Impact of Medicare Part D on net drug prices

When you buy a car, there is the sticker price and what you actually paid after haggling with the dealer over discounts. For pharmaceuticals, the media typically reports on list prices which are analogous to the “sticker price” for cars. However, what really matters is the net price, which is the price after discounts and rebates. One key question is, how well do Medicare Part D plans do at negotiating prices down from their list price.

A paper by Ippolito and Levy (2023) aims to answer that question using 2007-2019 data on drug prices and rebates from SSR Health and data on drug utilization from Medical Expenditure Panel Survey (MEPS).

Using these data, they compare the relative size of rebates for branded drug based on she share of patients who use the drug that are covered by Medicare Part D. The authors find that:

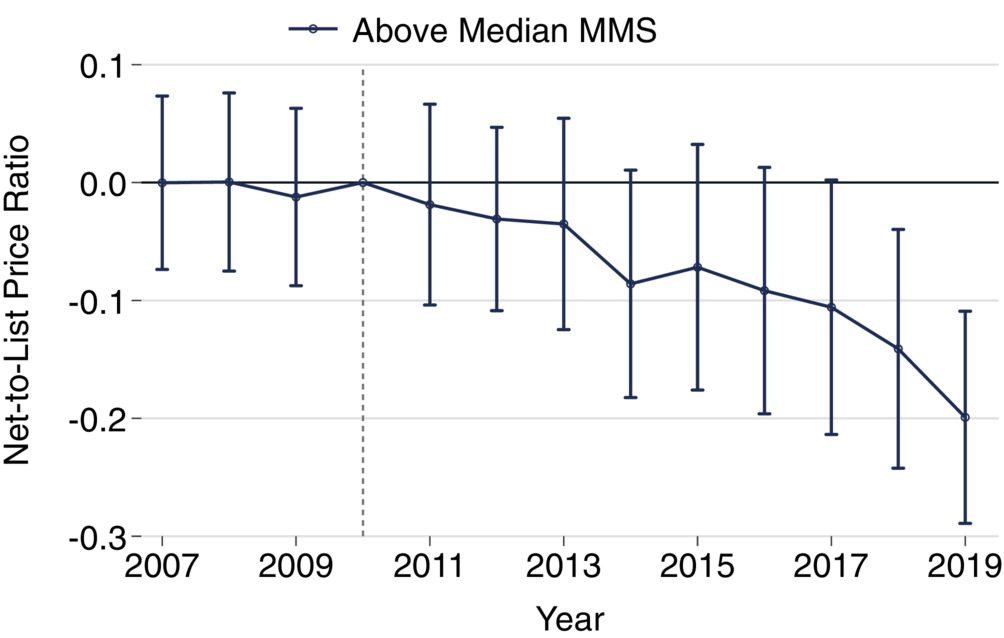

Net-to-list price ratios were negatively correlated with [Medicare market shares] MMS in the later years of our sample. In 2019, a 10% increase in MMS was associated with a significant 4.6% [95% CI: 2.1%, 7.1%] decrease in net-to-list ratio. Difference-in-differences showed net-to-list price ratios of drugs with above median MMS fell relative to those with below median MMS. By 2019, we observe an absolute reduction of −0.2 [95% CI: −0.29, −0.11], representing 28% reduction relative to the average ratio in 2010.

The study excludes physician administered drugs and drugs that are infrequently prescribed (i.e., <200,000 prescriptions).

The study finds that this relationship is stronger in later years, and hypothesize that changes in Part D benefit design form the Affordable Care Act and Bipartisan Budget Act of 2018 were a large reason for these additional discounts. The authors describe the specific policy change as follows:

In 2011, the Affordable Care Act phased the coverage gap down by requiring that manufacturers offer a 50 percent discount off of list price on brand drugs in that portion of the benefit. In addition to lowering spending by enrollees, these discounts were treated as if the enrollee had actually spent that money for purposes of determining where the beneficiary was in the benefit design. The Bipartisan Budget Act of 2018 increased these discounts to 70 percent, which lowered plan liability in this phase to just 5 percent.

Is this a good thing? In a partial equilibrium sense, the answer is ‘yes’. Lower net prices are good for Medicare’s bottom line. However, increasing the rebates and discounts that manufacturers likely will result either in higher list prices–so that the net price remains constant–or the amount of R&D investments and new drugs coming to market will fall as drug reimbursement becomes less generous. Like anything in health economics, there are always tradeoffs.

https://onlinelibrary.wiley.com/doi/full/10.1111/1475-6773.14139?campaign=wolacceptedarticle