Many Workers, Particularly at Small Firms, Face High Premiums to Enroll in Family Coverage, Leaving Many in the 'Family Glitch' – Kaiser Family Foundation

The Biden Administration recently issued a proposed rule to make it easier for family members of workers offered health insurance at their jobs to qualify for premium tax credits for Marketplace coverage. The proposal aims to address what has been called the “family glitch”. Under the ACA, an individual enrolling in a Marketplace plan is not eligible for a premium tax credit if they are eligible for job-based coverage that is considered affordable and provides minimum value (i.e., covers at least 60% of health expenses on average). Current regulations provide that job-based coverage is considered affordable to a worker and their dependents if the cost of self-only coverage for the worker is less than 9.6 percent of family income, without regard to the cost of adding family members. The proposal would revise that interpretation by assessing the affordability of job-based coverage available for the family members of a worker by comparing the total cost for the whole family (including the worker) to the 9.6 percent threshold. This assessment would measure affordability for members of the family other than the worker. Affordability for the worker himself or herself would continue to be based on the cost of self-only coverage.

The proposed rule explains that the current interpretation leads to cases where family members are considered to have an affordable offer even when they face very high contribution amounts if they want to enroll in that coverage, which the agencies assert is not consistent with the ACA’s purpose of providing access to affordable coverage for everyone. We previously estimated that 5.1 million people are currently caught in this ‘family glitch’.

In this analysis, we use the KFF Employer Health Benefits Survey (EHBS) to look at the shares of workers that might pay significant amounts to enroll families and how these shares vary across firms. These are the workers most likely to benefit from a fix to the family glitch.

Health insurance is expensive. The average premiums in 2021 were $7,739 for single coverage and $22,221 for a family of four. The average contribution amounts for covered workers were $1,299 for single coverage and $5,969 for a family of four. Importantly, there was considerable variation around these averages: for example, ten percent of covered workers were enrolled in a plan with a premium of more than $29,000 for family coverage; and 12% of covered workers were enrolled in a plan with a contribution of at least $10,000 for family coverage. It is the family members of workers in firms with high contributions that are most likely to benefit from the proposed rule change.

Before looking at some of the characteristics of these firms and workers, we should be clear about what these percentages mean. When we say that 12% of covered workers are in a plan that has a worker contribution of at least $10,000, we are not saying that 12% of covered workers actually enroll in family coverage and pay those amounts. Instead, we are saying that 12% of covered workers work at firms where the contribution for a family of four for their largest health plan (or sometimes an average of several plans) is at least $10,000. Surveys do not collect information about all of the health plans each employer may offer, nor are they able to account for potential adjustments that might affect individual workers or families (smoking surcharges, discounts for filling out a health risk assessment, surcharge if spouse is offered coverage at another job). So, while these surveys cannot give precise results on actual costs, they give a pretty good picture of the magnitude of the costs workers face to enroll in the plans that most workers choose.

