Business Owner Eligibility Graphic for ICHRAs

Health benefits have long been challenging for business owners, especially those seeking cost-effective, flexible solutions. The Individual Coverage Health Reimbursement Arrangement (ICHRA) is changing the game, offering businesses a tax-advantaged way to reimburse employees for individual health insurance premiums and medical expenses. However, not all business owners can participate in an ICHRA—eligibility depends mainly on the business’s legal structure.

Understanding ICHRA business owner eligibility is crucial, as C Corporations, S Corporations, Partnerships, Sole Proprietorships, and LLCs have different rules. While some owners can take full advantage of ICHRA tax benefits, others may need to explore alternative health benefits for business owners, such as Qualified Small Employer HRAs (QSEHRAs), Health Savings Accounts (HSAs), or spousal health plans.

In this article, you’ll learn:

Which business structures allow owners to participate in an ICHRA.

How to maximize ICHRA tax benefits and comply with IRS regulations

Alternative health benefits for self-employed individuals and ineligible business owners

Let’s dive into ICHRA eligibility rules and how business owners can maximize their health benefit options.

What Is an ICHRA and How Does It Work?

The Individual Coverage Health Reimbursement Arrangement (ICHRA) is a flexible and tax-efficient way for businesses to provide health benefits without the complexities of traditional group health insurance. Instead of offering a one-size-fits-all plan, employers set a customized reimbursement budget. Employees then purchase their health insurance plans, and the HRA can cover qualifying medical expenses, including insurance premiums.

Introduced in 2020 under new federal regulations, ICHRAs have quickly gained popularity among businesses of all sizes. They offer greater flexibility, cost control, and tax advantages, making them attractive for employers who want to provide health benefits without managing a group insurance policy.

Related: ICHRA Tax Benefits for 2025

Understanding the Basics of an ICHRA

An ICHRA works as a reimbursement model, meaning the employer does not directly pay for health insurance premiums or medical costs. Instead, the process typically follows these steps:

Employer Sets a Budget: The employer determines a monthly allowance for each employee (or employee class).

Employees Choose Their Coverage: Employees purchase an individual health insurance plan from the marketplace or a private insurer.

Reimbursements Are Tax-Free: Employees submit proof of eligible expenses, and the employer reimburses them tax-free up to the set allowance.

No Employer Mandate for Minimum Contributions: Employers can customize who gets how much based on employee categories, such as full-time vs. part-time workers.

ACA Compliance: ICHRAs can be structured to comply with the Affordable Care Act (ACA) requirements, ensuring employees have minimum essential coverage (MEC).

Unlike traditional group health plans, ICHRA business owner eligibility varies based on the company’s legal structure, which affects whether owners can participate alongside employees.

Benefits of an ICHRA for Employers and Employees

Benefits for Employers

Cost Control and Predictability: Employers set fixed reimbursement limits, avoiding unpredictable premium increases.

Flexibility in Benefit Design: Different reimbursement amounts can be assigned to different employee classes (salaried vs. hourly workers).

No Minimum Employer Contributions: Unlike traditional group plans, employers are not required to cover a fixed percentage of premiums.

Fewer Administrative Headaches: No need to manage group insurance plans or negotiate with insurers.

Tax Advantages: Reimbursements are typically 100% tax-deductible for C Corporations and tax-free for employees.

Benefits for Employees

Freedom to Choose Their Health Plan: Employees can select a plan that fits their needs rather than being limited to an employer’s group plan.

Portability: Unlike traditional group health insurance, employees keep their insurance policy if they leave the company.

Tax-Free Reimbursements: Employees get reimbursed tax-free for qualifying health insurance premiums and expenses.

Increased Access to ACA Premium Tax Credits: Depending on how the employer sets up the ICHRA, employees may still qualify for ACA subsidies.

An ICHRA offers a win-win solution: It gives businesses a cost-effective way to provide health benefits while offering employees greater choice and flexibility. However, business owners must carefully consider their eligibility before assuming they can also participate, which we’ll cover next.

