Private equity in health care

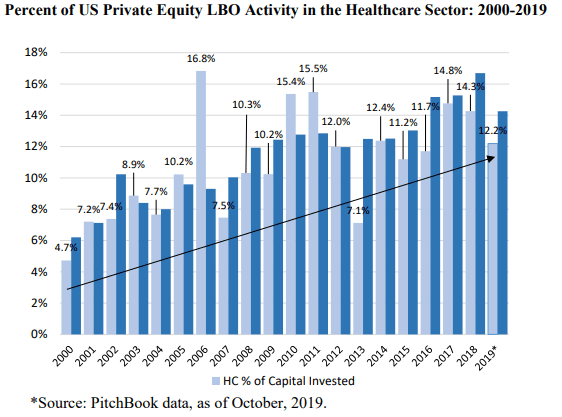

Private equity investments have grown in health care in recent years. According to Appelbaum and Batt (2020), whereas in only 4.7% of leveraged buy-outs (LBO) were in health care in 2000, that number had risen to 12.2% in 2019.

A 2022 white paper finds that investments in health care have risen even more:

The number of deals rose 36% to 515, up from 380 the prior year. Total disclosed value more than doubled to $151 billion from $66 billion (see Figure 1). The average disclosed deal value soared 134%, mainly because of 5 buyouts greater than $5 billion, compared with just 1 the year earlier.

The 5 largest deals in 2021 included purchases of Medline Industries ($34.0 billion), Athenahealth ($17 billion), Parexel ($8.5 billion), Inovalon ($7.3 billion), Cerba Healthcare ($5.3 billion). Other investments include those in “telehealth, digital health and health information technology” as well as provider acquisitions.

President Biden is skeptical about private equity investments in health care and even mentioned issues related to private equity takeovers of nursing homes in his 2022 State of the Union Address. Nevertheless, it remains to be seen if private equity investments can help provide additional funds to reduce cost and improve outcomes, or not. More specifically, which types of healthcare would benefit most from private equity investments? We can all agree that health care could benefit from additional use of technology to improve outcomes and make processes more efficient. Will private equity investments be a way to achieve those goals? Only time will tell.