanced artificial intelligence, including machine learning, deep learning and generative AI, most AI projects fail to reach deployment, according to Eric Siegel, a former professor at Columbia University and data scientist.

Siegel has had a lifetime obsession with predictive analytics and AI — so much so that he wrote and performed a music video about predictive analytics and has written a book called “The AI Playbook” – and is committed to changing this.

“I’ll do anything to help educate and ramp up the world on this technology,” Siegel recently told Digital Insurance’s sister publication, American Banker. “It’s fascinating learning from data to predict and then use those predictions to improve any and all of the large-scale operations that make the world go round.”

Read more: Predictable tasks are made for today’s generative AI

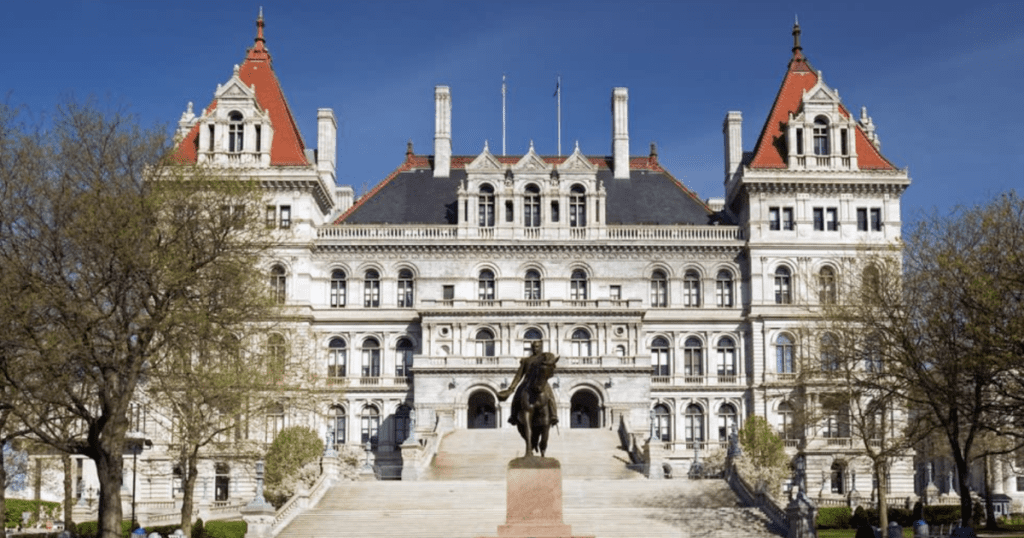

Siegel’s optimism is tempered somewhat by the need for insurance companies to watch the latest industry regulation on where responsibility lies for using AI for underwriting and pricing. New York state recently issued new regulatory guidance on the subject, one of the first states to do so.

New York’s guidance came from its Department of Financial Services, which regulates insurance, in the form of a circular related to Insurance Law Article 26. This is state law that addresses unfair claim settlement practices, discrimination and other misconduct, including making false statements. The circular specifies that the elements the law addresses should not be violated by the misuse of AI and consumer data and information systems.

Catch up on this and all of our recent coverage of how AI is reshaping the industry.