5 ways to simplify and reinvent your insurance enterprise

In a context of ongoing disruption, insurers are being called to reinvent themselves. In order to transform on an operational level, insurers need to move from complexity to simplicity. This alone is a daunting task. Composable architecture helps insurers to simplify this complexity at every step of the insurance value-chain, often using processes already at their disposal. Below are 5 practical composable architecture use cases.

1. Policy management – from complex organizational structures to agile and integrated ecosystems

Many of the services for new insurance coverage applications can be unbundled. This will enable insurers to intake applications from digital portals and an AI-based product/coverage selection engine. This can also help them establish a pre-qualification engine based on data from various vendors like distance to coast, CLUE reporting, risk inspection using IOT sensors (Surveillance Systems, Smart Home appliances, Smart Metering, etc.), as well as externalized rating and pricing engines. This assists in distributing development, integration, and testing efforts as well as uptaking new business policy applications at a much faster pace. Breaking down processes into multiple sub-processes helps users consume them at different points of the policy transaction timeline such as when creating a monetary endorsement, or during renewals.

View larger image

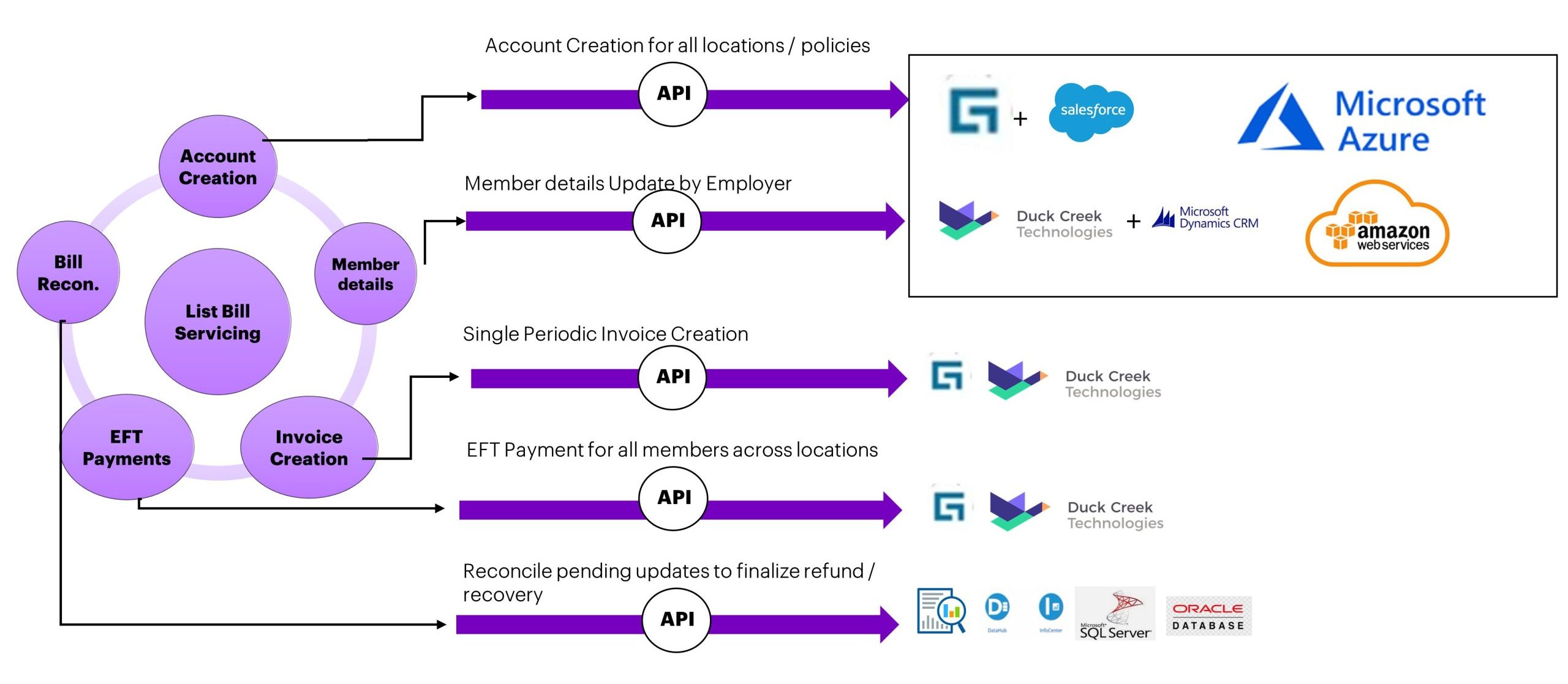

2. Billing management – from manual to automated and personalized invoicing

In the case of billing management, a list bill service breakdown can be used to help build re-usable functions such as account creation and member detail updates. An invoice is generated for transactions across multiple policyholders or agents, at specific frequency and EFT payments are completed for different policy members across locations. Recovery and refund transactions can be triggered based on audit tasks completed at the end of the policy year. Many of these individual services are re-usable for regular audits for commercial lines as well.

