Why doctors don’t like insurance

If you go to the doctor or dentist in the US, you often can get a discount if you pay out of pocket as compared to paying through insurance. Why is that the case? Wouldn’t the physician like to get a big insurance company to pay them as compared to potentially incurring credit card fees for patient self payment? The reason why doctors don’t like insurance is because payment is slow, uncertain and administratively burdensome to their staff.

A recent paper by Sahni et al. (2024) first identifies the criteria for an efficient market system and shows that in the US health care is far from an efficient payment system.

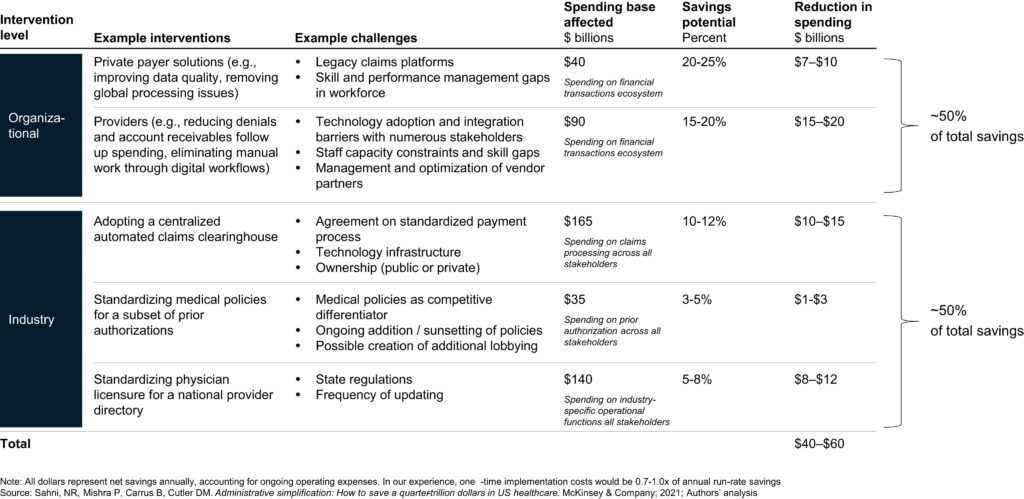

Efficient financial transactions ecosystems from other industries and countries exhibit 2 features: immediate payment assurance and high use of automation throughout the process. The current system has an average transaction cost of $12 to $19 per claim across private payers and providers for more than 9 billion claims per year; each claim on average takes 4 to 6 weeks to process and pay. For simple claims, the transaction cost is $7 to $10 across private payers and providers; for complex claims, $35 to $40. Prior authorization on approximately 5000 codes has an average cost of $40 to $50 per submission for private payers and $20 to $30 for providers. Interventions aligned with a more efficient financial transactions ecosystem could reduce spending by $40 billion to $60 billion…

The authors claim that about half the cost savings could be realized through organization refer (i.e., scaling interventions) and half through industry-wide systems (e.g., centralized automated claims clearinghouse, standardized medical policies, etc.). The table below summarizes these potential savings.

You can read the full paper here.