ICHRA Business Owner Eligibility by Business Type

One of the most important factors in determining whether a business owner can participate in an ICHRA is their business structure. While some owners qualify to receive reimbursements tax-free, others are considered self-employed and cannot participate in the same way their employees can.

Below, we break down ICHRA eligibility rules by business type, including C corporations, S corporations, partnerships, sole proprietorships, and LLCs.

C Corporation Owners – Eligible for an ICHRA

Owners of a C Corporation (C Corp) are considered separate legal entities from their business, meaning they are treated as W-2 employees. Because of this distinction, C Corp owners:

Are eligible to participate in an ICHRA just like any other W-2 employee.

Can reimburse themselves tax-free for individual health insurance premiums and medical expenses.

Can deduct ICHRA reimbursements as a business expense, reducing taxable income.

Can offer ICHRA benefits to dependents if the plan allows.

Example: A C Corp owner sets up an ICHRA for their employees and includes themselves in the plan. The company reimburses the owner for their individual health insurance premiums tax-free, and the business deducts these reimbursements as a legitimate expense.

Key Takeaway: C Corp owners receive the full benefits of an ICHRA, making it an attractive health benefits solution for corporations.

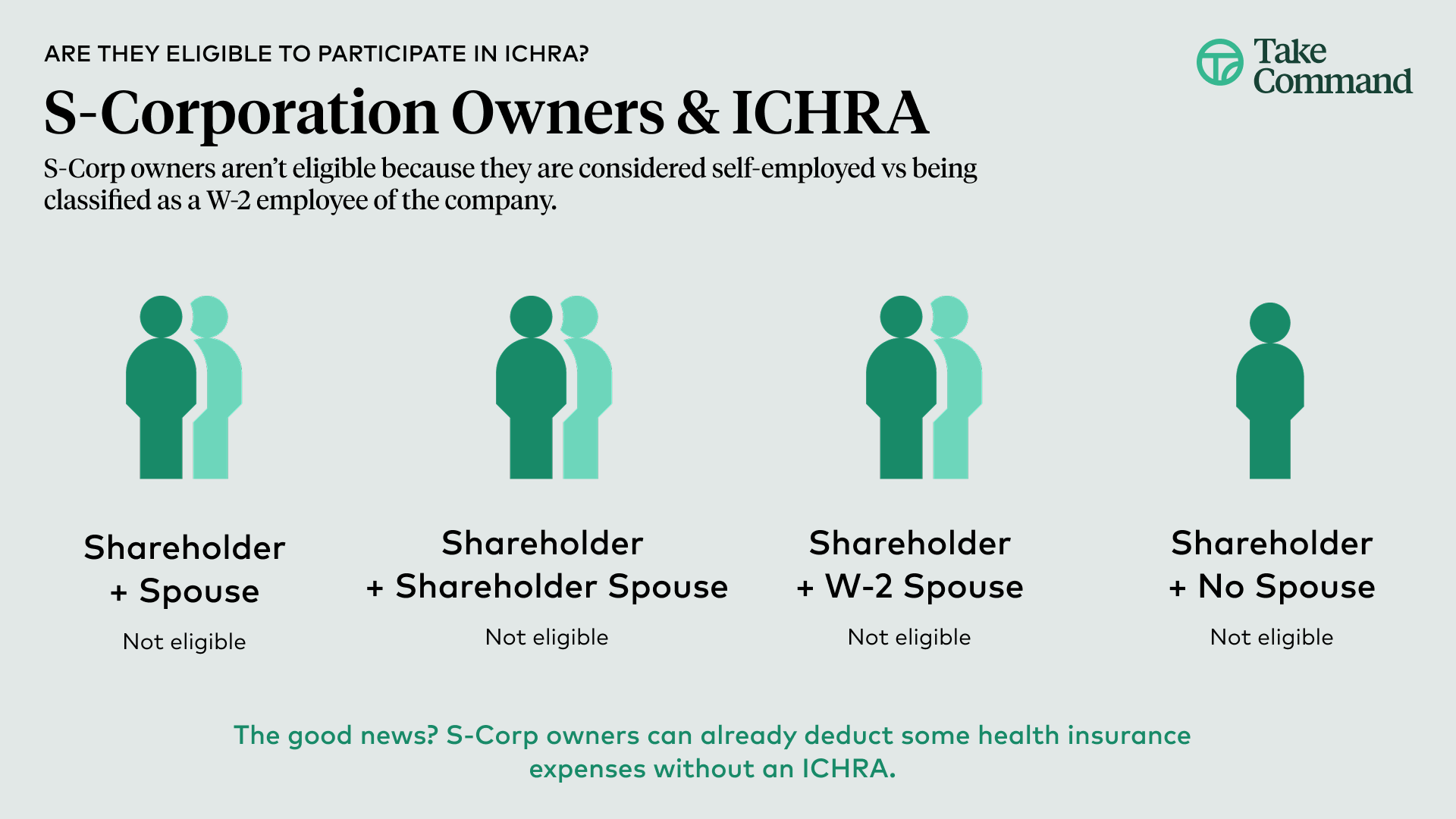

S Corporation Owners – Restrictions on ICHRA Participation

Owners of an S Corporation (S Corp) face stricter restrictions on ICHRA participation. If they hold more than 2% ownership, they are considered self-employed, not employees, making them ineligible for tax-free ICHRA reimbursements.

S Corp owners cannot receive tax-free ICHRA reimbursements.

Family members of an S Corp owner (spouses, children, parents, grandparents) who work for the business are also ineligible.

However, S Corp owners can still deduct health insurance premiums on their personal tax returns under IRS Section 162(l).

Example: An S Corp owner offers an ICHRA to employees but cannot participate themselves. Instead, they pay for their health insurance directly and deduct it as a self-employed health insurance deduction on their personal tax return.

Key Takeaway: Although S corporation owners are not allowed to participate in ICHRA, they can still receive some tax benefits by deducting health insurance costs personally.