View larger image

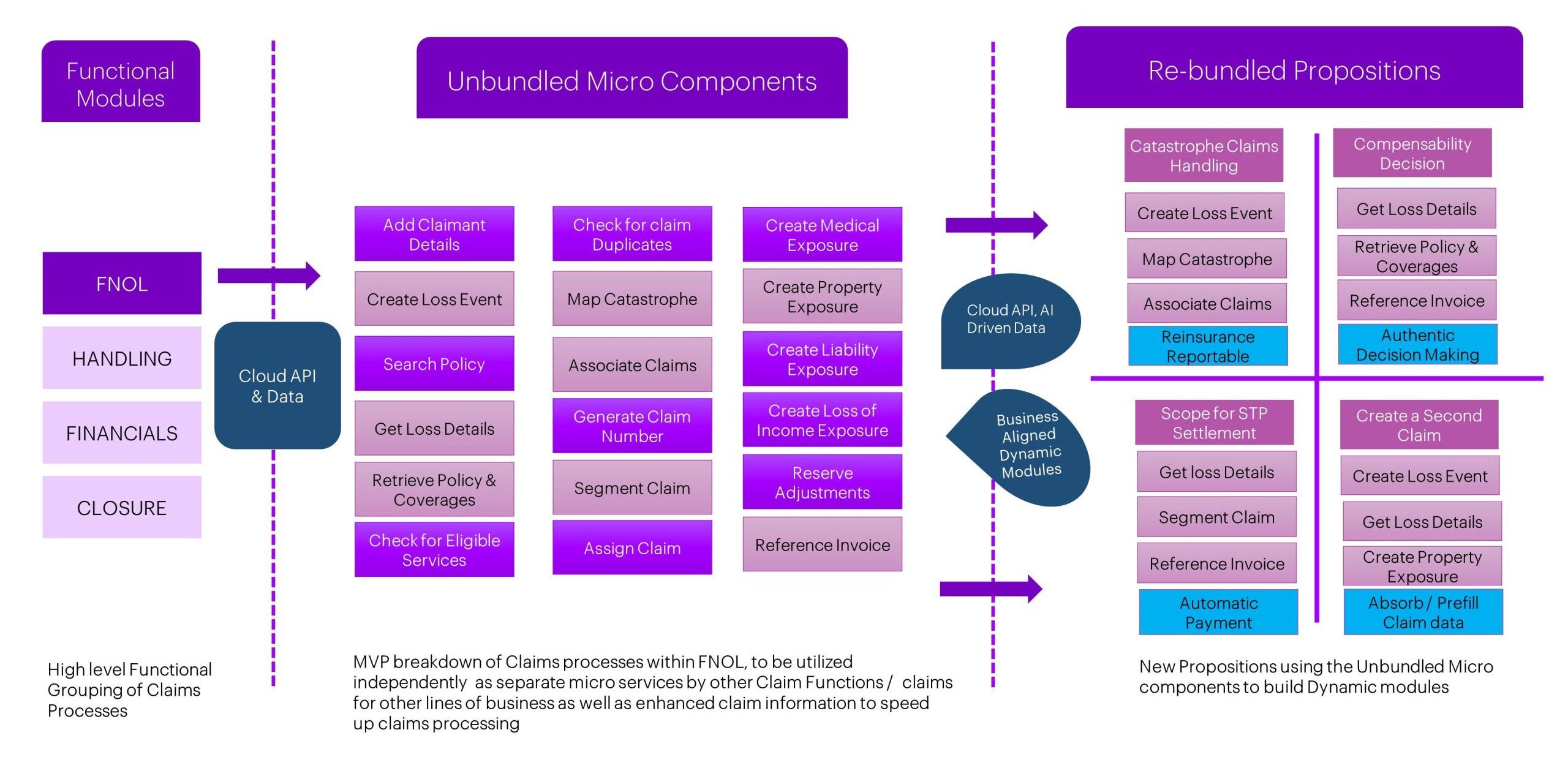

3. Transforming claims with composability – from inflexible to dynamic claims solutions

Claims processing has four high level modules: First Notice of Loss (FNOL), Handling, Financials and Claim Closure. The FNOL process has micro level services that can be unbundled as individual application programming interface (API) services to internal and external systems and listed as unbundled micro components. In a composability business model, these unbundled components can be rebundled to build dynamic modules.

