Healthcare spending for individuals with FSAs and HSAs

In the U.S., health insurance premiums are tax deductible–if paid through out of pocket expenses–but out-of-pocket expenses are not. However, there are exceptions to this rule. These include two often-used tax-favored accounts:

Flexible savings accounts (FSA). These accounts allow employees to set aside a portion of their pretax income to cover qualified medical expenses; however, if the employee does not use these funds by the end of the year, they are forfeited. Health savings accounts (HSA). HSAs also allow employees to save pretax income to cover qualified medical expenses, but–unlike FSAs–HSA balances roll over from year to year. While anyone with a qualified plan can enroll in an FSA, only employees who enroll in a high-deductible health plan (HDHP) are allowed to contribute to an HSA.

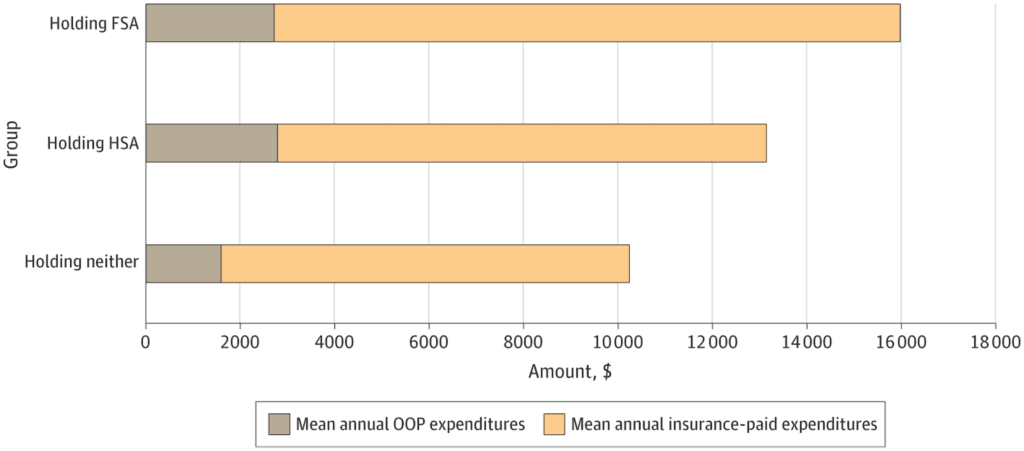

How does having an FSA or HSA impact health care expenditures. A paper by Ding and Glied (2024) use data on health care expenditures for working age adults from the 2011-2019 Medical Expenditure Panel Survey (MEPS) to find the answer. Their study found that:

…families with FSAs spent a mean of 20% or $2033 (95% CI, $789-$3276) more on health care annually than non–account holding families, largely due to increased insurer-paid expenses. Families with HSAs spent a mean of 44% or $697 (95% CI, $521-$873) more on out-of-pocket expenditures and had insignificantly higher insurance-paid expenditures than families without accounts, resulting in overall expenditures comparable to those of non–account holders. The additional tax expenditures associated with FSAs were a mean of $1306 (95% CI, $536-$2076) annually per family.

https://jamanetwork.com/journals/jama-health-forum/fullarticle/2823758

You can read the full paper here.