Life sciences companies falling behind?

That is what an analysis from PwC finds, at least with respect to stock market returns.

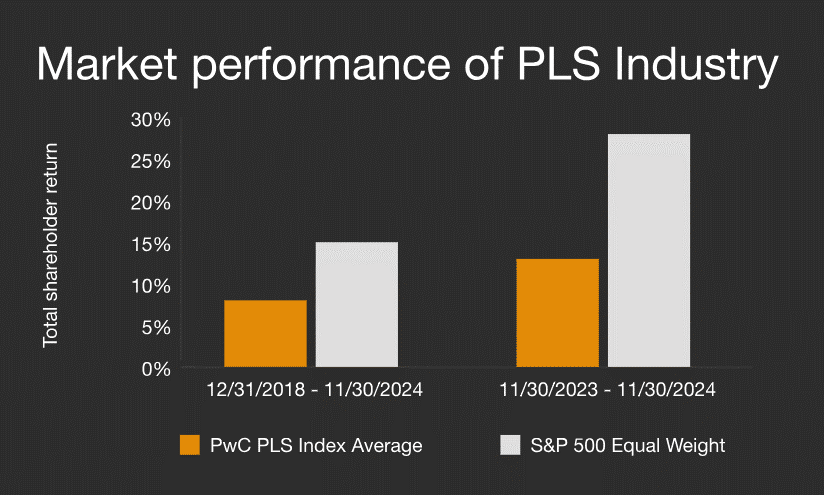

Our PwC equal-weight index of 50 pharma companies analyzes the sector’s total shareholder returns performance relative to the S&P 500 Equal Weighted Index. From 2018 through November 2024, the PwC pharma index returned 7.6% to shareholders, compared with more than 15% for the S&P 500. Over the last year, this dynamic became even more pronounced with the PwC pharma index returning 13.9% compared to 28.7% for the S&P through November 2024.

https://www.pwc.com/us/en/industries/pharma-life-sciences/pharmaceutical-industry-trends.html

Unsurprisingly, value growth is highly concentrated in just a few companies:

…since 2018, an increasingly limited set of companies have influenced positive returns in the pharmaceuticals sector. Within the S&P 500, the so-called “Magnificent 7” accounted for 40% of the increase in value since 2018. In the pharma industry, this dynamic is even more stark with just two [leading GLP-1 manufacturers]…accounting for nearly 60% of the increase in value growth among the 50 pharma companies analyzed by PwC.

With the advent of the IRA and increasing pressure on price negotiation in many countries, will investors continue to fund life science innovators? Let me know your thoughts.