View larger image

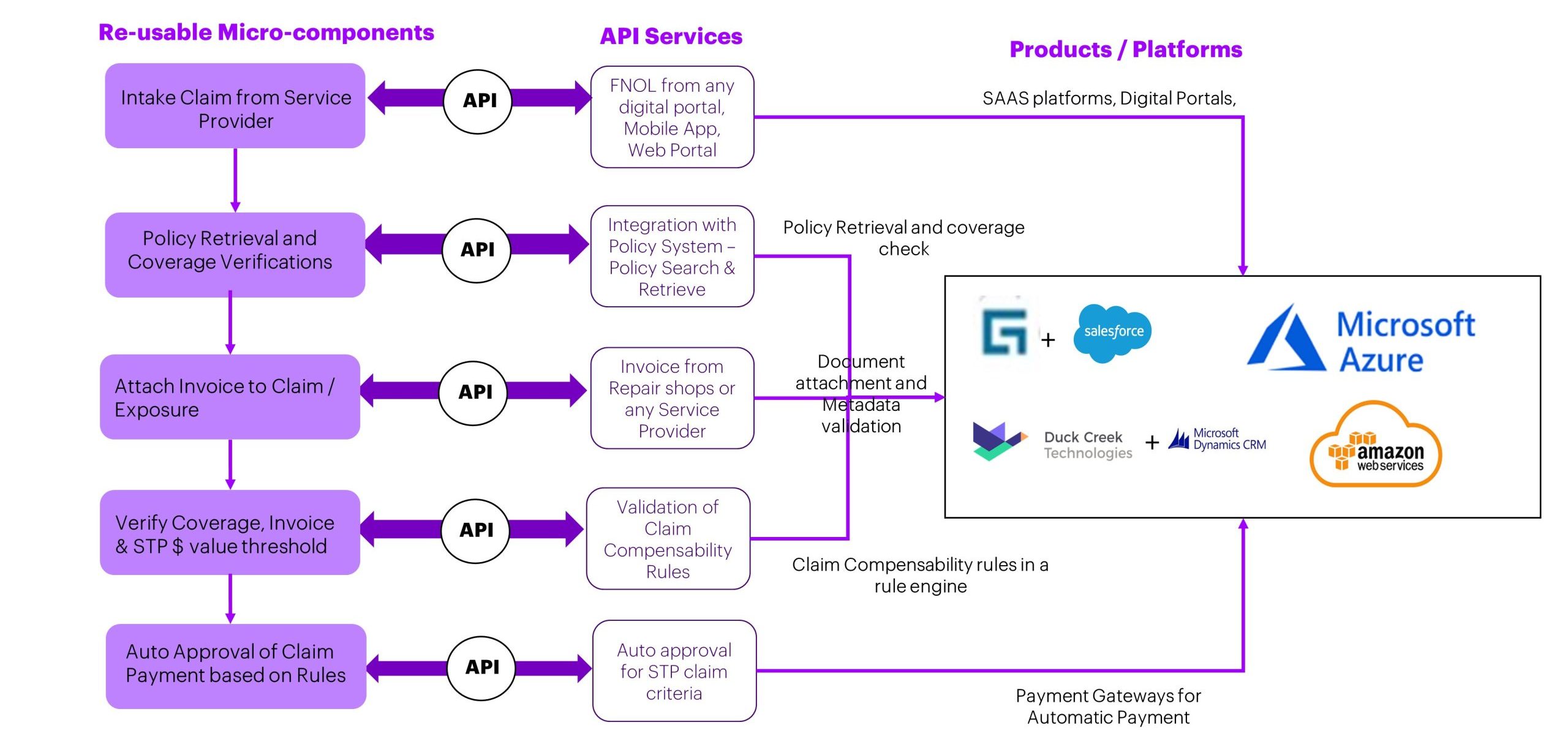

4. Straight-Through Processing (STP) in Claims – from time-intensive review processes to API-led auto-approval

Straight-Through Processing (STP) claims refer to high volume, low value claims which can be paid instantly without a detailed adjudication process. In this case, different APIs are used for the following processes: starting from a base of claim intake; policy search and retrieval; attaching a claim invoice by pushing invoices which have vehicle or claim number automatically; verifying coverage for the specific details in the invoice; and seeing if the invoice amount is less than the STP threshold (say $350) defined by an insurance company. Based on the outcome of all these API processes, claim payments can be auto approved and the amount is paid to the insured instantly. These can be utilized for automobile ‘glass only’ claims, as well as low-cost medical injuries.

View larger image

5. Monolith simplification – from large scale legacy infrastructure to a modular, agile approach

In current conversations with clients, we are recommending the simplification of monolith structures for the effective implementation of a composable architecture. This refers to the process of incrementally dismantling the current infrastructure and rebuilding it in a way that is more efficient. Monolith simplification helps to minimise risk when a client has an active monolith application which is supporting the business and continuously undergoing enhancements.

Once we determine that composable design can be applied, we approach it in three phases – understand the challenge, evaluate the action needed, and implement the solution. Following this initial approach, a further component checklist can be created to classify monolith experiences.

Get in touch to discover how it can be used to streamline and grow your insurance business for Total Enterprise Reinvention.