2021 US National Health Expenditures

A paper in Health Affairs by Martin, Hartman, Benson, Catlin, and The National Health Expenditure Accounts Team (2022) finds that national health expenditures (NHE) rose but declined as a share of gross domestic product (GDP).

Health care spending in the US grew 2.7 percent to reach $4.3 trillion in 2021, a much slower rate than the increase of 10.3 percent seen in 2020. The slower rate of growth in 2021 was driven by a 3.5 percent decline in federal government expenditures for health care after a spike in 2020 that occurred largely in response to the COVID-19 pandemic. Alongside this decline, the use of medical goods and services increased in 2021. The share of the economy accounted for by the health sector fell from 19.7 percent in 2020 to 18.3 percent in 2021, but it was still higher than the 17.6 percent share in 2019.

For those without access, a blog post summarizes the findings here and there is coverage elsewhere here. As stated above, the decline in health care costs (as a share of GDP) is largely to a reduction in COVID-19 spending and an increase in the economy.

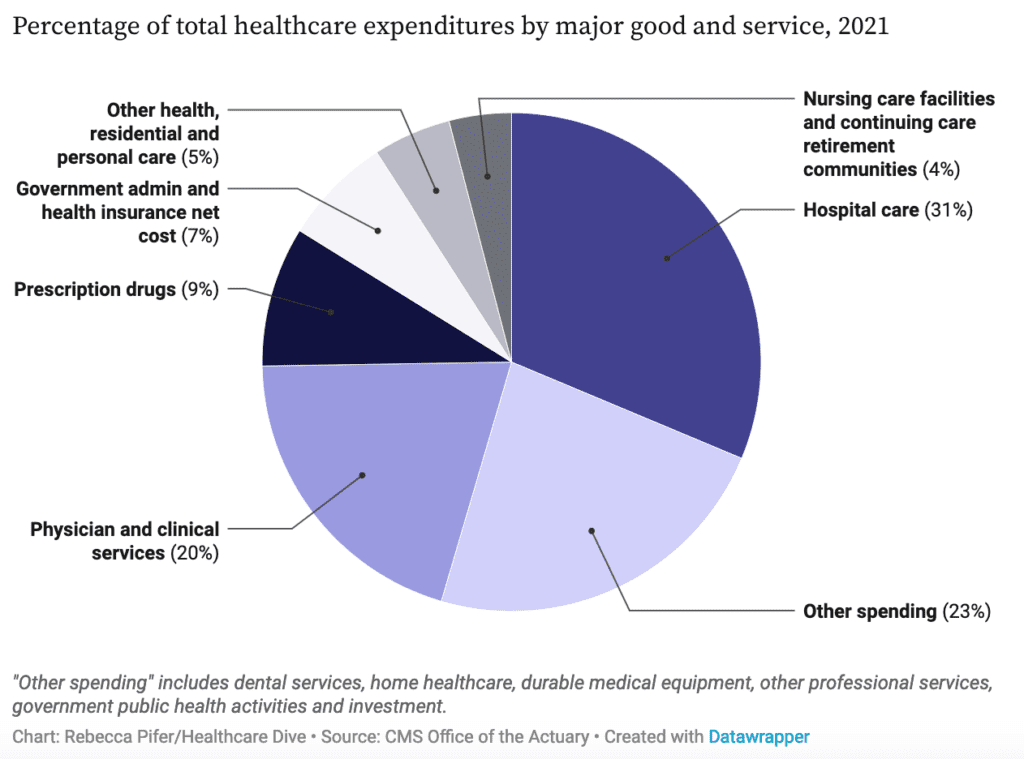

Digging into some more detail, we see that institutional services make the largest share of health care spending. Specifically, hospital care made up 31% of cost, a broad “other” category 23%, physician services 20% and prescription drugs 9%. Administrative costs from government and health insurers made up 7% of costs which is relatively high by international standards.

How did health care spending vary by insurance type? Healthcare Dive reports:

Private health insurance grew 5.8% in 2021 and remained responsible for the largest percentage of total health expenditures by payer type, at 28%.

Medicare spending grew 8.4%, while Medicaid growth remained generally stable year over year at 9.2%.

Out-of-pocket spending jumped 10.4%, the fastest rate of growth since 1985, according to the analysis, as consumers spent more on dental services and durable medical equipment.

While the decline in health care spending as a share of GDP may be considered a good thing, it is unclear if this trend is sustainable given the post-COVID adjustments in the health care sector and broader economy. It will be interesting to see whether 2022 sees another decline in health care spending, which could be due to government reimbursement rates lagging behind inflation in the broader. However, the data is yet to be released for 2022.