CIDA Light — Coming Soon (We Hope)

Yesterday, New Year’s Day 2022, I posted about New York Governor Kathy Hochul’s unfortunate and ill-informed signing of New York’s new, so-called Comprehensive Insurance Disclosure Act–CIDA for short–on New Year’s Eve, December 31, 2021. Today I learned that a lighter version of CIDA, which derives from Senate Bill S7052, is already in the works. In her CIDA approval memo, Gov. Hochul reportedly stated:I agree with the intent of the bill and have reached an agreement with the Legislature to ensure that the scope of the insurance coverage information that parties must provide is properly tailored for the intended purpose, which is to insure that parties in a litigation are correctly informed about the limits of potential insurance coverage.This morning I received a marked-up version of S7052, uploaded and linked below (thank you Javier R. Tapia of NYIA) that may represent the “agreement” Gov. Hochul spoke about in her approval memo and the “likely future version” of an amended CIDA (which I’ve dubbed CIDA Light). Bear in mind that NY’s Assembly and Senate still need to pass and Gov. Hochul needs to sign an amended version before it supersedes the CIDA (“Original Strength CIDA”) that is already in effect.

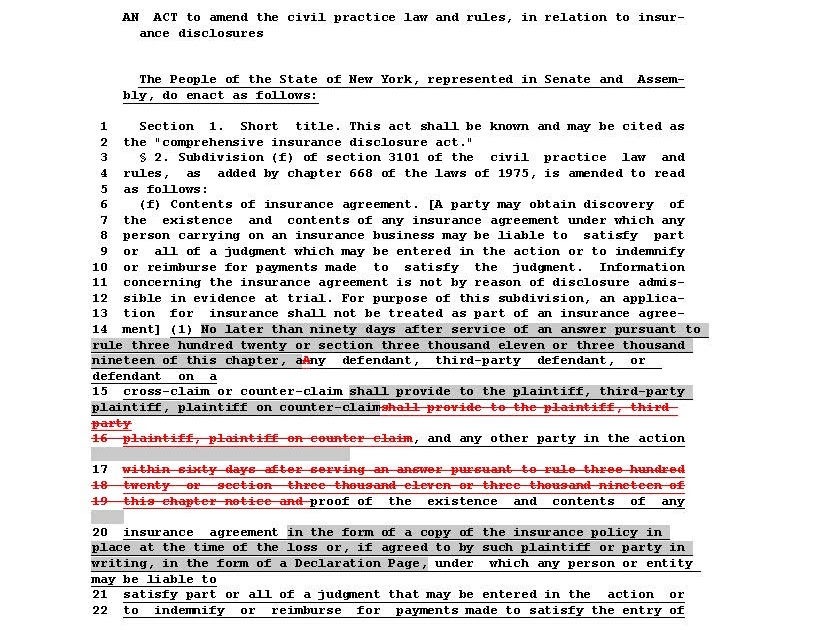

But if the marked-up version below represents what eventually will become New York’s new comprehensive #insurance disclosure law, the significant differences between Original Strength CIDA and CIDA Light are:

CPLR 3101(f)(1): the mandated disclosure must be made within 90 days rather than 60 days of service of the disclosing party’s answer; 3101(f)(1): the “proof of the existence and contents of any insurance agreement” that must be provided can be “in the form of a copy of the insurance policy in place at the time of the loss or, if agreed to by such plaintiff or party in writing, in the form of a Declaration Page”;3101(f)(1): a party who agrees to accept a declarations page instead of a complete copy of the policy is entitled to the other information required by CPLR 3101(f)(1) and can revoke that agreement at any time and insist on a policy copy;3101(f)(1)(i): the “policies, contracts or agreements” that must be disclosed are only those that “relate to the claim being litigated”;3101(f)(1)(iii): only the name (not telephone number) and email address of “an assigned individual responsible for adjusting the claim at issue” must be disclosed; 3101(f)(1) subparagraphs (v) and (vi) have been deleted and subparagraph (iv) is amended to require disclosure only of “the total limits available” under the relevant policy/contract/agreement, meaning “the actual funds, after taking into account erosion and any other offsets” available to satisfy a judgment; 3101(f)(2): disclosing parties will not have an “ongoing obligation” to make the required disclosures but “must” make reasonable efforts to provide accurate information initially and at the time the note of issue is filed, when engaging in court-conducted or court-supervised settlement negotiations, at mediation, and when the case is called for trial; CIDA’s original 60-day post-settlement/judgment disclosure requirement remains; 3101(f)(3): policy applications are NOT to be treated as “part of an insurance agreement” (meaning they do not need to be disclosed)” and the “[d]isclosure of policy limits under this section shall not constitute and admission that an alleged injury or damage is covered by the policy”; 3101(f)(5): the new disclosure requirements “shall not apply to actions brought to recover motor vehicle insurance personal injury protection benefits under Insurance Law Article 51 or Insurance Regulation 68”; andthe revised CIDA is to “take effect immediately [upon the governor’s signing of it] and apply to all actions commenced on or after the effective date”; the original retroactive provision (“to all pending actions”) has been deleted.

The new, double-certification requirement (new CPLR § 3122-b), however, remains.

CIDA Light’s addition of an explicit exception for “actions brought to recover motor vehicle insurance personal injury protection benefits under Insurance Law Article 51 or Insurance Regulation 68” (i.e., PIP coverage suits) has me confused. Does CIDA apply to first-party property coverage actions sued in NY state courts? The proposed addition of a PIP suit exception would be unnecessary if CIDA applied only to third-party liability claims. But the first sentence of Senate S7052’s “Justification” section speaks of the need for complete, accurate and timely information about the nature and extent of insurance coverage “[i]n personal injury cases[.]” And the “excess and umbrella policies” referred to in 3101(f)(1)(i) typically provide third-party liability coverages, not first-party property coverages. Can someone explain? Does CIDA apply to first-party property coverage suits? 😕

New York’s next legislative session is slated to begin on January 5, 2022. The hope is that the amended bill will get passed and signed soon, possibly in January. After all, Original Strength CIDA, now in effect, requires that the mandated disclosures be made by March 1, 2022 (60 days after its effective date for all pending and applicable state court actions).

CIDA Light is less filling, but still doesn’t taste great.