Blue Cross Blue Shield of Michigan subsidiary to acquire AmeriTrust Group – Detroit News

A subsidiary of Blue Cross Blue Shield of Michigan on Tuesday declared its intention to purchase Southfield-based insurer AmeriTrust Group Inc. from a Chinese conglomerate in a move the company says will help to diversify its income streams, benefit customers and keep hundreds of jobs in Michigan.

Details on the transaction’s value weren’t disclosed by the private entity. AF Group, BCBSM’s wholly owned holding company subsidiary whose affiliated brands provide specialty and workers’ compensation insurance, is financing the acquisition from Shanghai-based Fosun International Limited through its subsidiary, the Accident Fund Insurance Company of America, without other financial support from BCBSM.

The deal negotiated by AF’s leadership is subject to regulatory approvals and is expected to close in the fourth quarter of this year or the first of next, Daniel Loepp, Blue Cross Blue Shield of Michigan president and CEO, told The Detroit News.

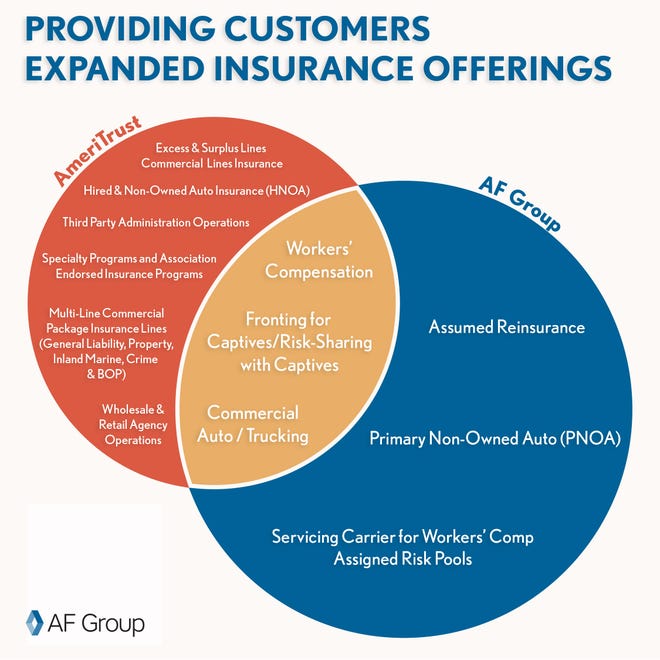

AmeriTrust could grow the AF Group, the No. 9 largest workers compensation insurance group in the country, by a third, Loepp said. AmeriTrust offers nationally specialty insurance products, including workers’ compensation, commercial packages, automotive business coverage and offerings in various industry segments. Such business would make Blue Cross Blue Shield less reliant on the premiums and administrative fees of its health insurance customers, Loepp said.

“They’ve dividend back probably close to a billion dollars over the period of time that we owned it,” he said of the AF Group that became a part of BCBSM starting in 1995. “It really softens the rates that we charge, especially to individual customers and group customers, and so, it’s been really great on its own for the Blues.”

BCBSM pointed to how it has generated more than $900 million from its investment portfolio and non-health lines of business like the AF Group in 2021, allowing it to absorb $860 million in COVID-19 costs for treatment, testing and vaccine administration instead of passing those costs onto its members.

AmeriTrust employs nearly 800 people in Michigan. Loepp said he predicts some right-sizing from duplicative jobs, but emphasized the acquisition was attractive for AmeriTrust’s workforce and that it operates in niche businesses it doesn’t already do. BCBSM also acquires the company’s Oakland County building visible from Interstate 696.

“That’s going to keep those jobs here in Michigan,” Loepp said. “This isn’t a fire sale. There’s a lot of talent there, and they’re going to make us a better company.”

The workers’ compensation business often works inversely from BCBSM’s health care business from a margin standpoint, Loepp said: “Oftentimes the workers comp business is doing better and vice versa. And so, it’s a good business model.”

BCBSM had looked at purchasing the company when it was Meadowbrook Insurance Group about a decade ago, but because of decades-old state legislation limiting BCBSM’s operations, it was unable to do so. With the help of bipartisan legislation signed by Gov. Rick Snyder, it became a nonprofit mutual insurance company in 2016, opening the way for a transaction of its size at a time when the company also has matured and grown to operate in all 50 states, Loepp said.

“None of this stuff could happen without us becoming a nonprofit mutual,” he said.

The investment also reinforces AF Group’s increasingly prominent position and reputation in the property and casualty insurance market, the company said. AF Group is recognized for its financial strength as a Ward’s 50 company and has earned an “A” (Excellent) rating by A.M. Best. AF Group’s annual written premium has grown to $2.3 billion last year from $184 million in 1995. AmeriTrust has a “A-” (Excellent) rating.

“This exciting acquisition aligns two world-class organizations toward a common goal of providing exceptional, customer-focused insurance products and services through our valued agents,” Lisa Corless, president and CEO of AF Group, said in a statement. “The reputation and performance of AmeriTrust is proven in the marketplace, and we’re excited to welcome their exceptional team to our award-winning organization as we work together toward even greater success.”

bnoble@detroitnews.com

Twitter: @BreanaCNoble