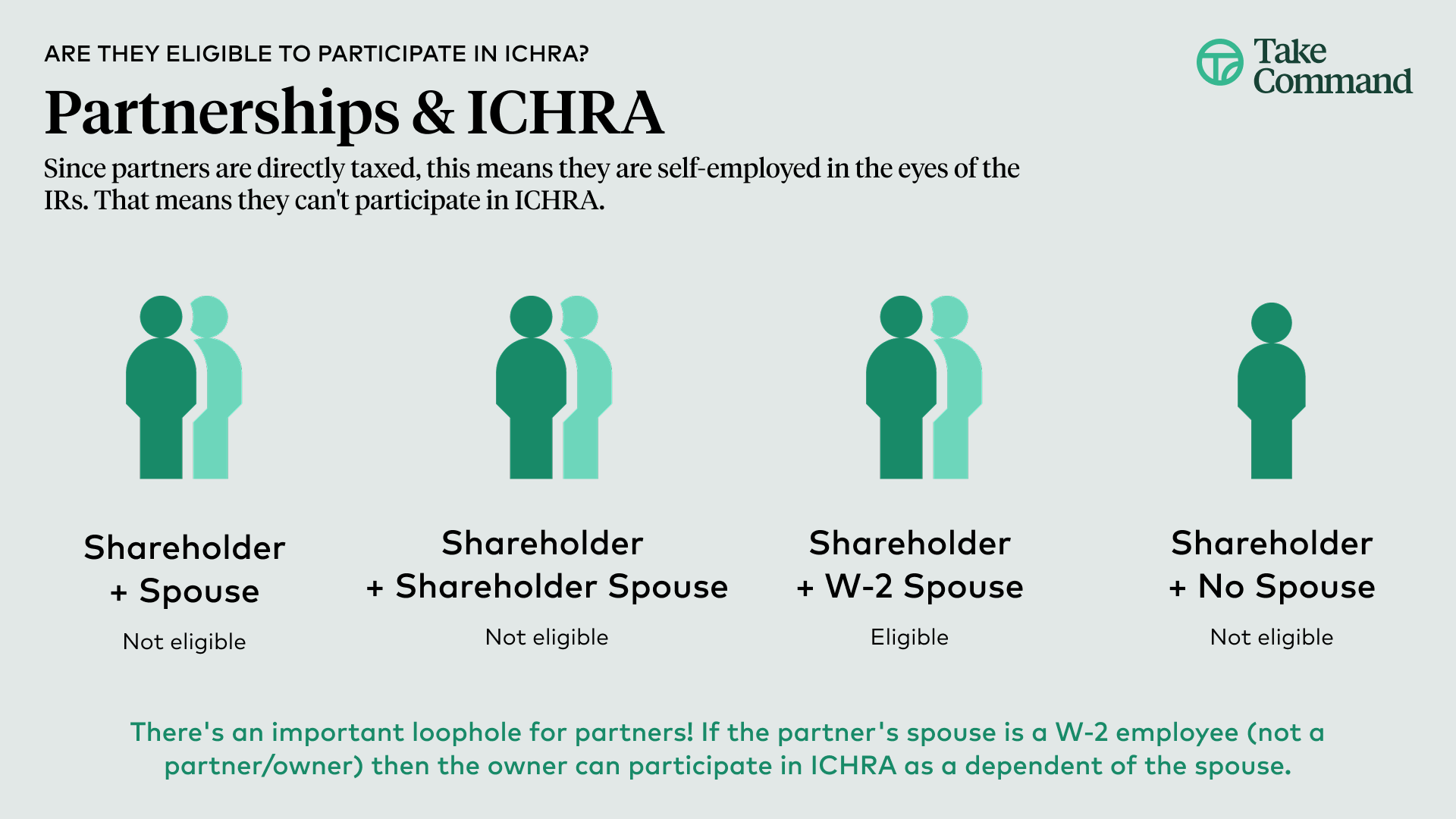

Partnership Owners – How ICHRA Eligibility Works

Partners in a Partnership (or Limited Partnership, LP) are classified as self-employed, not employees, making them ineligible for ICHRA participation. However, there is a workaround:

Partners cannot participate in an ICHRA because they are not considered W-2 employees.

However, partners can deduct health insurance premiums under self-employed tax rules.

Spouses of partners who are employed as W-2 employees can participate in an ICHRA.

Example: A business partnership provides an ICHRA for employees, but the partners themselves cannot participate. However, one of the partners employs their spouse as a W-2 employee, allowing the spouse to receive ICHRA benefits, indirectly benefiting the partner.

Key Takeaway: Partners cannot participate in an ICHRA but can explore spousal participation or self-employed health insurance deductions.

