The new OMB Social Welfare Function

Recently, the Office of Management and Budget has released new procedures to assess government regulation (Circular A-4) and economic policies (Circular A-94). What is unique about this guidance is that it weights benefits and costs of new regulations and policies based on the income of the individuals impacted. The goal is to help reduce inequality. Costs and benefits that accrue to low-income individuals are weighted more; those that accrue to high-income individuals are weighted less.

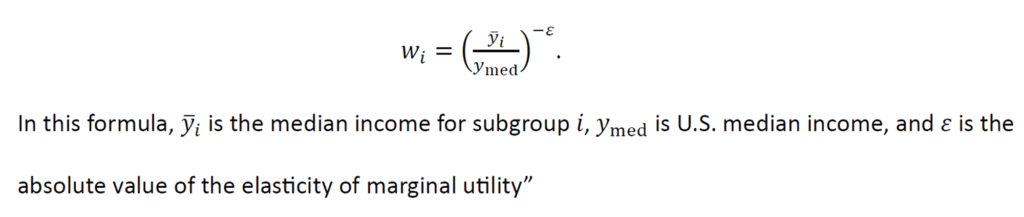

A paper by Viscusi et al. (2024) explains what this policy is and some of its challenges. First, Viscusi explains that the policy puts explicit weights on policies by income group using the following formula:

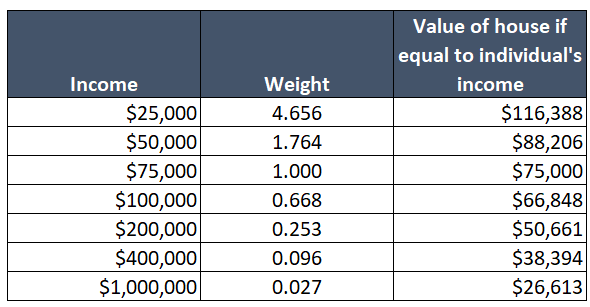

So how does this formula impact the weight we place on benefits and cost to different groups? Well, if we assume median income in the US is $75,000, then the value of costs and benefits to someone making $25,000 are weighted 4.7x as much as the median person; someone who makes $400,000 has a weight that is 90% lower than a median person.

At first glance, this may seem like a reasonable policy; reducing inequality is a laudable policy goal. However, these weights can also create inefficient policies. For instance, consider the case where each person in society owns a home who’s value is equal to their income. If this case, the income weights mean that richer people’s houses are downweighted. But we also get an odd result. As Visculsi writes:

Somewhat paradoxically, market house values go up at higher income levels, but the weighted house values go down.

One can see this from the table above where a $25,000 house is valued at $116,000 but a $1,000,000 house has a weighted value of only $26,613. This can result in the odd scenario where a disaster protection policy could enacted only if it were applied to protect less rather than more valuable houses. While this may appear acceptable at first glance–rich people could buy their own insurance perhaps–it does create inefficient policies.

Consider the case where policymakers were considering a sea wall to reduce flooding. Let’s say that the sea wall costs $1,000 per house to build and the risk of flooding was 1%. If this was in a poor area–where all houses cost $25,000–it would not be worth it to build the wall under a standard OMB calculation because the expected losses are only $250 (i.e., $25,000 x 1% = $250). However, with the new weighting scheme, $25,000 houses are worth $116,000 so OMB would say they should build it ($116,000 x 1% = $1,116 > $1,000). However, if redistribution was the goal, it would be more effective to give poor home owners $1,000 rather than install a sea wall that is only worth $250 per house.

Overall, the Viscusi paper reaches 6 conclusions:

Quantitative distributional weights created. The OMB approach creates explicit and operational distributional weights.Major impact. Viscusi believes that “the weights will have profound effects on benefit-cost analyses”Inefficient. Viscusi belives that “the application of the OMB weights is potentially very inefficient”. Part of the reason is that income is highly right-skewed; part of the reason is that there may more efficient mechanisms for reducing income inequality. Grouping matters. How OMB groups policies will matter. If there is a city that has half poor and half rich neighborhoods, cost-benefit will be upweighted for poor neighborhoods and downweighted for rich neighborhoods. If another city also has half poor and half rich individuals but individuals live side by side, the individuals in this mixed city would not benefit as much from the OMB approach because OMB could not segregate the policy by income since all neighborhoods are of mixed income. Mortality risks. OMB excludes health benefits and risk from the inequality weighting procedure saying. However, if these were applied to reduced health risks, it would explicitly value the lives of low-income individuals much more than high-income individuals. Interaction with other policies. Viscusi notes that there is “no discussion of how the weights will interact with other progressive elements of administration policy”

I encourage you to read the full paper here.