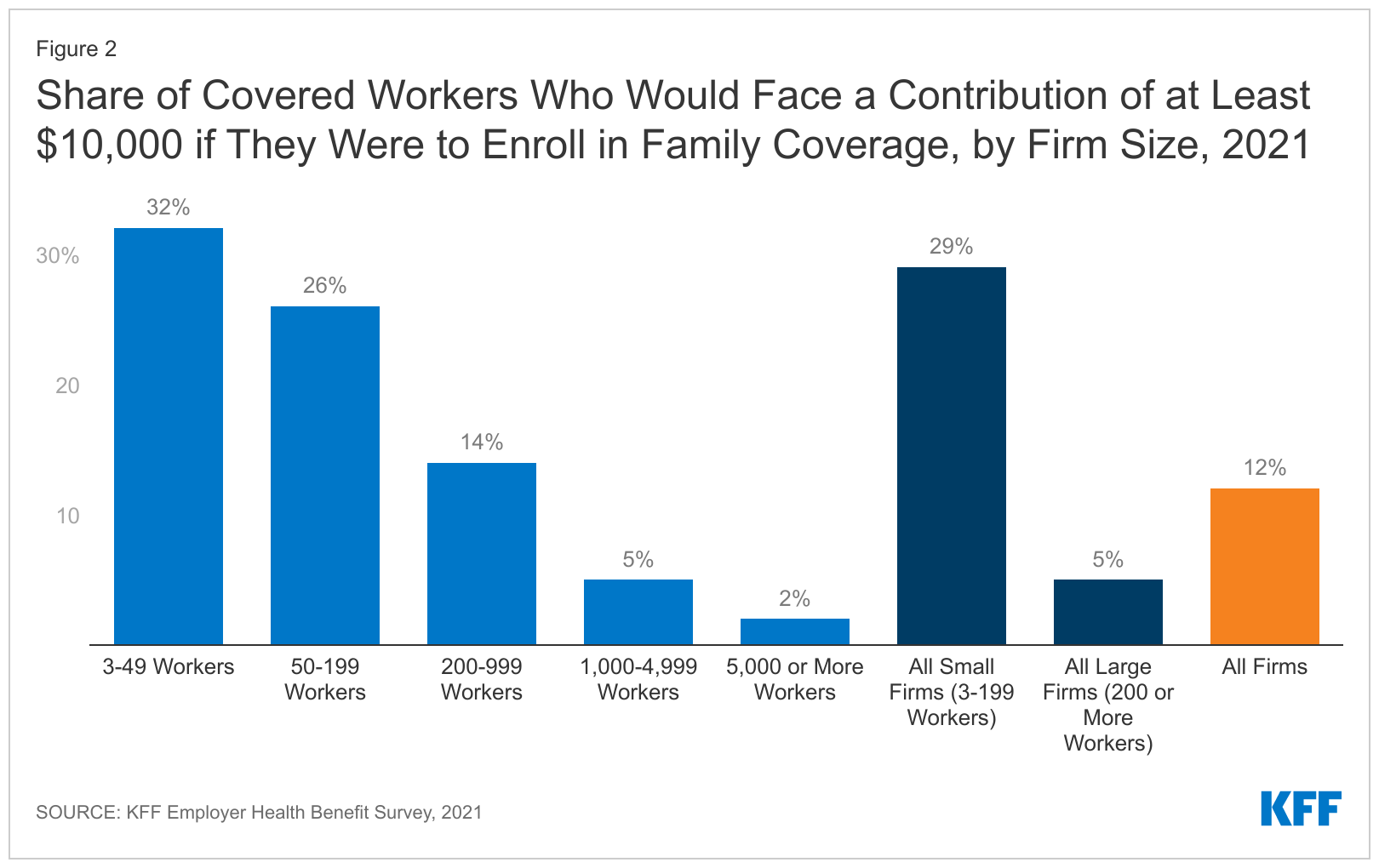

Workers in small firms face higher contributions for family coverage. Workers in small firms (3-199 workers) on average face higher contributions to enroll in family coverage and are more likely to face very high contribution amounts. The average contribution for a family of four in 2021 was $7,710 for workers in small firms, compared to $5,269 for workers in larger firms. Twenty-nine percent of covered workers in small firms faced a contribution of at least $10,000 for family coverage, compared to only 5% of covered workers in larger firms.

One reason family contributions may be higher in smaller firms is that some small employers only make a contribution toward the cost of self-only coverage, leaving the worker to pay the entire difference between the premium for self-only coverage and the premium for family coverage. Even in firms selecting less comprehensive coverage, this difference can be many thousands of dollars. We estimate that 19% of small firms offering health benefits make little or no additional contribution towards the cost of family coverage. These firms employ about 17% percent of the covered workers enrolled at small firms (3-199 workers).

Workers in the service industry are more likely to face high contributions for family coverage. Contributions for family coverage vary significantly by industry. Covered workers in certain industries are more likely to face high contributions for family coverage while covered workers in other industries (wholesale, transportation, communications, utilities, state and local government) are less likely.

The proposed rule addresses the eligibility for premium tax credits in situations where workers face unaffordable contribution amounts to enroll their family members in job-based coverage. Data from the KFF Employer Health Benefits Survey demonstrates that some workers face very high contribution amounts for family coverage, with 12% facing a contribution of at least $10,000 for a family of four. Workers with coverage through small firms are particularly at risk of high contributions for family coverage, and would therefore benefit from the family glitch fix.

The annual KFF Employer Health Benefits Survey (EHBS) for 2021 was conducted between January and July of 2021, and included almost 1,700 randomly selected, non-federal public and private firms with three or more employees. The full EHBS, including a detailed methodology section, is available at ehbs.kff.org. EHBS collects information from employers about how much employers and employees contribute in their largest health plans.