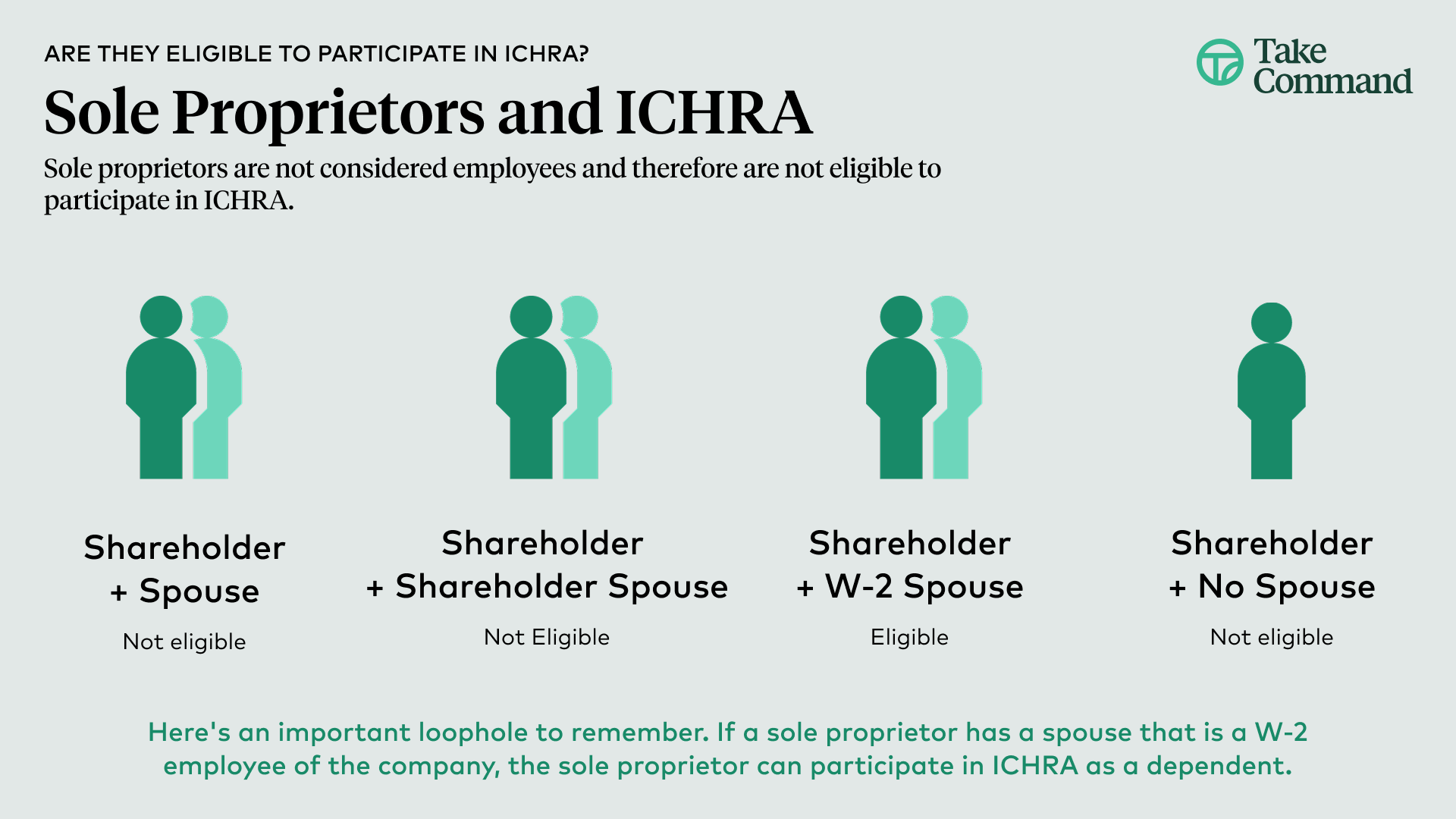

Sole Proprietors – Can They Participate in an ICHRA?

A Sole Proprietorship is not legally separate from its owner, meaning the business owner is considered self-employed rather than an employee. Because of this:

Sole proprietors are not eligible for an ICHRA.

However, they can deduct their health insurance premiums on their personal tax return.

If a sole proprietor hires a spouse as a W-2 employee, the spouse can participate in an ICHRA, extending benefits to the owner.

Example: A sole proprietor hires their spouse to work for the business. The business provides the spouse with an ICHRA, allowing them to receive tax-free health reimbursements—which the owner can use indirectly to cover the family’s health insurance.

Key Takeaway: Sole proprietors cannot participate in an ICHRA, but a strategic approach involving a spouse can help them benefit from the plan.

LLC Owners – ICHRA Eligibility Depends on Tax Classification

A Limited Liability Company (LLC) can be taxed differently, directly impacting ICHRA eligibility. Here’s how it breaks down:

LLC taxed as a C Corporation → Eligible for ICHRA

LLC taxed as an S Corporation → Treated as an S Corp (Not eligible)

LLC taxed as a Sole Proprietorship (Single-Member LLC) → Not eligible

LLC taxed as a Partnership (Multi-Member LLC) → Not eligible

Example: If an LLC is taxed as a C Corporation, its owner can participate in an ICHRA because they are classified as W-2 employees. However, if the LLC is taxed as a Partnership or Sole Proprietorship, the owner is not considered an employee and cannot participate.

