A Guide to Student Energy Bills

Leaving home to start uni is an exciting time, but it can also feel a bit overwhelming, particularly at a time when every other headline is warning us about the energy crisis and the increased cost of living.

Chances are your parents or guardians have always sorted the household bills and you might not have any idea where to start, you also have much more exciting things to think about; bills are boring, right?

But don’t worry, we’ve put together a simple guide to energy bills that will hopefully make it all a lot more straightforward, so you can focus on the important things, like settling in and having fun. We’ll also explain some of the jargon; what even is a utility? Or a tariff?

Let’s start with the basics.

Which utilities do you need as a Student?

The three basic utilities are gas, electricity and water, but things like TV and broadband may also be thought of as utilities.

This list might seem a bit daunting, but as a full-time student you’re exempt from paying council tax if you study for at least 21 hours per week (however, if you live in a property with non-students, they might eligible for a discount), and water bills are often included in your rent. If they’re not, it’s very straightforward to sort out because there is only ever one provider in each area, the only thing you need to know is whether you’re on a water meter.

Gas and electricity can be the biggest bills, so it’s often simpler and cheaper to combine them.

It could be argued that broadband is the most important utility of them all – having decent Wi-Fi is a basic human right! This is definitely one that benefits from shopping around for the right package and you might want to combine it with a digital TV package.

You do still need a TV licence as a student, your parents’ licence won’t cover you at uni, and it’s the same with contents insurance; your parents’ insurance doesn’t necessarily cover your belongings when you’re living away from home, so for peace of mind it’s worth taking the time to have a look at student insurance as often it doesn’t cost much more than the price of a cup of coffee.

How much will your energy cost?

How much you end up paying per month will depend on a few things; how many people you’re sharing with, how well the property is insulated, how much you use the internet/bath/oven etc. Also, bills are at their highest at the moment, but this is a rough idea of how much you can expect to pay each :

Gas/Electric – £20 – £30

Water – £10

Broadband – £8

TV Licence – £13.25

Contents Insurance – £5

Based on averages before the 2022 energy crisis.

How to compare prices and get the best deal

It’s fairly easy to compare prices, you can just do it online, however, at the moment most providers are charging the maximum so it’s not as easy to find a cheaper deal. On top of that, not all companies are accepting new customers, so it’s probably safer for now to stick with the current provider.

How do you switch energy provider?

If you do manage to find a cheaper deal, or need to switch for other reasons, here’s what you need to do:

Find out who the current supplier is, ask the landlord or there may be a bill lying around

Find out where the meters are and take a reading

Ask around and look at comparison sites and choose a quote

The new supplier will do the rest, they’ll inform the old supplier and let you know when it has switched over

Remember, if you’re renting and bills aren’t included, as long as you get your landlord’s permission first.

How to read your energy bills

It helps to understand your bills because you need to be aware of how much energy you’re using, it also helps to compare your energy usage from different times of the year so you can see if there are any ways you can save money by lowering that usage.

All bills look different, but they all have the same information on them, including usage . They’ll have the account number, date and invoice number as well as the balance from the previous month, this shows what you paid the previous month, including any over-payment/under-payment, and what’s owed this month with the date you have to pay it by. The main section you need to look at is the ‘Amount Due’ part. This is exactly what you need to pay this month.

While we’re explaining things, let’s take a look at some of the jargon you might come across when familiarising yourself with utility bills:

Direct debit – this is set up by the organisation you’re paying; you agree to them collecting funds from your account each month, this amount can change but they must let you know at least 14 days in advance

Standing order – a set amount that you set up to pay other people. You can amend/cancel it when you want

Tariff – the rate at which you pay for your electricity etc. A fixed tariff is a locked price often for two years, a variable tariff can go up and down

Dual Tariff – Gas and electricity on the same contract

Water meter – you’re charged for the amount of water you use

Smart meter – lets you see how much energy you’re using, shows you in monetary terms

Economy 7 – a type of tariff that charges different rates for electricity used during the day and overnight (which is usually cheaper)

Standing charge – a fixed daily charge for keeping the property connected to the Grid, you’ll be charged this even if you don’t use any energy

Unit rate – the cost of the gas/electricity you used, based on the meter reading/estimate

The Grid – the network that connects the electricity from generation (power plants) via power lines, to supply (your kettle)

Meter Point Reference Number – the MPRN – the unique number on your gas meter, sometimes called the M number, 6 – 10 digits long

Energy Price Cap – this is the maximum price you can be charged for each unit of gas and electricity, but not a cap on the total amount you pay; you’ll still pay more if you use more units.

