How to protect your finances with a supplemental medical insurance plan – PhillyVoice.com

Life can be unpredictable. Accidents, injuries, and illnesses are bound to

happen; and when they do, you should be able to focus on your recovery —

not worrying about finances.

Plan For the Unexpected

An

Independence Blue Cross (Independence) health plan

offers you the security of knowing you have access to high-quality care,

including the largest network of doctors and hospitals in the region. For

added peace of mind, consider pairing your Independence health plan with an

accident, critical illness, and hospital recovery insurance plan from the

LifeSecure Insurance Company*, an independent company.

LifeSecure plans offer financial support when you need it most — in the

event of an accident, serious illness, or hospital stay. You can make up

for lost income and pay for medical deductibles, out-of-network office

visits, uncovered treatments, childcare, transportation to appointments,

household upkeep, or anything else you may need.

Let’s explore the plans available from LifeSecure and how they can enhance

your medical coverage!

Accident Insurance

In the event of an accident, an Independence health plan provides benefits

for covered medical services associated with an injury. But you might also

want supplemental medical insurance to help with out-of-pocket costs

resulting from an accident that can set you back financially.

That’s where LifeSecure comes in. LifeSecure’s personal accident insurance

provides cash benefits paid directly to you to help offset injury-related

expenses, such as copays, tests, X-rays, and therapy, regardless of any

other insurance you have.

Accidents Happen

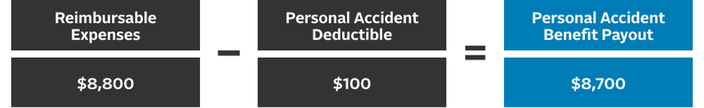

Here’s an example of how a LifeSecure accident insurance plan with an

annual benefit amount of $10,000 can help you in the event of an accident:

Donna has a $100 deductible under her LifeSecure personal accident

insurance plan and has incurred $8,800 in reimbursable medical expenses,

including the costs of deductibles, copays, and coinsurance. Her benefit

payout would be $8,700.

Critical Illness Insurance

When you or someone in your family is dealing with a major health event,

such as a heart attack, stroke, or cancer, a critical illness insurance

plan from LifeSecure can help pay for expenses that traditional insurance

plans do not cover, such as lost income, mortgage payments or other

household bills, medical deductibles, rehabilitation, and uncovered

treatments.

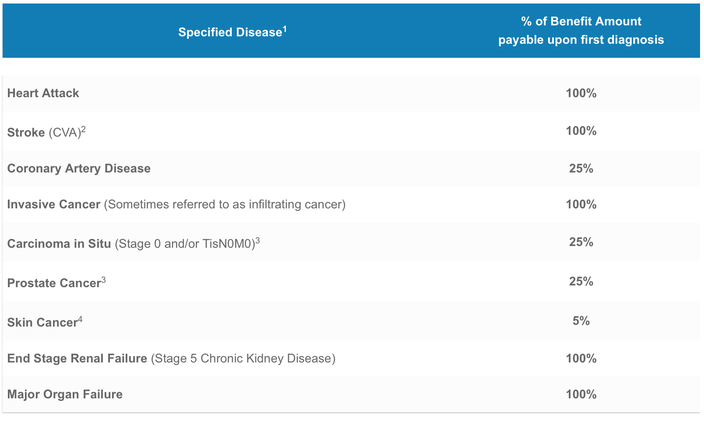

LifeSecure’s critical illness insurance plans offer a lump-sum cash benefit

upon diagnosis of a covered disease to help pay these expenses. Below is a

chart that details what percentage of the benefit amount you would receive

upon first diagnosis for several commonly covered diseases.

Protection For the Whole Family

With a critical illness insurance plan, you’ll have the security of knowing

that everyone in your family is protected:

• If you include your spouse or partner, his or her benefit amount will match

yours.

• Each dependent child is automatically covered with a $2,500 benefit amount

— at no additional cost.

• Subsequent diagnosis of a different critical illness is also eligible for

payment.

Hospital Recovery Insurance

An Independence health plan provides benefits to help with medical costs

resulting from an inpatient hospitalization or treatment in an observation

unit. By pairing your medical plan with a LifeSecure hospital recovery

insurance, you can extend your protection past your hospital stay.

A hospital recovery insurance plan provides cash benefits for each day of a

covered hospital stay, regardless of any other insurance you have. Benefits

can help pay for anything you need during recovery, including

transportation, delivery or take-out meals, or help around the house.

Focus on Recovery, Not Finances

In the event of an inpatient hospitalization, here’s an example of how a

LifeSecure hospital recovery insurance plan with a $10,000 benefit amount

can help you:

Cindy selects a daily benefit amount of $500. She is later hospitalized for

four days after back surgery. Upon discharge, Cindy’s benefit payout will

be $2,000.

Get Protected

You can’t predict where life may take you, so be prepared. LifeSecure’s

plans offer affordable and reliable coverage to provide financial support

when it really counts. Visit the

LifeSecure website

to learn more about their plans and get an instant quote.

*Independence Blue Cross is an independent licensee of the Blue Cross

and Blue Shield Association. The products listed are offered by

LifeSecure Insurance Company, an independent company. These are not

Blue Cross products. Independence Blue Cross is acting solely as an

agent for LifeSecure. LifeSecure is solely responsible for the

administration of its products.

LifeSecure Insurance Company (Brighton, MI) underwrites and has sole

financial responsibility for the Accident, Critical Illness and

Hospital Recovery insurance products. The products listed are offered

by LifeSecure Insurance Company, an independent company. These are not

Blue Cross or Blue Shield products. LifeSecure is solely responsible.

LifeSecure and the logo are trademarks of LifeSecure Insurance Company.

These policies include limitations and exclusions. Refer to the Outline

of Coverage or Policy. This is an insurance solicitation.

1

In PA: Specified Disease is called Critical Illness

2

In NH: This disease is called Severe Stroke

3

In CA: This disease is called Cancer Confined in its Site of Origin

4

In CA: This disease is called Excluded Skin Cancer

This content was originally published on

IBX Insights.

About Brett Mayfield

Brett Mayfield is senior vice president and market president — local. He

joined Independence Blue Cross in 1991 and is responsible for the new

business and retention of Independence’s Consumer, Small Group, and Middle

Market segments. Brett graduated from Shippensburg University in

Pennsylvania with a bachelor’s degree in criminal justice. He currently

resides in Maple Glen, Pennsylvania with his family.