Key Takeaway: LLC owner eligibility for an ICHRA depends on tax classification—LLCs taxed as C Corps can participate, while those taxed as S Corps, sole proprietors, or partnerships cannot.

Maximizing ICHRA Tax Benefits for Business Owners

ICHRA offers significant tax advantages for businesses and employees. Though tax benefits vary depending on the business structure and how the IRS classifies business owners. While C Corporation owners can fully deduct reimbursements, S Corporation owners and self-employed individuals must consider alternative tax strategies.

Understanding the tax implications of ICHRAs can help business owners maximize deductions, reduce taxable income, and stay compliant with IRS rules. Below is a breakdown of how different business structures can benefit from ICHRA reimbursements or explore other tax-saving options.

How C Corp Owners Can Deduct ICHRA Reimbursements

A C Corporation (C Corp) is a separate legal entity from its owners, meaning the corporation employs its owner as a W-2 employee. This classification allows C Corp owners to fully participate in an ICHRA and receive the same tax advantages as their employees.

Key Tax Benefits for C Corp Owners:

ICHRA reimbursements are 100% tax-free for employees and owners.

Employers can deduct all reimbursements as a business expense, reducing taxable income.

Reimbursements do not count as taxable wages for the owner or employees.

The owner’s dependents may also be eligible for tax-free reimbursements under the ICHRA.

What S Corp Owners Need to Know About Health Insurance and ICHRAs

S Corporation (S Corp) owners of more than 2% of the company are classified as self-employed rather than W-2 employees. This means they cannot receive tax-free ICHRA reimbursements, but they can still take advantage of other tax deductions for health insurance.

Tax Implications for S Corp Owners:

ICHRA participation is not allowed for S Corp owners.

Health insurance premiums the business pays must be included in the owner’s W-2 income as taxable wages.

S Corp owners can deduct personal tax on their income tax return for health insurance costs under IRS Section 162(l).

Family members of an S Corp owner who work for the business cannot receive tax-free ICHRA reimbursements.

Tax-Saving Strategies for Self-Employed Business Owners

Self-employed individuals, including sole proprietors, partners in a partnership, and more than 2% S Corp owners, cannot participate in an ICHRA because they are not considered employees. However, they can still reduce their tax liability through other health insurance deductions.

Tax Deduction Options for Self-Employed Business Owners:

Self-Employed Health Insurance Deduction (Section 162(l))

This law allows self-employed individuals to deduct 100% of their health insurance premiums from their adjusted gross income (AGI).

The deduction applies to the owner, spouse, and dependents’ medical, dental, and long-term care premiums.

Reduces taxable income but does not lower self-employment tax.

Health Savings Account (HSA) Contributions

If paired with a high-deductible health plan (HDHP), self-employed individuals can contribute tax-free to an HSA and use those funds for medical expenses.

HSA contributions lower taxable income and grow tax-free.

How ICHRA Reimbursements Impact Employee Taxes

ICHRA reimbursements are tax-free for eligible employees and C Corp owners, but there are a few important considerations regarding how reimbursements interact with ACA premium tax credits and employee wages.

Tax-Free Reimbursements:

ICHRA reimbursements do not count as taxable income for employees or C Corp owners.

Employers can deduct ICHRA reimbursements as a business expense.

Employees cannot double-dip by using an ICHRA and claiming an ACA premium tax credit—if an ICHRA is considered affordable, the employee loses eligibility for ACA subsidies.

Impact on ACA Premium Tax Credits:

Employees who accept an ICHRA offer cannot receive ACA premium tax credits.

If an ICHRA is deemed unaffordable under ACA rules, an employee can opt out and claim ACA premium tax credits instead.

Employers must ensure they are following ICHRA affordability guidelines to maintain compliance.

What If You’re Not Eligible? Alternative Health Benefit Solutions

If you’re a self-employed business owner or an ineligible S Corp owner, you may need to explore other health benefit solutions beyond an ICHRA. While an ICHRA offers flexibility, different options can still provide tax advantages and cost-effective coverage.