What is the energy bill support scheme?

This is a £400 discount and is part of the Government’s plan to help people deal with increasing energy costs throughout the winter months. Anyone who has a domestic connection is eligible, they don’t need to apply for it.

It will be paid from October on a monthly basis for six months, even if you don’t pay your bills monthly, at a rate of £67 for the first two months, then £66 a month after that.

If you’re in a property where bills are included in your rent, your landlord must pass this down to you. They’re not legally allowed to charge their tenants more than they themselves are paying, so they need to pass the discount on to their tenants .

Tips on splitting bills with housemates

Nothing ruins a vibe in a shared house like arguments about money; everyone has different ways of dealing with their finances so it’s important to set up a system for paying the bills that makes everyone feel like they’re being treated fairly.

The most straightforward way is to find a bill splitting app, there are plenty out there that are free but it’s worth doing some research and finding the right app for you . They help calculate the amount owed and tracks who has and hasn’t paid. Alternatively, you could allocate each utility to a person, so that a particular bill is their responsibility; they have to pay it and get the money from off everyone else. The problem with this is that person then has to have enough money in their account to pay the bill until everyone pays them back, unless everyone else sets up a standing order.

It goes without saying that you should only live with people you trust, but often students, particularly first year students, don’t get much choice about who they live with. The key is to set the bills up as soon as you move in and get a system in place, this includes rules for guests which is often a tricky subject; for example, anyone staying regularly for more than three nights a week should probably contribute to bills.

Tips to save you time, money and stress

Sort the bills out as soon as possible, don’t leave it until you move in

Take a meter reading on the day you move in and then try to submit them regularly so you’re only paying for what you use

Put everyone’s names on the bills, so everyone is jointly responsible

Read the small print, if a deal seems too good to be true, it probably is

Pay on time, or….

Pay by direct debit it’s easier as it means you don’t have to think about it, and it can be cheaper, usually by about 6%, as you often get a discount for paying this way

Choose paperless bills

Split the bill monthly if you can, it’s best to pay in smaller chunks

Small changes can make a big difference:

Only boil the water you need, you don’t need to fill the whole kettle for one cup of tea

Turn the thermostat down, turning it down just 1 degree could save around £60 a year

Before you reach for that dial to turn the thermostat back up, try wearing more layers and, at the risk of sounding like your dad, turn the lights off when you’re not in the room!

Unplug appliances when you’re not using them

Use the microwave instead of the oven, it’s cheaper. If you do use the oven, make sure you all cook meals together; there’s no point having it on for one lonely jacket potato. Then leave the door open afterwards, it will help warm the house

Use the dishwasher if you have one, it’s more efficient. Just make sure it’s full before switching it on

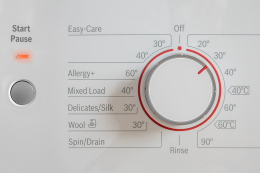

Wash clothes on 30 degrees and try not to use a tumble dryer

Only heat rooms you’re using

Save water by having a shower instead of a bath and try to keep your showers short, you could limit yourself to 2 songs on your playlist. Turn off the tap when brushing your teeth

Charge devices in the uni library/in coffee shops/on public transport

Use draft excluders

Where to go if you need help

If you do find yourself struggling, or if you just need some advice, there’s plenty of help out there. Your uni will have a student welfare service that can offer practical and emotional support; from mental health issues to working out a budget. You’ll be given details of how to contact them when you first arrive, and you’ll be able to get details from the Students’ Union. Most universities have an app with information about the different kinds of support available, including advice about student bills and managing money.

There are also plenty of charities who can offer support and advice, for example, Citizens Advice give independent advice on a range of issues, including money and managing debt. Student Space is part of the student charity, Student Minds, and gives advice and practical tips to help with any financial worries.

For most people, going away to uni is the first time they’ve had to be responsible for their own finances, and this isn’t something we’re taught at school, so it’s okay to ask for help. Most people end up blowing too much money in those first few weeks; it’s new and you’re out a lot and you haven’t quite got your head around your budget, yet.

It’s worth getting on top of your bills right at the start; setting up the direct debits and talking about how you’ll split the bills, so that you can save money and enjoy your time at uni.

All content provided on this blog is for informational purposes only. We make no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. We will not be liable for any errors or omissions in this information nor for the availability of this information. We will not be liable for any loss, injury, or damage arising from the display or use of this information. This policy is subject to change at any time.

We offer a variety of cover levels, so please check the policy cover suits your needs before purchasing. For your protection, please ensure you read the Insurance Product Information Document (IPID) and policy wording, for information on policy exclusions and limitations.