Qualified Small Employer HRA (QSEHRA) as an Alternative

A Qualified Small Employer HRA (QSEHRA) is a great option for businesses with fewer than 50 employees. It allows owners to reimburse employees for health insurance on a tax-free basis. However, self-employed individuals cannot participate unless they qualify through a spouse’s W-2 employment.

Group Health Insurance vs. ICHRA – Which One Works Best?

Traditional group health insurance offers predictability but higher costs and administrative burdens. An ICHRA provides more flexibility, allowing employees to choose their own plans while still being reimbursed. A group plan may be better for business owners who want coverage.

Leveraging an HSA With a High-Deductible Health Plan (HDHP)

A Health Savings Account (HSA) allows self-employed individuals to save pre-tax dollars for medical expenses. You must enroll in a high-deductible health plan (HDHP) to qualify. HSAs provide triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Using a Spouse’s Employer Health Plan as a Strategy

If a business owner cannot participate in an ICHRA, but their spouse is employed elsewhere, they may be able to join their spouse’s employer-sponsored health plan. This is often a cost-effective way to get coverage while offering employees an ICHRA or QSEHRA.

Even if you’re not eligible for an ICHRA, alternative health benefit solutions exist to help business owners and self-employed individuals find affordable and tax-efficient coverage.

Frequently Asked Questions (FAQ) About ICHRA Eligibility

Understanding ICHRA business owner eligibility can be complex, especially regarding spousal participation, reimbursement amounts, ACA subsidies, and business structure changes. Below are answers to some of the most common questions about ICHRA eligibility.

Can My Spouse Participate in an ICHRA if They’re on Payroll?

Yes, but it depends on your business structure.

C Corp Owners: A spouse who is a W-2 employee can participate in an ICHRA and receive tax-free reimbursements.

S Corp Owners: If you own more than 2% of the business, neither you nor your spouse can receive tax-free ICHRA reimbursements.

Partnerships and Sole Proprietors: If your spouse is a legitimate W-2 employee, they can participate in an ICHRA and receive reimbursements.

How Do I Calculate Fair ICHRA Reimbursements for Employees?

Employers can set different reimbursement rates based on employee classes, such as full-time, part-time, salaried, hourly, or remote employees. However, the IRS prohibits discrimination—you must offer consistent reimbursements within each class.

A common approach is to base reimbursement amounts on:

Employee health insurance costs in your region.

Company budget and tax advantages.

Affordability rules under ACA compliance.

Does an ICHRA Affect Employee ACA Subsidies?

Yes. Employees cannot use both ICHRA and ACA premium tax credits simultaneously.

If an ICHRA is deemed affordable under ACA guidelines, employees must opt out of ACA tax credits to accept ICHRA reimbursements.

If an ICHRA is not affordable, employees can decline it and continue receiving ACA subsidies.

Employers should run affordability calculations to ensure compliance and provide clear guidance to employees.

What Happens If My Business Structure Changes?

If your business structure changes, it may impact ICHRA eligibility for you as the owner.

Converting from an S Corp to a C Corp: You become a W-2 employee and gain ICHRA eligibility.

Switching from a Sole Proprietorship to an LLC taxed as a C Corp: You become eligible for an ICHRA.

Switching from a C Corp to an S Corp: You lose ICHRA eligibility if you own more than 2% of the business.

To avoid compliance issues, it’s important to reassess ICHRA participation when changing your business structure.

ICHRA rules can be nuanced, so it is recommended that you consult with a tax professional or benefits advisor when determining eligibility.

How to Choose the Right Health Benefits for Your Business

Choosing the right health benefits for your business depends on your business structure, tax strategy, and employee needs. While an Individual Coverage Health Reimbursement Arrangement (ICHRA) offers flexibility and tax advantages, not all business owners qualify. Understanding eligibility rules and alternative health benefit options can help you make the best decision for your business and employees.

Need help choosing the right health benefits coverage? Talk to one of our experts today!